Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

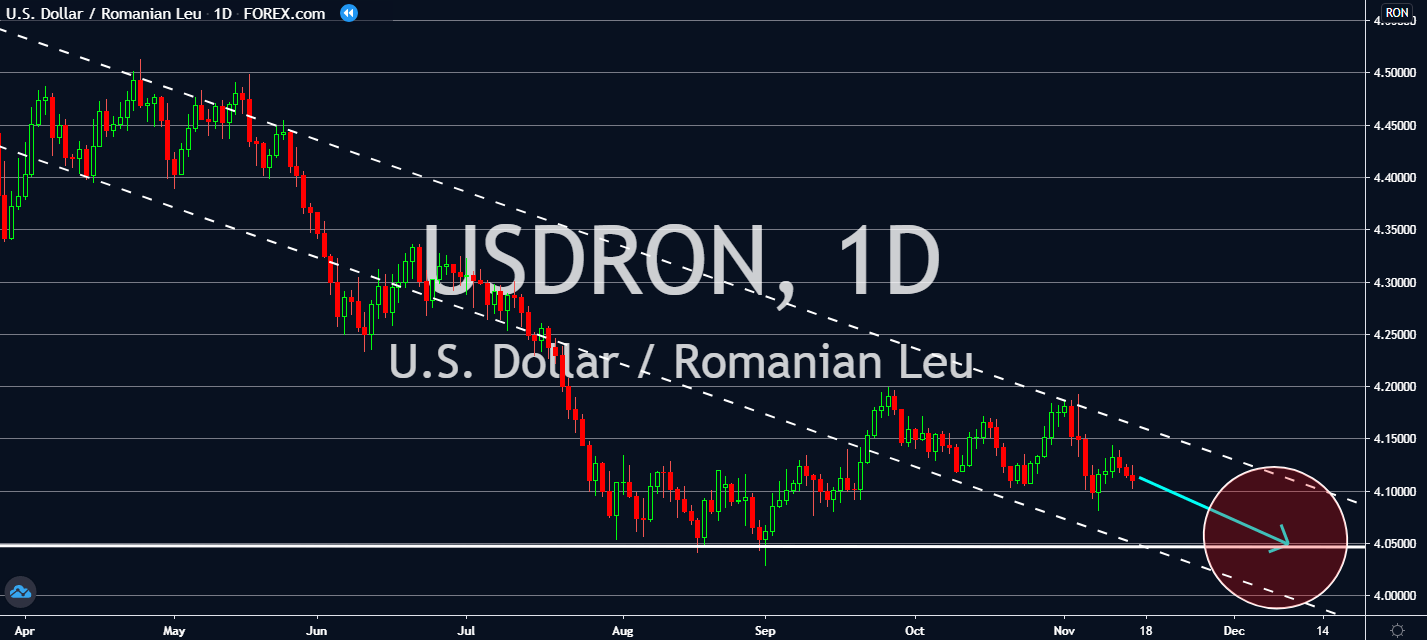

USDRON

Coronavirus cases are on the rise in all 50 states over the past two weeks. In a dozen of those states, infections have spiked to more than 100 percent. The United States is seemingly breaking its record for the total number of new patients on the daily. Meanwhile, President Donald Trump is still refusing to concede his loss to Joe Biden in the recent election. His administration has made no move to tell the president-elect about the locations of coronavirus relief supplies are, how much the federal government has bought, how they plan to allocate it, and what models they’re using. The mental state of millions of Americans are threatening a long-term rise in unemployment, all while the country’s major grocery store chains have limited their in-store and online purchases of toilet paper, cleaning supplies, paper towels, and the like are pressuring supply chains, harming the market’s engagement to the greenback in the near-term.

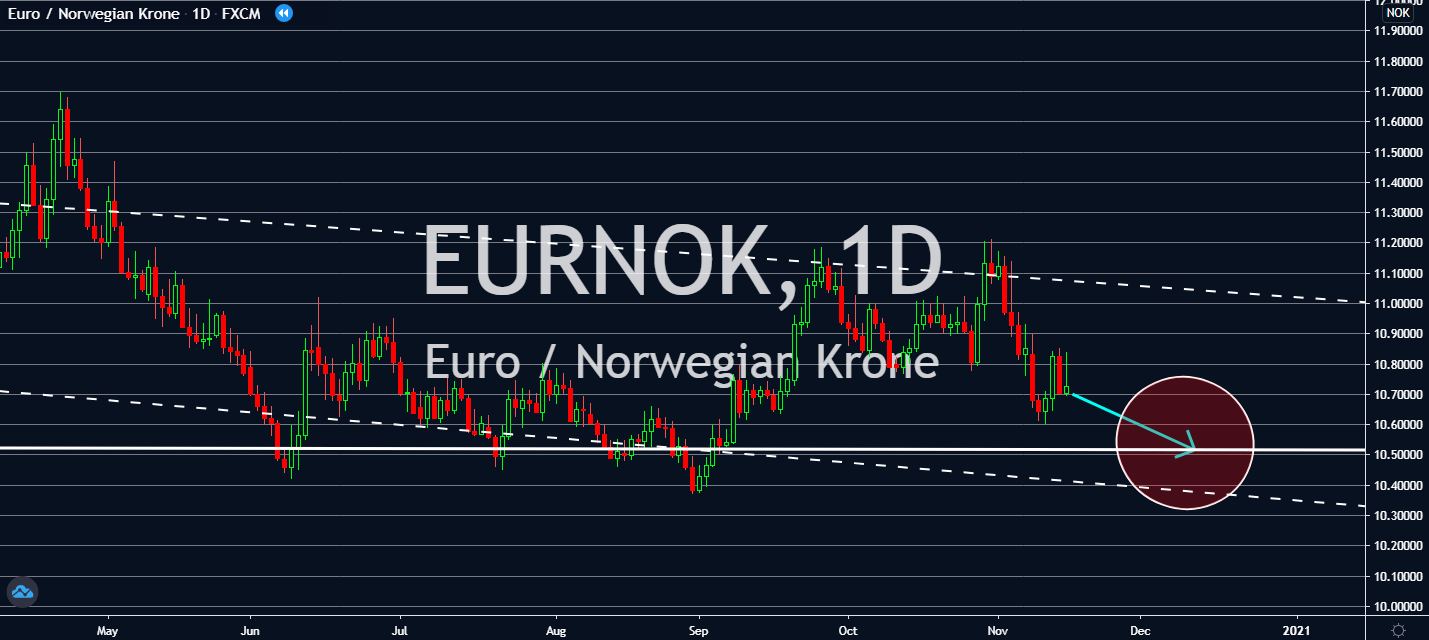

EURNOK

One of Norway’s biggest market just topped 11 trillion Norwegian kroner for the first time in history. The recent coronavirus vaccine helped boost the prices, driving up the value of the world’s largest sovereign wealth fund. The new record topped last year’s value of 10 trillion NOK for the first time last year. Pfizer and Moderna, two of the most reliable pharmaceutical firms in the United States, just reported the most effective coronavirus vaccine to date. The stock market’s increase worldwide will influence an increase in Norway’s fund’s global value. The value dipped to 9.3 trillion in the earlier days of the pandemic, but the news is projected to help the fund boost throughout the year. The fund will also help lift not only against the euro, but possibly its economic activity, as well – possible progress in the development of these vaccines could help increase oil revenue while the world begins to up their transportation.

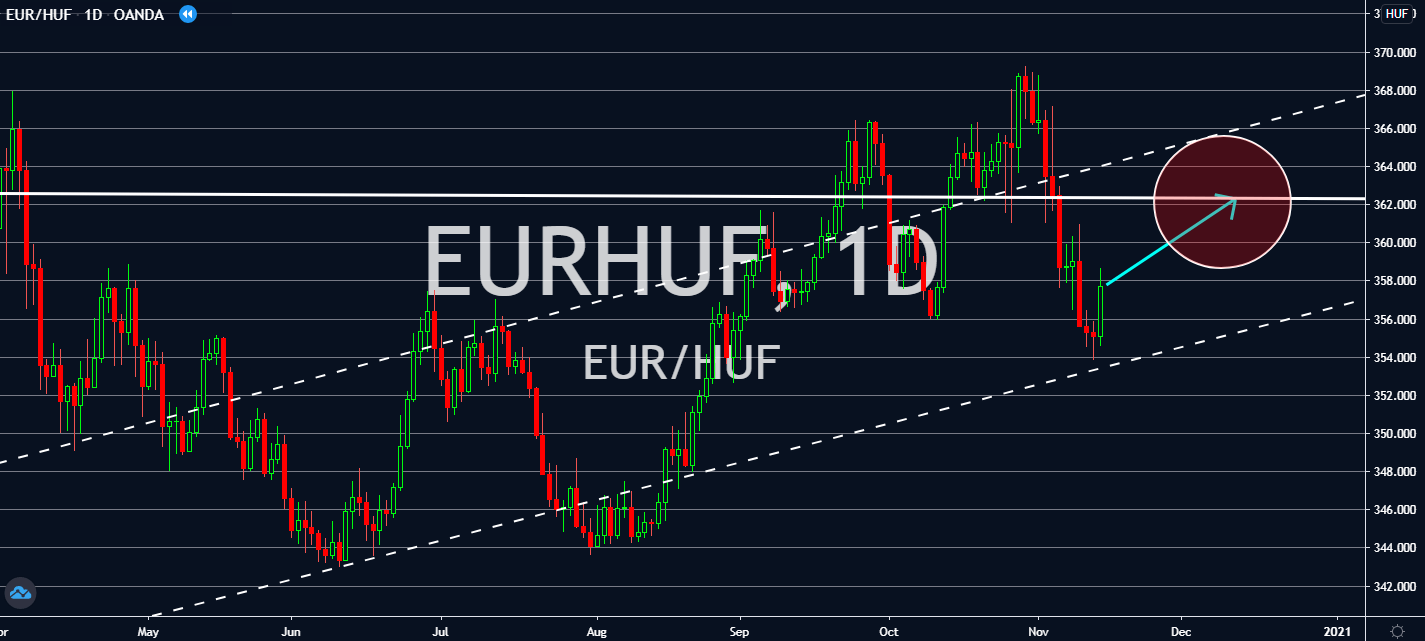

EURHUF

Hungary refused to follow the European Union’s long-term budget over biases against the rule of law requirement. The vote on Monday had required unanimous support for a 1.8 trillion euro package that included a 1.1 trillion euro budget and 750 billion euros for the coronavirus package. Now that no EU country will receive any of the funds allocated for a seven-year economy, this could risk worsening the economic impact of the pandemic over the hardest-hit states, including Hungary. Hungary and Poland were set to receive enough sums in budget and recovery fund money under the package, but both economies worry that they won’t be able to access it under a conditionality rule. After all, both countries are under investigation for accusations that their governments have interfered with key contributors to democracy, such as its judicial system, media, and non-government organizations. The fragility at hand will pull the forint lower.

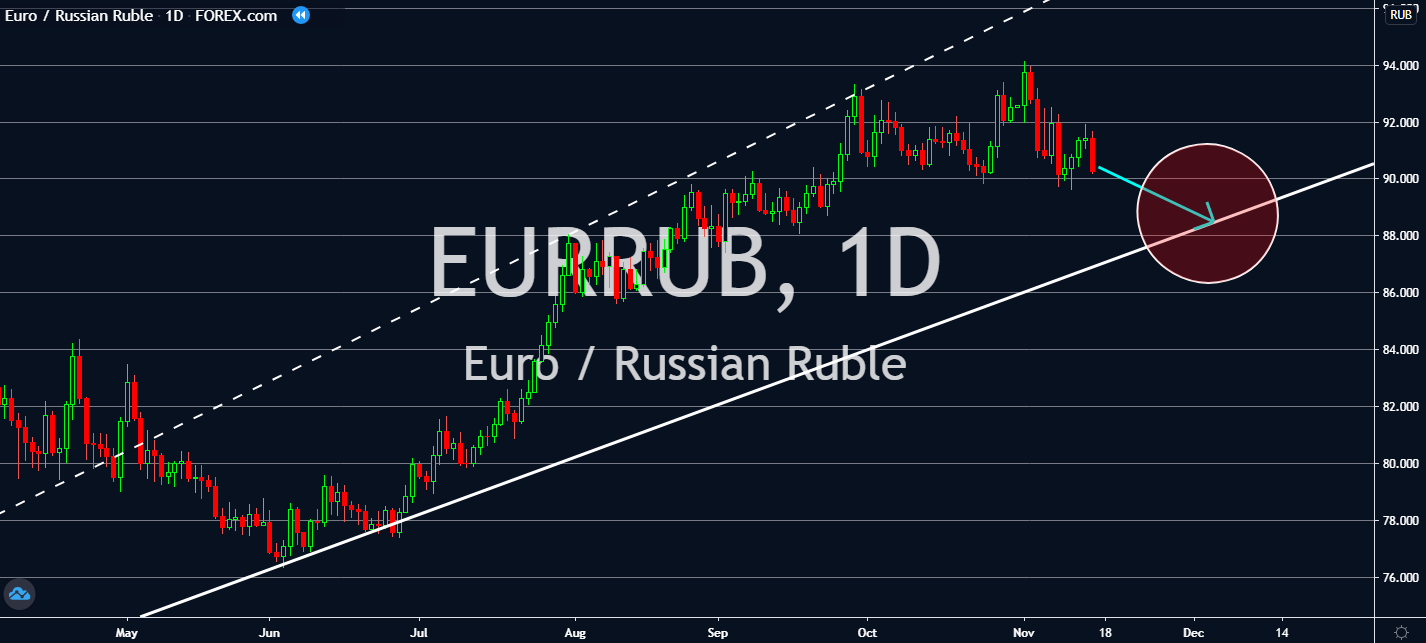

EURRUB

The Russian economy is in danger to lose an equivalent of 44 billion US dollars to cybercrime within 2020 as the shift to online buying throughout the pandemic raises unforeseen concerns. Now that transactions are made more often online than with cash during lockdown and health restrictions, footprints from people spending money have become far less traceable. Russia’s largest lender, Sberbank, claims that this could cause significant economic damage that has the potential to double next year, as well. The bank claims that it has to deal with 26 billion cybersecurity events on the daily. Crimes linked to bank cards over the year reached up to 500 percent over the past year – although Sberbank has the capacity to repel these attacks, investors are still projected to keep worrying about the economy over the pace at which these threats have been increasing. The ruble will then fall against its bigger counterpart, the euro currency.