Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

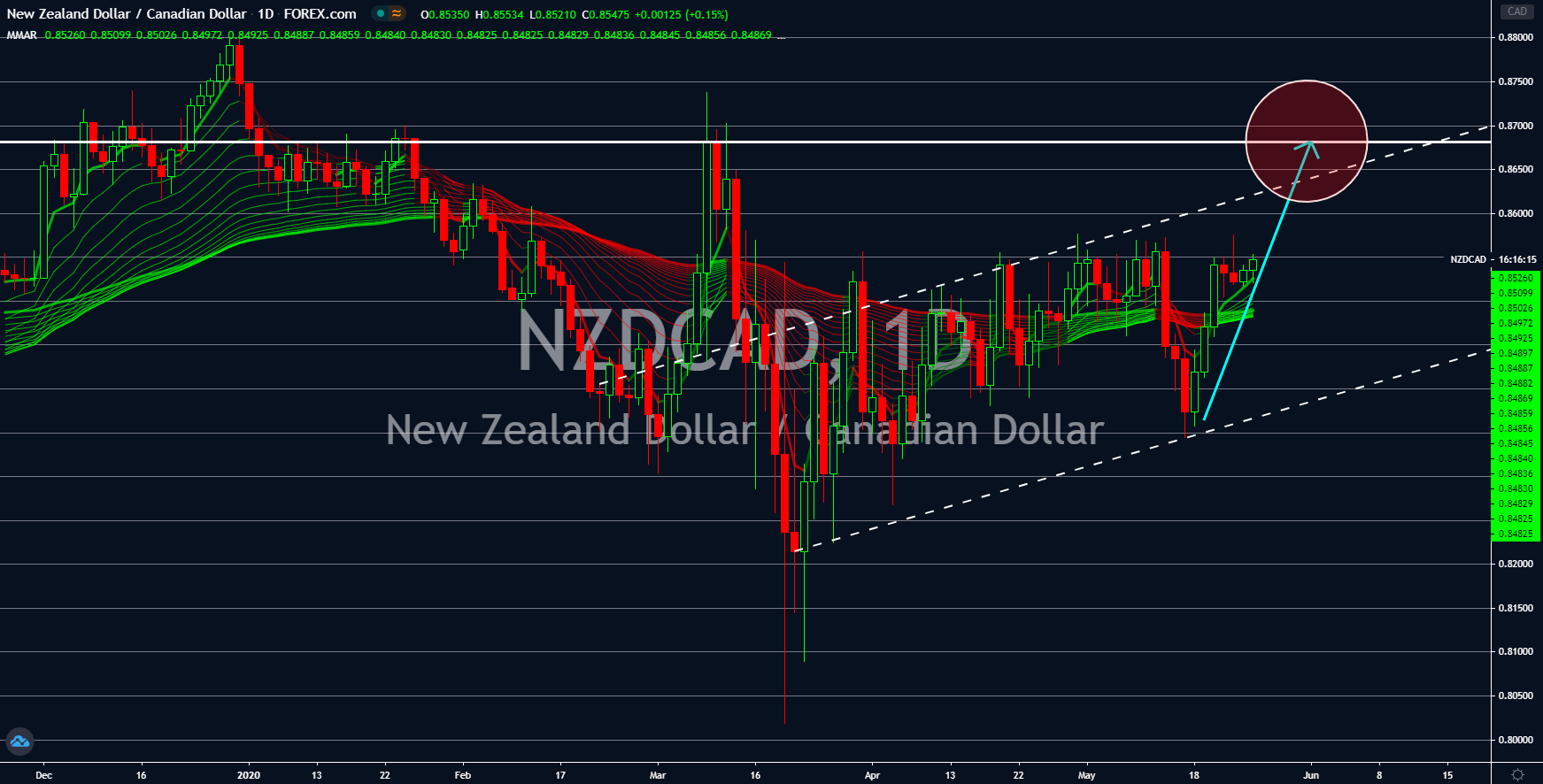

NZDCAD

The Canadian dollar will be in a defensive position against the New Zealand dollar in the coming sessions. New Zealand proved to investors that it is a force that they can rely on during times of crisis. On the country’s Import, Export, and Trade Balance report yesterday, May 26, the government showed data that pointed out a momentum of increased export by New Zealand. This means that the coronavirus pandemic hasn’t stopped Wellington’s local businesses. And now that the country has lifted its lockdown restrictions, an increase in its export is expected. This, in turn, will strengthen the NZD in the following days. On the other hand, Canada is bracing for a surge in coronavirus cases in the country as the US began easing its lockdown restrictions. The US has the largest COVID-19 cases and deaths around the world and fear in Canada over the contagious disease continues to bother investors.

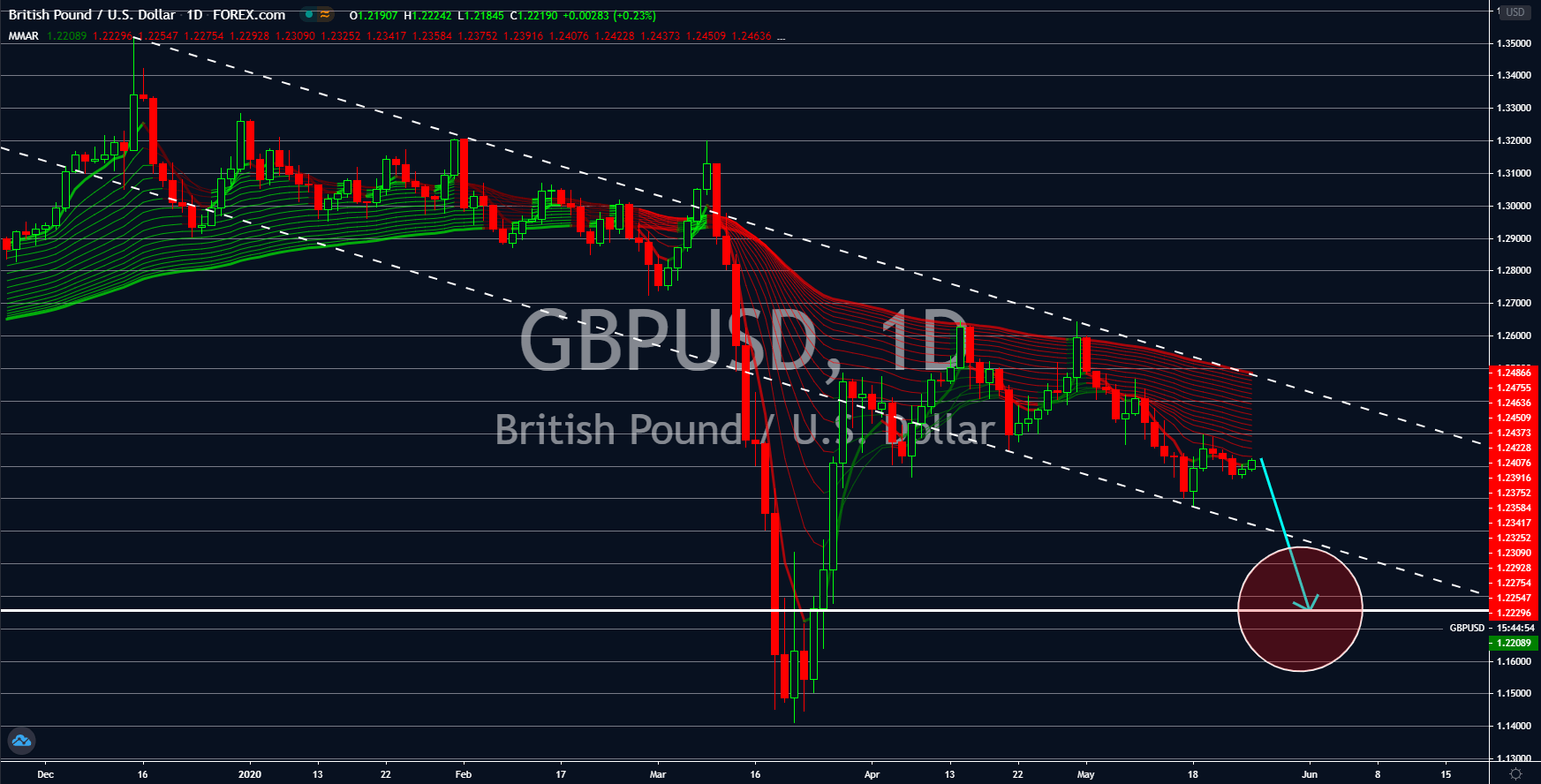

GBPUSD

The United Kingdom is facing its deepest economic crisis for the past three (3) centuries. This crisis was brought by a double whammy of events, the withdrawal of the UK from the European Union and the coronavirus pandemic. In Q1 2020, Britain’s GDP growth shrunk by -2.0% and analysts warned that further decline on the UK’s growth is expected in the coming quarters. The warning from analysts echoed the continuous increase of coronavirus cases in the country, which is now the fifth highest in the world. In addition to this, the country remained in a lockdown with no specific time when it will be lifted. Its strained relationship with the largest trading bloc is also expected to take a toll on the country’s economy. Britain’s biggest possibility of surviving this economic shock was a trade deal with the US. However, with the largest economy focused on stopping China’s political, economic, and military might, the UK was left to see its economy crash.

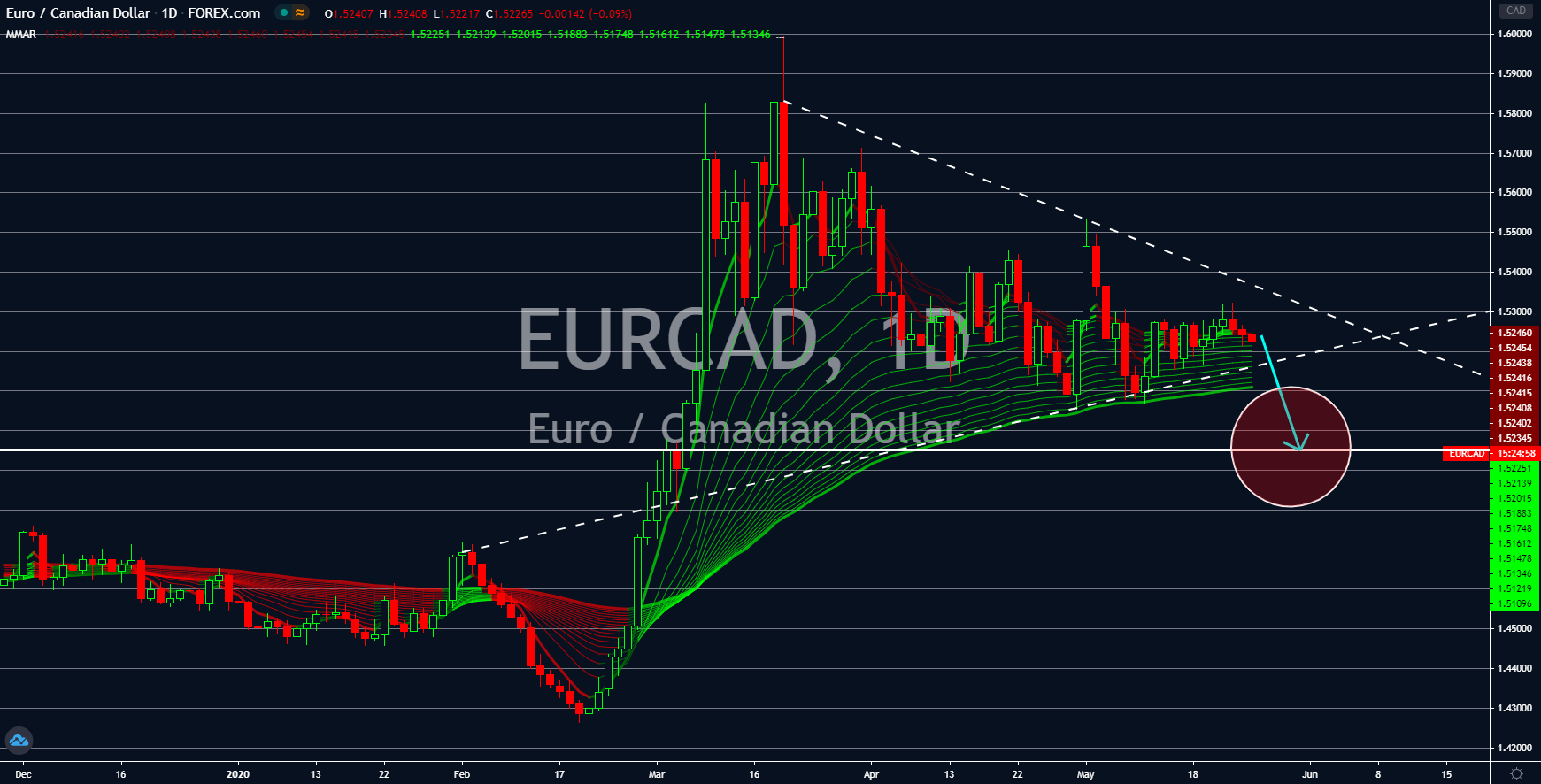

EURCAD

A domino effect in the eurozone is expected after Germany posted its biggest GDP decline since the Great Recession of 2008. Berlin dropped by 2.2% on its first quarter GDP growth, which followed Q4 2019’s decline of 0.1%. This sent the largest economy in Europe in a technical recession. The report is not only significant for Germany but also for the eurozone. Connected with a single currency, the euro, members of the monetary union will feel Germany’s weakness. Analysts were convinced that the economic recovery in Europe will benefit Germany as it is already experiencing a slowdown prior to the pandemic. The decreased economic activity in Q4 2019 was due to the US-China trade war. With China and the US’ phase one trade deal, investors in Germany were relieved. However, as tension between Beijing and Washington was reignited by the pandemic, Germany will feel the disruption in the global supply chain.

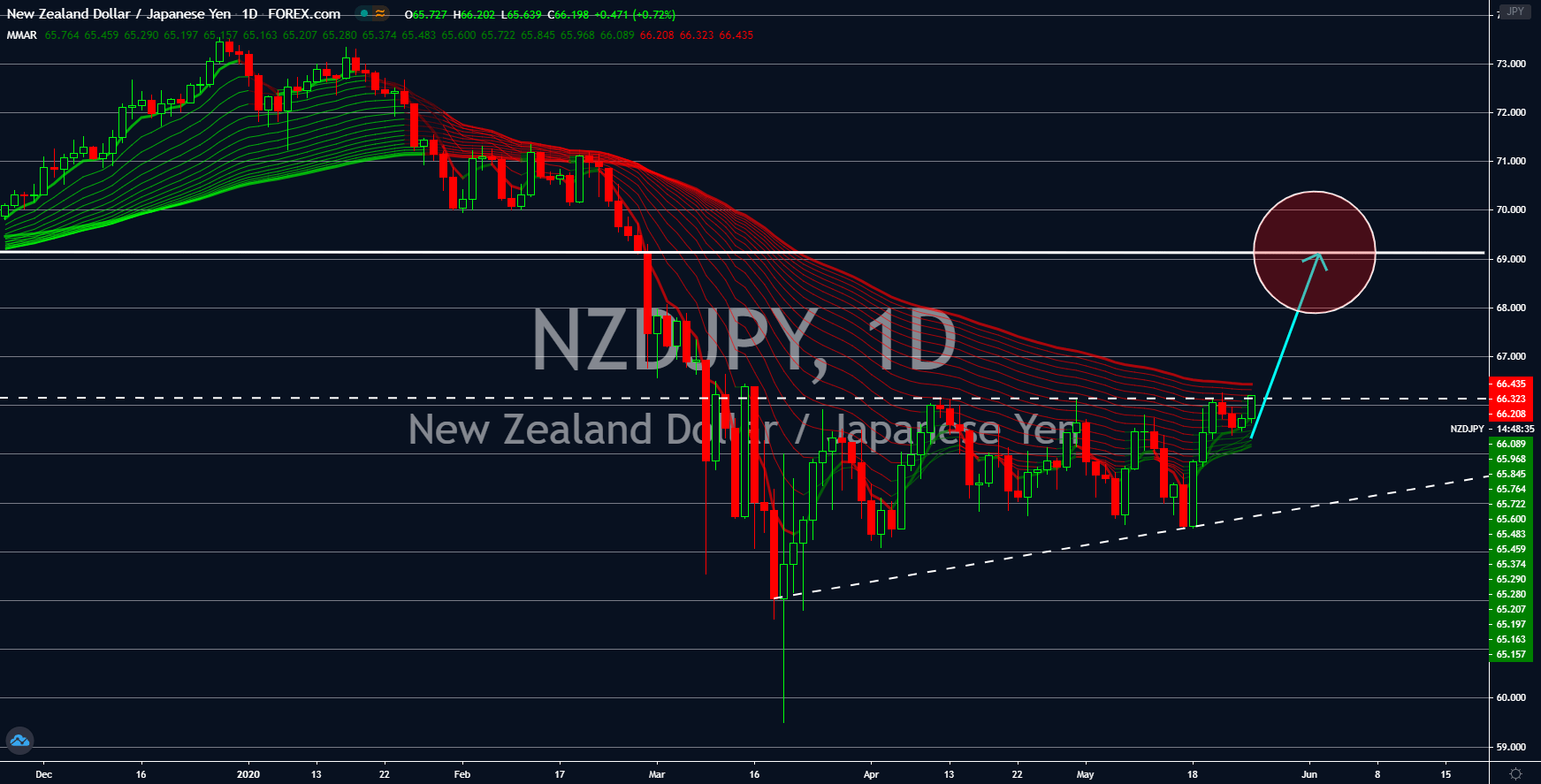

NZDJPY

Japanese Prime Minister Shinzo Abe lifted the country’s State of Emergency yesterday as it successfully contained coronavirus cases. However, this announcement failed to cheer investors as the government plans to inject another round of fiscal stimulus to cover the damages incurred by businesses and individuals due to the coronavirus. Abe is looking to spend another $930 billion dollars to rebuild the third largest economy in the world. This followed its biggest stimulus in history at $990 billion. The fresh money in the market will further drag the value of the Japanese yen against a basket of major currencies. Another country that successfully ended the spread of the coronavirus is New Zealand. Last week, PM Jacinda Ardern officially ended its lockdown and began to reopen its economy. Investors were keen into investing in the NZD as reports show export business in Wellington continue thriving amidst the pandemic.