Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

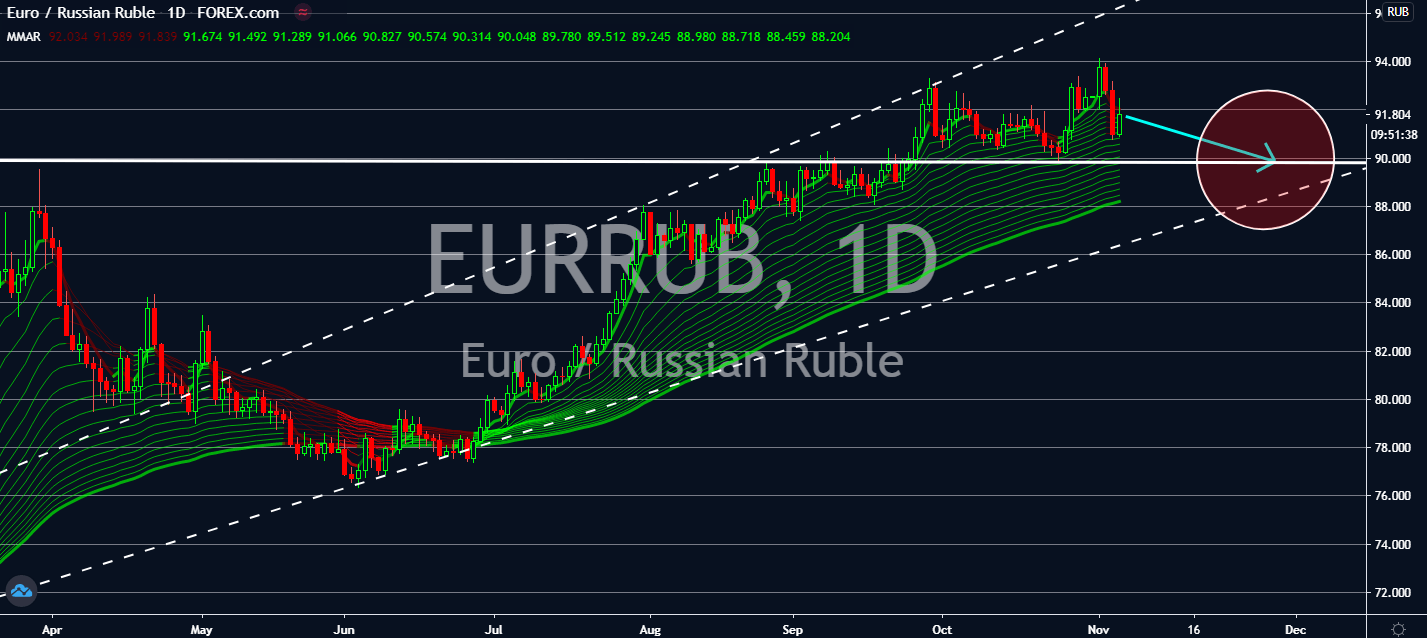

EURRUB

The unexpected economic shutdown in Russia seen at the end of September brought its HIS Markit to a massive drop in Russia’s Services purchasing managers index, marking its biggest single-month fall from 53.7 to 46.9 in October. This followed Russia’s manufacturing PMI within the month, which also fell from 48.9 in September to 46.9 last month. Composite PMI also fell below the needed 50-point mark to 47.1 in October, reversing September’s growth to 53.7. Now that both indicators have fallen to represent a technical contraction of business activity, Russia’s ruble is now projected to fall against its safer currencies because of it. Weaker demand conditions will also be accompanied by the number of new daily coronavirus infections in Russia, which is approaching 200,000 cases a day in the first week of November. Although Kremlin chose not to impose a second lockdown, current restrictions are likely to pull the ruble low.

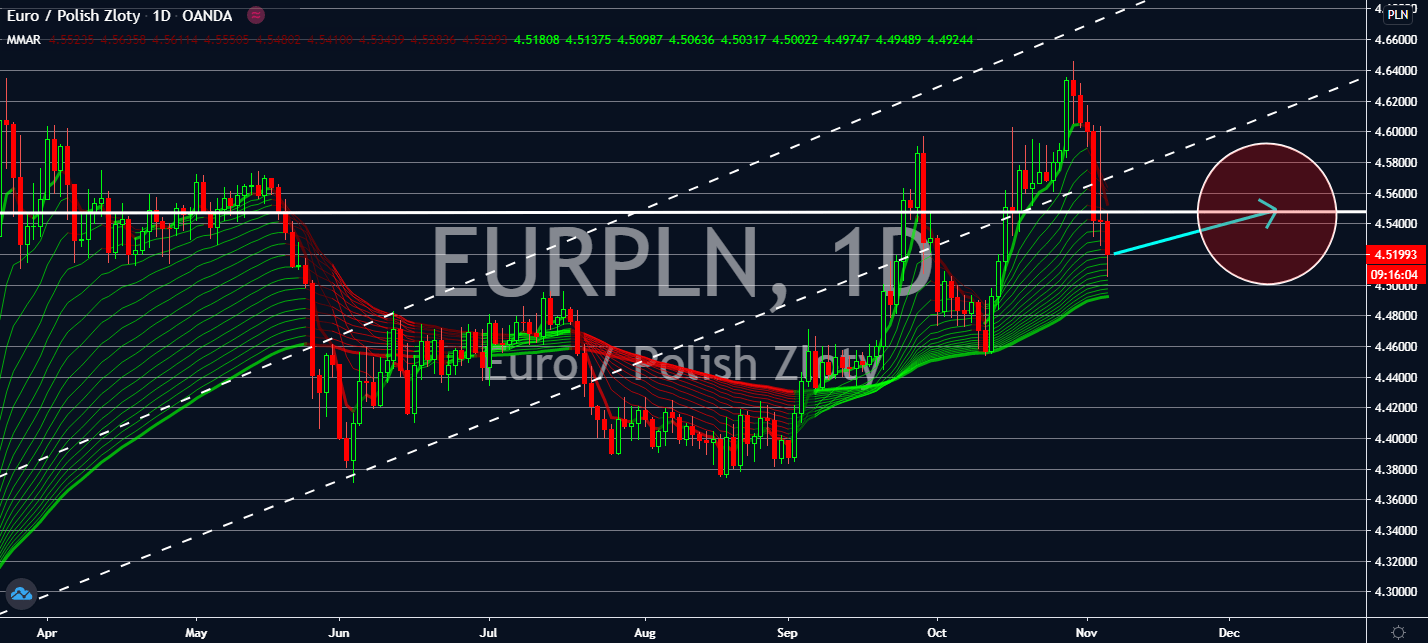

EURPLN

Poland reached a new daily high of nearly 25,000 cases of the coronavirus, bringing new restrictions on shops, schools, and cultural institutions throughout the whole month of November. Prime Minister Mateusz Morawiecki is considering a full national lockdown if its current restrictions don’t contain enough virus spread. Although its economy is projected to fall by a timid 3.9 percent by the end of the year, markets claim that the recent rise in infections could stall its recovery. Recent huge protests against a near-total abortion ban are projected to lift the number in the near-term, keeping investors uncertain of its recovery through the year. Meanwhile, investors are expected to keep their money on the euro as its purchasing managers index remains hesitantly optimistic, after having succeeded in key economies such as Germany, France, Italy, and Spain. Overall Markit Composite PMI remains at growth, as well.

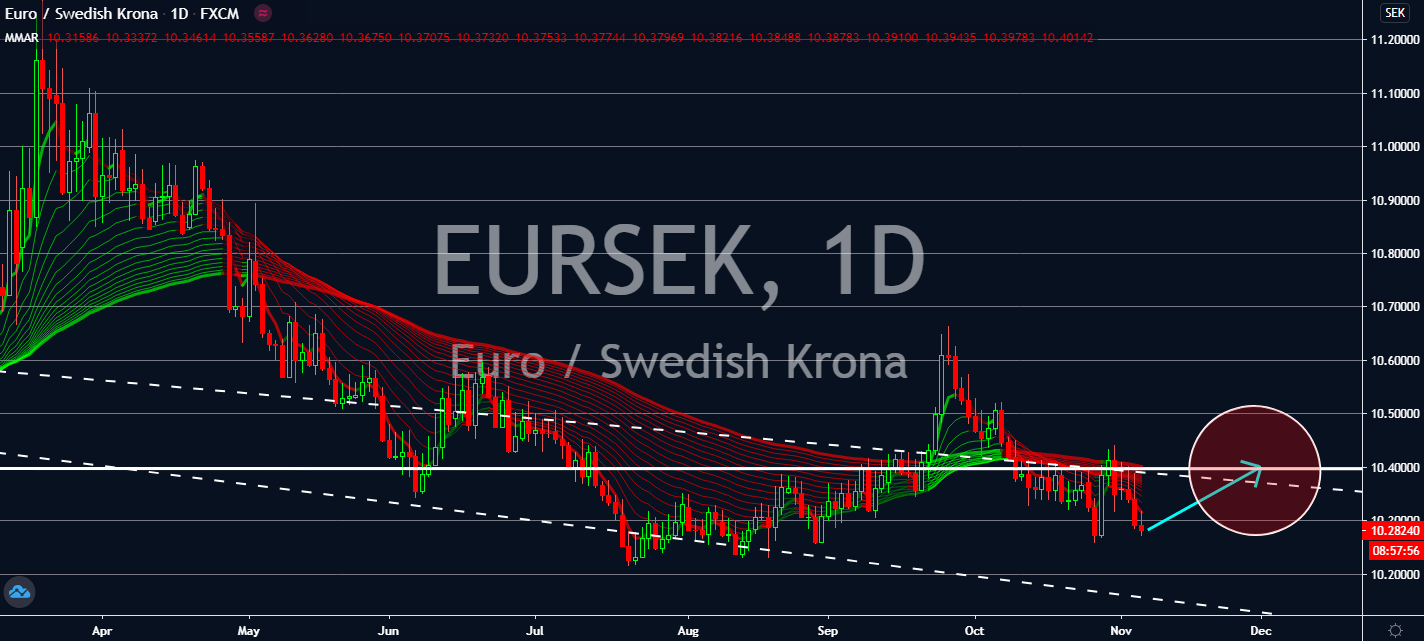

EURSEK

After months of refusing to give in to its European neighbors, Sweden introduced new Covid-19 restrictions to curb the rise in coronavirus cases across its nation. The new measures took effect on Tuesday. The new restrictions now require people to work from home if possible, and only to have physical contact with people in the same household. Hospitals have no been overwhelmed by the increase in daily cases, after Sweden hit a new record of daily coronavirus cases of 5,000 on October 27. The total confirmed coronavirus cases in the Scandanavian country is now near 135 thousand cases since the beginning of the pandemic, and nearly 6 thousand people have died because of it. The now “very serious situation” is projected to pull the crown low against the single currency in the near-term as markets worry that too many people have died, causing what could be a more long-term economic effect of the coronavirus.

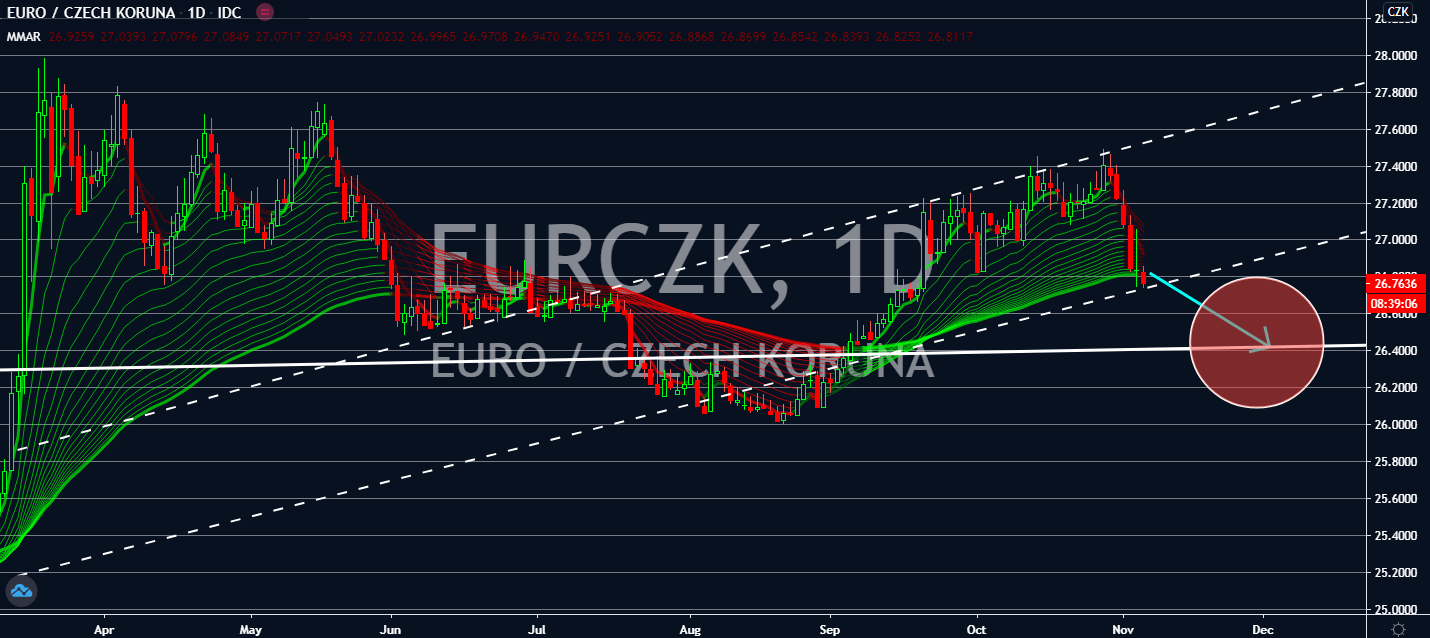

EURCZK

The Czech Republic is on track to get ahead of larger economies in the eurozone in terms of gross domestic product per capita. Although the result is affected by the coronavirus crisis, the latest International Monetary Fund survey claims that the metric should remain in place even after the coronavirus crisis subsides. The country is also expected to reach beyond New Zealand and Japan in GDP per capita within the next five years. The IMF forecasts that the Czech economy will create 45,490 international dollars of 2017 per capita, surpassing Spain’s 42,809 and 42,525 in Italy. The metric is expected to push the pair to a bearish market in the near-term as more markets grow uncertain of their outlooks toward the eurozone’s economy as a whole. After all, recent purchasing managers index indicators have seen lower growth in the month of October. The slowdown in activity in the bloc is projected to yank its currency lower.