Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

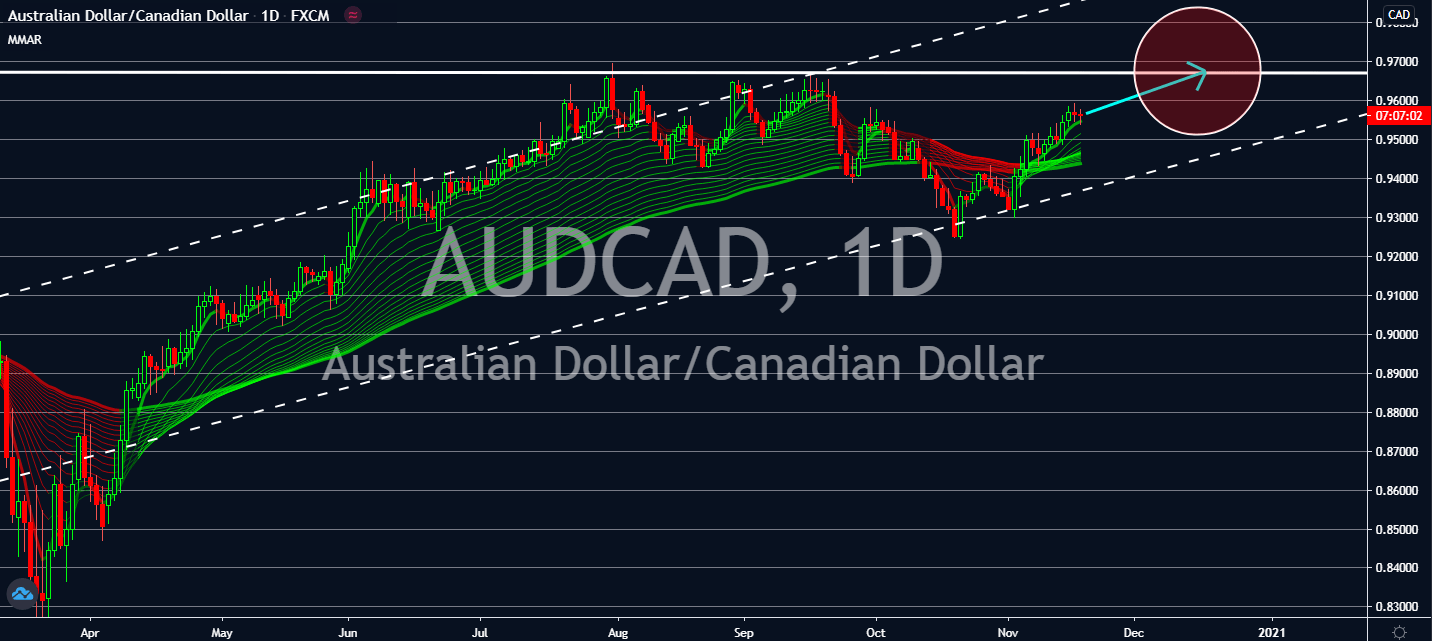

AUDCAD

Core CPI in Canada slightly improved in October in comparison to the month prior, which came in at 0.4 percent, up 0.1 percent in September. Its CPI also jumped to positive territories at around 0.4 percent, up from the -0.1 percent seen prior and the 0.2 percent the market had previously predicted. The rates followed the announcement from Chief Economist at the Conference Board of Canada Pedro Atunes. Although its real GDP is projected to decline by 4.7 percent by the end of the year, the country was able to avoid a steeper decline thanks to its performance in the previous quarters. The Reserve Bank of Australia announced that it will be focusing on the country’s employment figures over its inflation. This could raise certainty on its inflation forecasts once the rate stabilizes, but its currency could still fall against the loonie near-term.

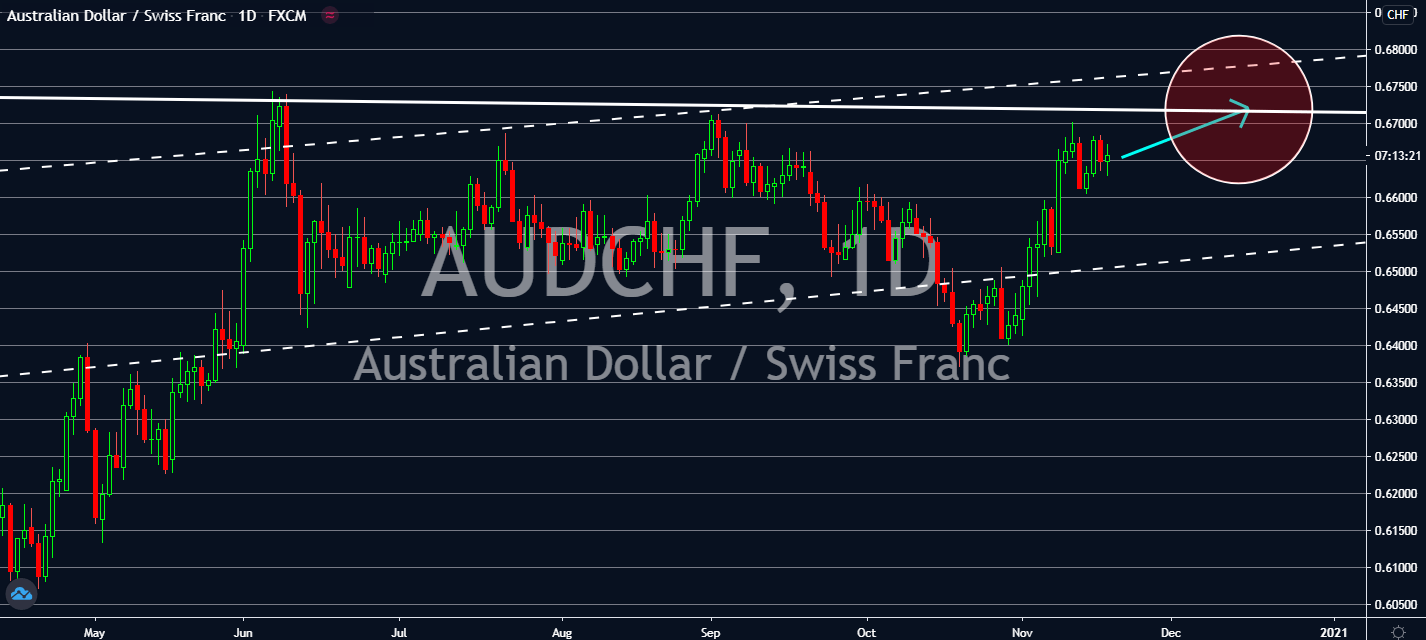

AUDCHF

Switzerland is under the tides with the second wave of coronavirus and now has one of the worst surges in Europe. Now called the second Sweden, its government remains lax despite having all of the 87 certified ICU beds occupied. Of all the 22,211 available acute care beds, 16,889 were occupied. The Alpine county is projected to fall back from its relatively shallow contraction in gross domestic product in the spring as its per capita infections double the average of those seen in the European Union. Meanwhile, the Reserve Bank of Australia recently announced that it will focus on the country’s unemployment instead of its yearly inflation rate. The shift in focus should keep optimism up amid its struggling economy. The bank is also in discussion to purchase 100 billion Australian dollars over the next sixth months, which could also raise optimism toward its recovery once its employment rate does recover by then.

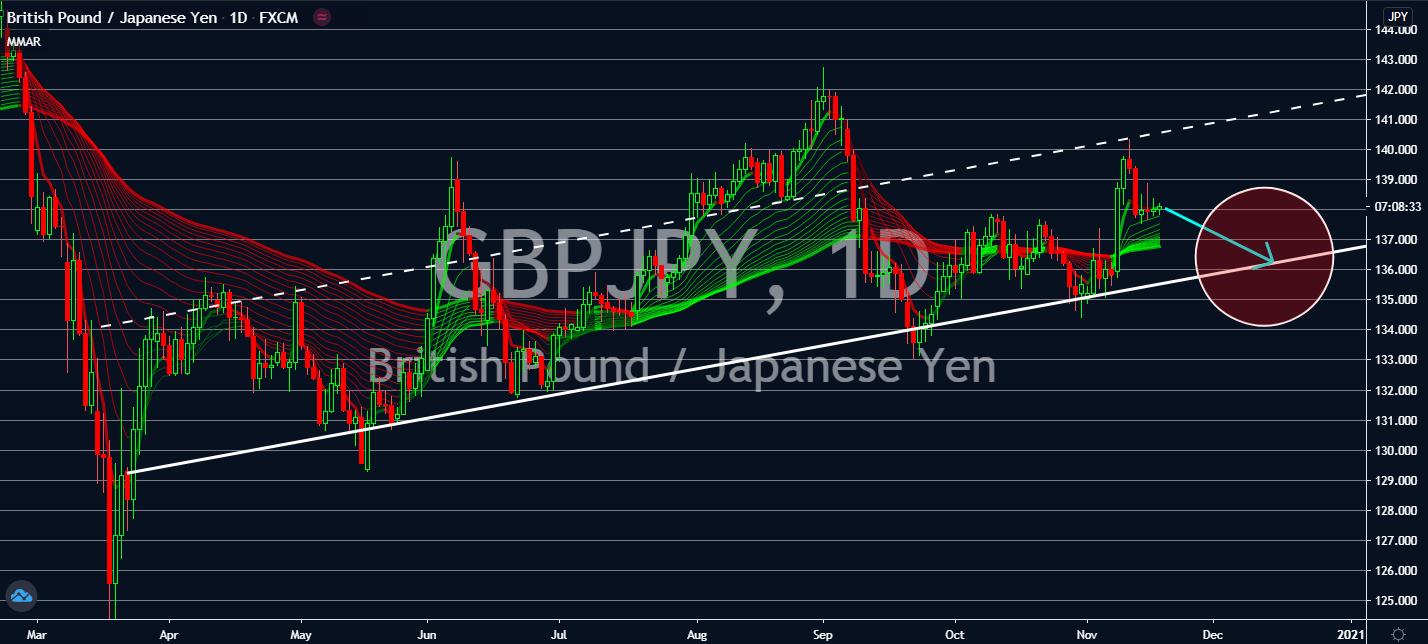

GBPJPY

Japan’s economy has finally withdrawn from its steepest post-war contraction with improving exports and consumption within the third quarter. The 21.4 percent expansion of its gross domestic product had beaten the market’s consensus of an 18.9 percent gain by a far margin. This rate followed the initial contraction during the quarter ending June. Despite the possibility that its rise will soften within the next few months led by the recent resurgence in coronavirus cases in the country, its currency’s safe haven status should be enough as leverage against the uncertain Sterling. Economists claim that a no-deal Brexit could cause its economy about 50 billion pounds as it recovers from the coronavirus pandemic. Reports now claim that the UK could experience the deepest downturn on record, prompting what could be a hard hit to key sectors such as manufacturing while supply chains, border delays, and additional paperwork restrict its regrowth.

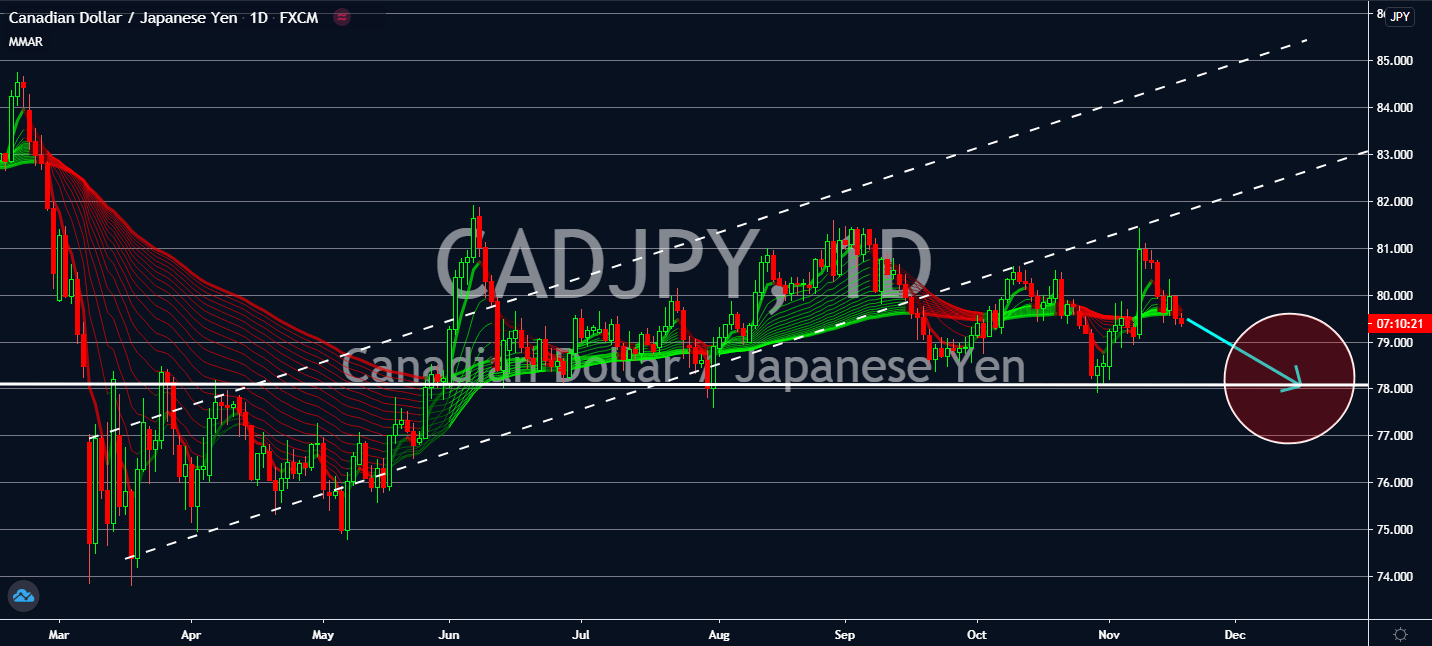

CADJPY

The Japanese economy just experienced its biggest economic increase just after its steepest economic slump, while Canada is projected to meet contract to negative levels by the end of the year. In the third quarter, the Japanese economy had seen a 21.4 percent expansion in gross domestic product that beat Main Street’s prediction of an 18.9 percent increase. This was the first increase in four quarters since it initially plunged by 28.8 percent in the second quarter ending June. The Japanese improvement is projected to witness a more gradual decline through the rest of the year despite the recent resurgence in coronavirus cases seen in October, although it already escaped enough of what could be a negative contraction. The market should wait for Canada’s inflation report, though, which is due to be reported within the week. Climate change should also be a major contributor to Canada’s economy, as well.