Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

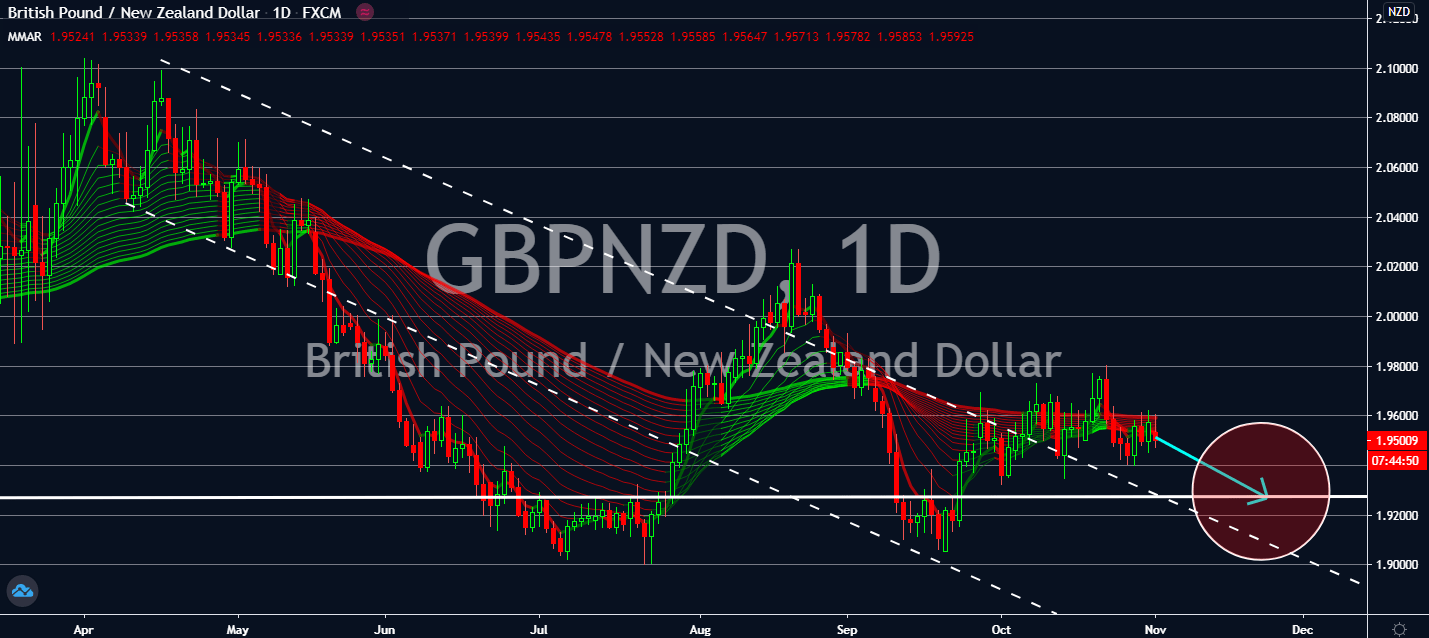

GBPNZD

The Office for National Statistics in the UK estimated that every 1 in every ten people has Covid-10 in England. This was a rapid increase compared to 1 in 2,300 in July and 1 in 200 at the beginning of October. This led to another lockdown in for England, following weeks of warnings from scientific experts in the City. What makes matters worse: economists claim that the lockdown may have to last through the first week of December. Worries about the surge in coronavirus cases are going to be the cause of Sterling’s fall in the near-term. Meanwhile, the New Zealand dollar is projected to keep its safe haven status. Jacinda Arden is slowly forming her cabinet ministry as she handles less than four imported Covid-19 cases in the country. As the world descends into another wave of infections, the kiwi dollar is expected to act as a safe haven across the board.

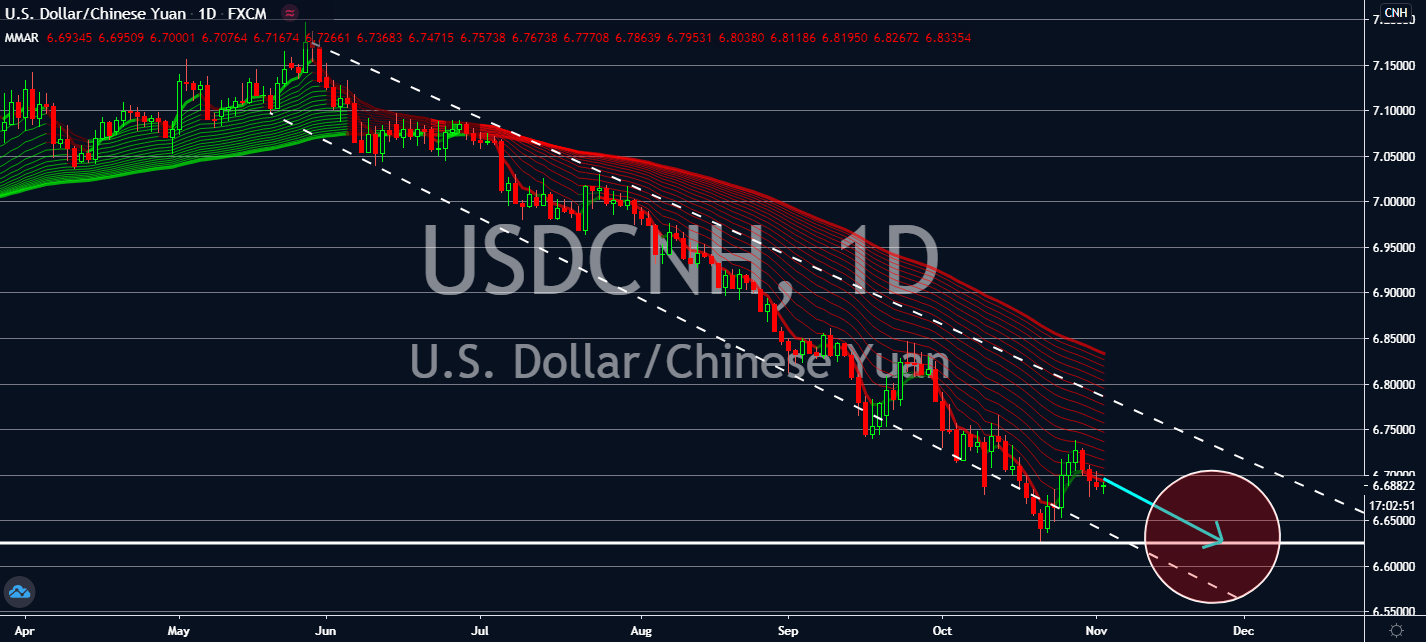

USDCNH

The Caixin/Markit Purchasing Managers’ Index for Chinese manufacturing rose from 53.0 to 53.6 for October. This was better than the market’s forecasts of 53.0, which also recorded its highest since January 2011 to its sixth-month consecutive growth, as well. Moreover, China’s official manufacturing PMI came in at 51.4, marking its eighth consecutive expansion in a row, and is also above readings of 51.3. Markets are expected to invest in the figure’s speedy recovery, considering that Caixin Insight Group’s Wang Zhe confirmed that the country’s manufacturing firm has continued to pick up speed since its last recording. The greenback’s relative uncertainty is projected to pull it down against the yuan as the presidential election looms over the possibility of another stimulus package for its businesses by the end of the year, especially now that the incumbent US government failed to wrap up pre-election negotiations.

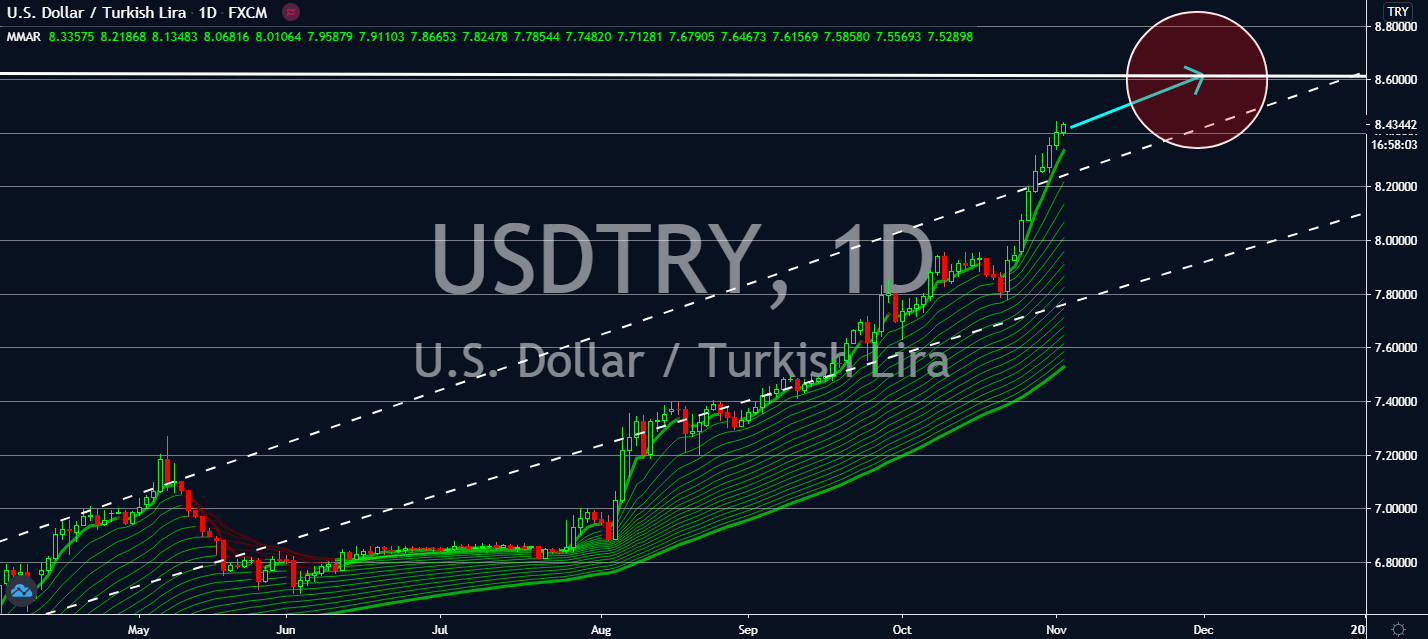

USDTRY

The Turkish lira is projected to keep losing against the dollar in the near-term as continued worries about the coronavirus push emerging markets lower against the greenback’s safety. Turkey’s central bank upped its policy rate in September and raised the top level of its interest rate corridor, which was used to counter the double-digit inflation. Any signs of uncertainty in the global economy will keep the greenback up, even in the long-term, no matter who wins in tomorrow’s presidential elections. Meanwhile, the greenback is expected to benefit from the latest polls released over the weekend that Joe Biden is more likely to become the next president of the United States. Although the US dollar could fall in the long-term, its status as a safe haven will likely prevail with the volatile uncertainty. Improving global trade relations are projected to keep the dollar up against its Turkish counterpart, as well.

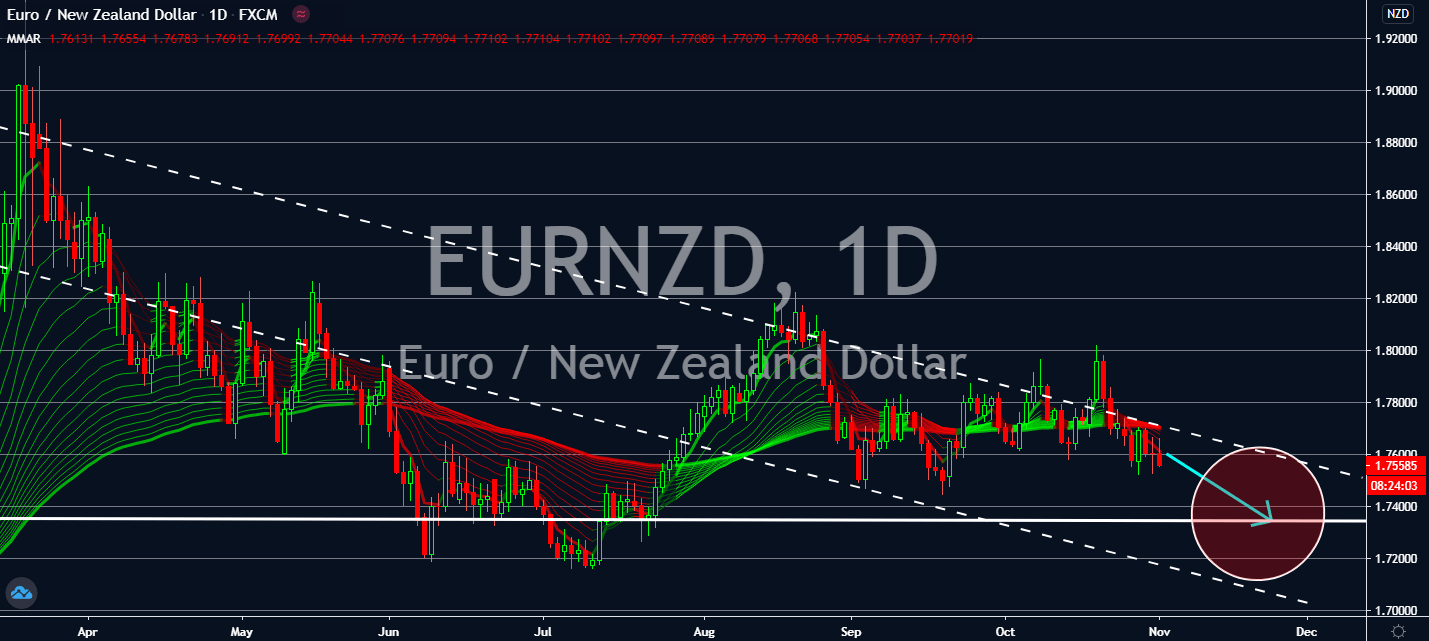

EURNZD

Manufacturing PMI in Germany, France, and Italy were all in better territories than expected over the month of October. In fact, all of them also grew within the month than in September. Italy’s figure grew from 53.2 to 53.8, which was also up from the expected 53.5. France’s equivalent inched up from 51.0 to 51.3, even when the market had anticipated a stagnant October for the reading. The most anticipated German figure also saw an increase in October from 58.0 to 58.2, an inch up that was more than expected. However, it might all come to an end: the biggest economy in the eurozone just began its month-long partial lockdown to slow the spread of the coronavirus in the country. Its economic activity’s halt is likely to affect the market’s bearish sentiment in the near-term, as New Zealand’s parliament continues to form its cabinet under Prime Minister Jacinda Arden’s care, increasing investments for the kiwi dollar.