Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

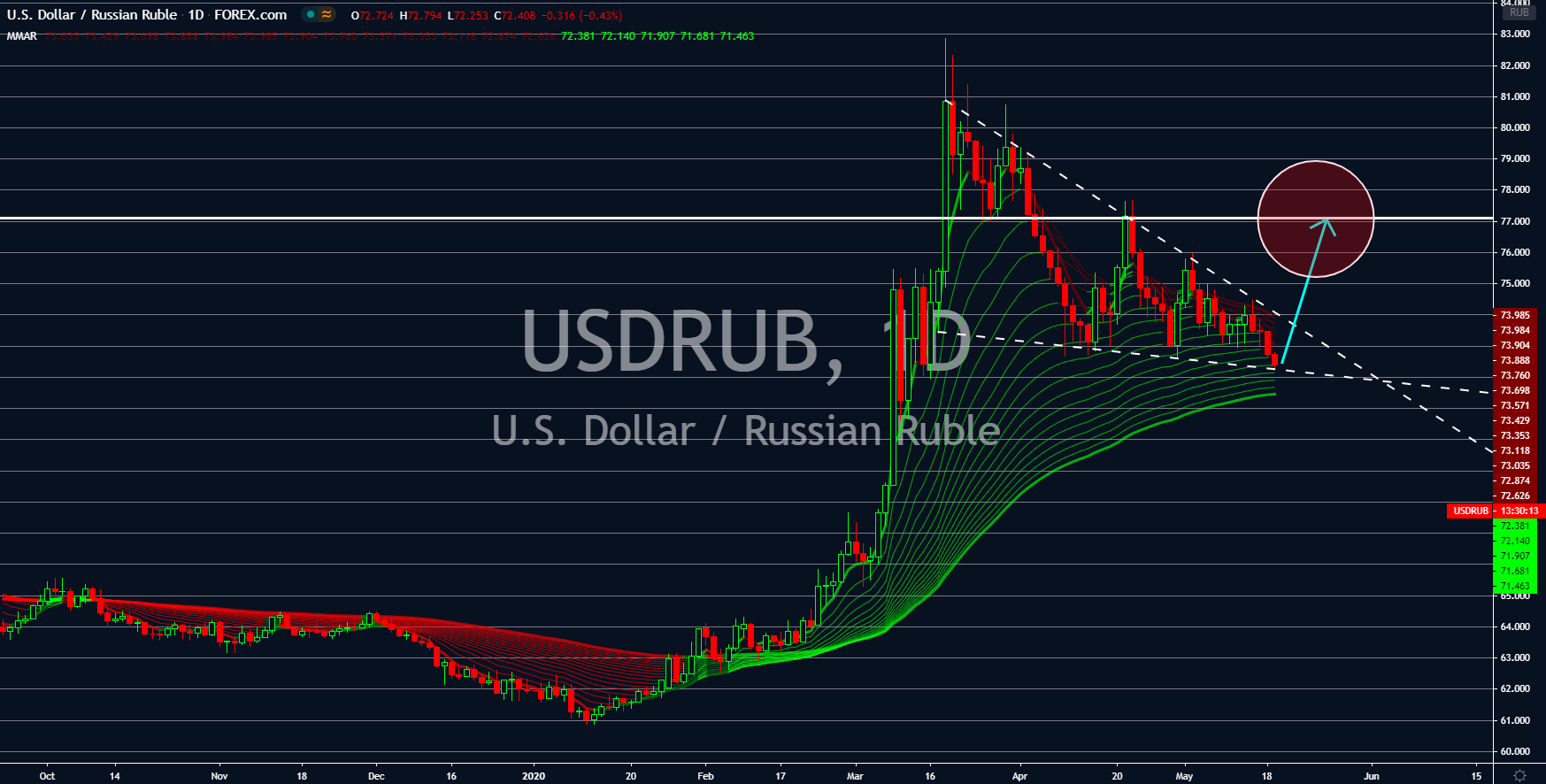

USDILS

The economic and political uncertainty in Israel will weigh down on the shekels in the coming sessions. Israel’s unity government formally sworn in on Sunday, May 17. This was following the year-long political battle over three (3) national elections by Prime Minister Benjamin Netanyahu and former Speaker of Knesset Benny Gantz. Under the coalition deal, Netanyahu will remain as Israel’s PM until November 16, 2021 and will share his term with Gantz over the remaining time of the premiership. The incumbent prime minister paved the way for stronger US-Israeli ties in the previous years. However, as new leadership comes aboard, the strong relationship between the two (2) countries might finally come to an end. China, the US’ archrival, is also setting its foot on the Jewish country. In other news, following the establishment of the new Israeli government, Chinese ambassador to Israel was found dead in his home in Tel Aviv.

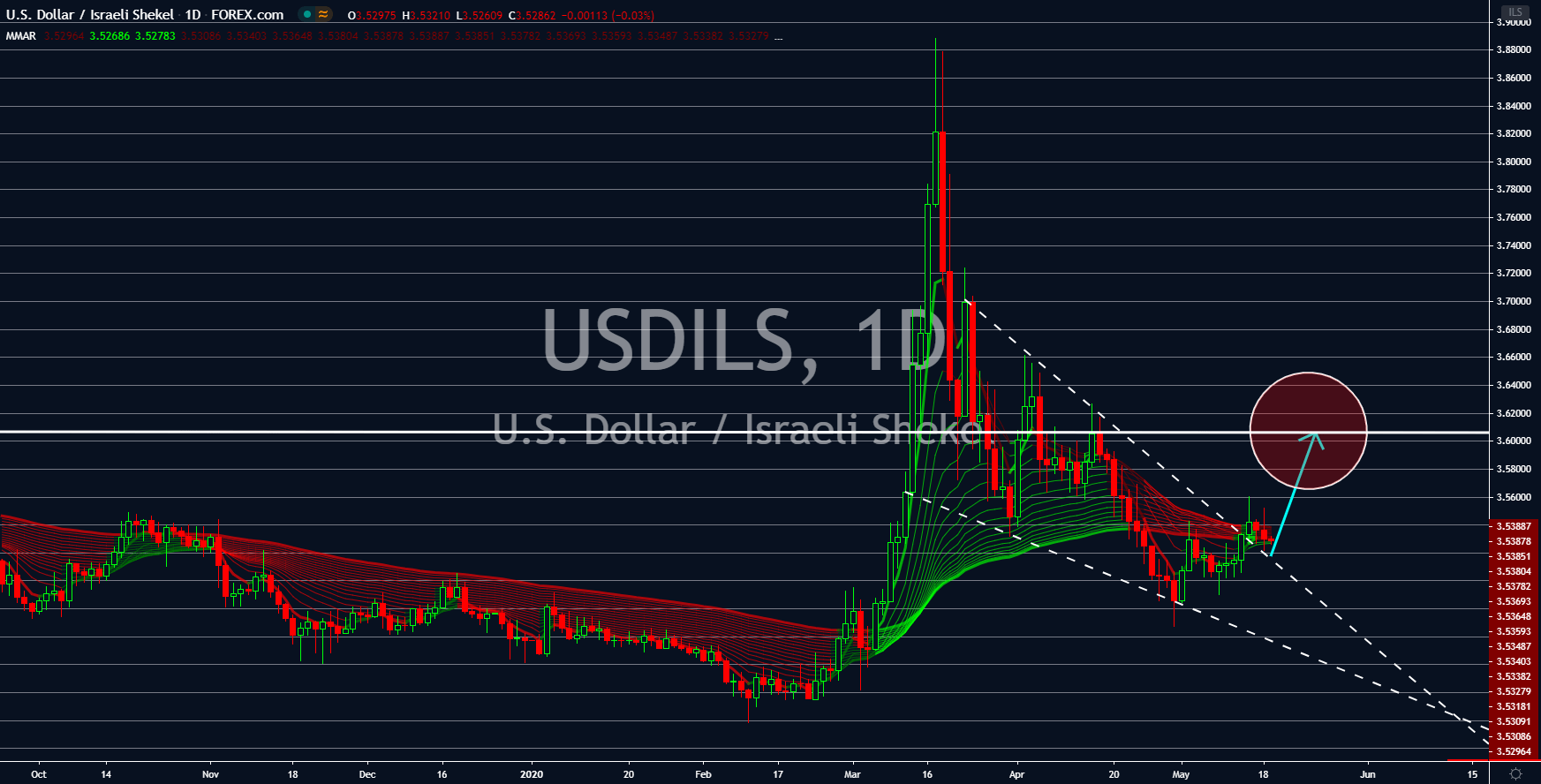

USDSEK

Sweden had its deadliest month for the past three (3) decades, according to a recent report. Despite this, the Swedish koruna will still be in a bullish position against the US dollar. Sweden is known for having a different approach against crises. In 2015, the country slashed its interest rate to -0.10 to mitigate the impact of the European debt crisis. The eurozone, on the other hand, lent credit to its members to prevent their economies from collapsing. Now that the world is facing the coronavirus pandemic, Sweden is doing a different approach. The country didn’t enter in a lockdown despite most economies in Europe imposing a self-quarantine on its citizens. Instead, the Swedish government encouraged its citizens to go out and develop herd immunity. The continuity of business operation is expected to spare the country’s economy from an economic downturn. Sweden only contracted 0.3% in Q1 2020, below Europe’s average.

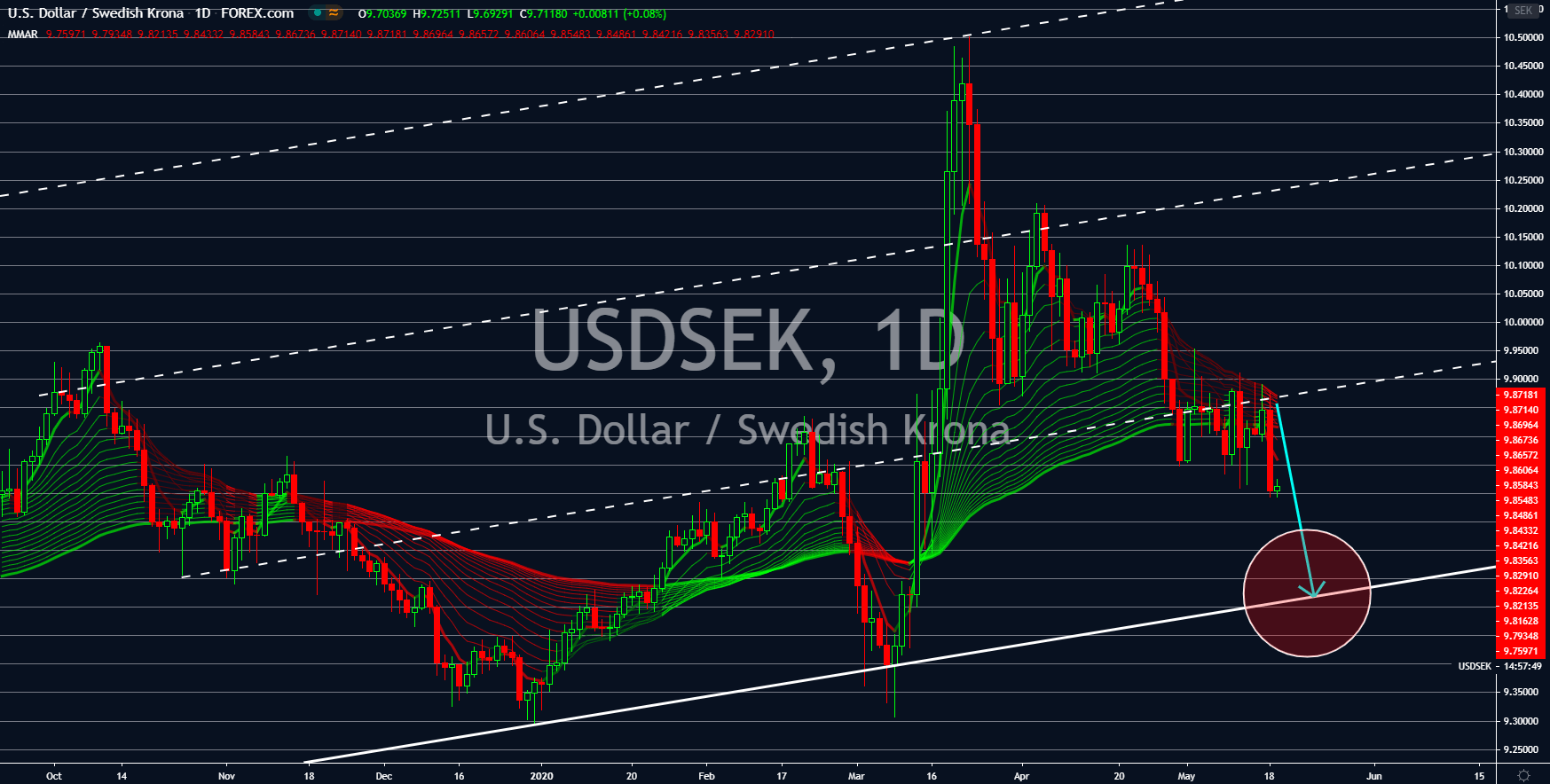

USDZAR

The South African rand will see some weakness against the greenback until the end of the month. The SA economy is a disaster in waiting. The country is currently in a recession with a -0.8% and -1.4% growth during the two (2) previous quarters. Analysts are expecting Cape Town to enter its third consecutive month of contraction once it posted its figure for Q1 2020. Estimates for the country’s first quarter GDP growth figure for the fiscal year was at -6.0%, striking fears among investors. South Africa is currently in a lockdown and government data shows the country losing almost a billion dollar every day. The largest economy in Africa might also struggle from the rising tension between the United States and China. A recent report by the US Trade Representative Robert Lighthizer shows South Africa still under observation from the Special 301 report. The report includes countries violating US Intellectual Property (IP) rights.

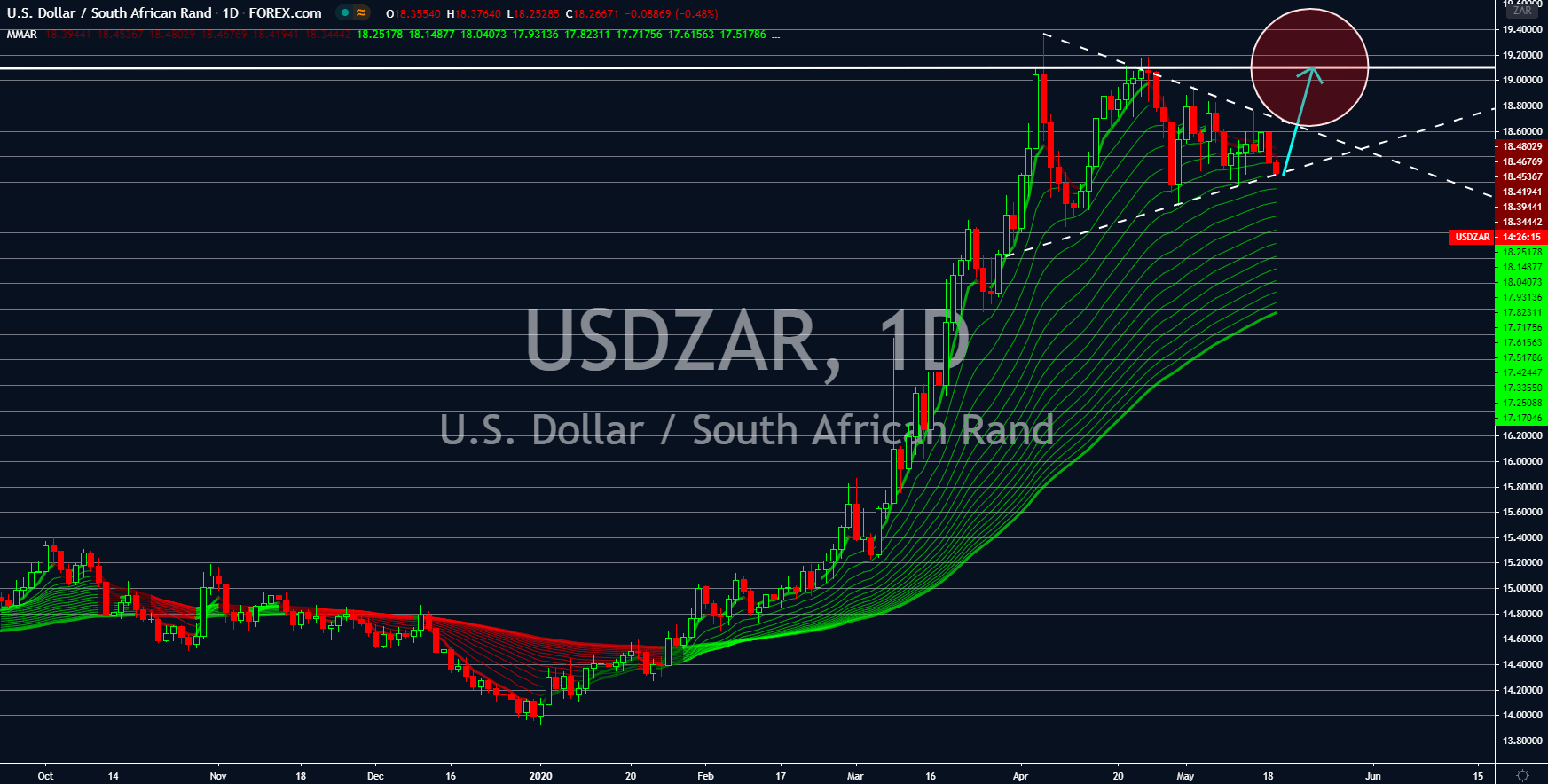

USDRUB

Russia is rising as the center of the coronavirus pandemic. Currently, the country has 291,000 cases of COVID-19, the second largest in the world next to the United States. Analysts warned that this could further cripple the already ailing Russian economy. Russia was hit by the oil market crash in April after the OPEC+ alliance forced the country to cut more production than it originally agreed to. In relation to this, President Vladimir Putin is pushing to lift its lockdown and prevent its economy from collapsing. However, analysts warned that lifting the restrictions will only result in Russia suffering more from the global pandemic. As the cheap dollar continues to flood the market, the Central Bank of Russia might be tempted to purchase the American currency, which, in turn, will support the American economy. The US has currently the largest COVID-19 cases at 1.54 million, prompting its government and central bank to introduce fiscal stimulus.