Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

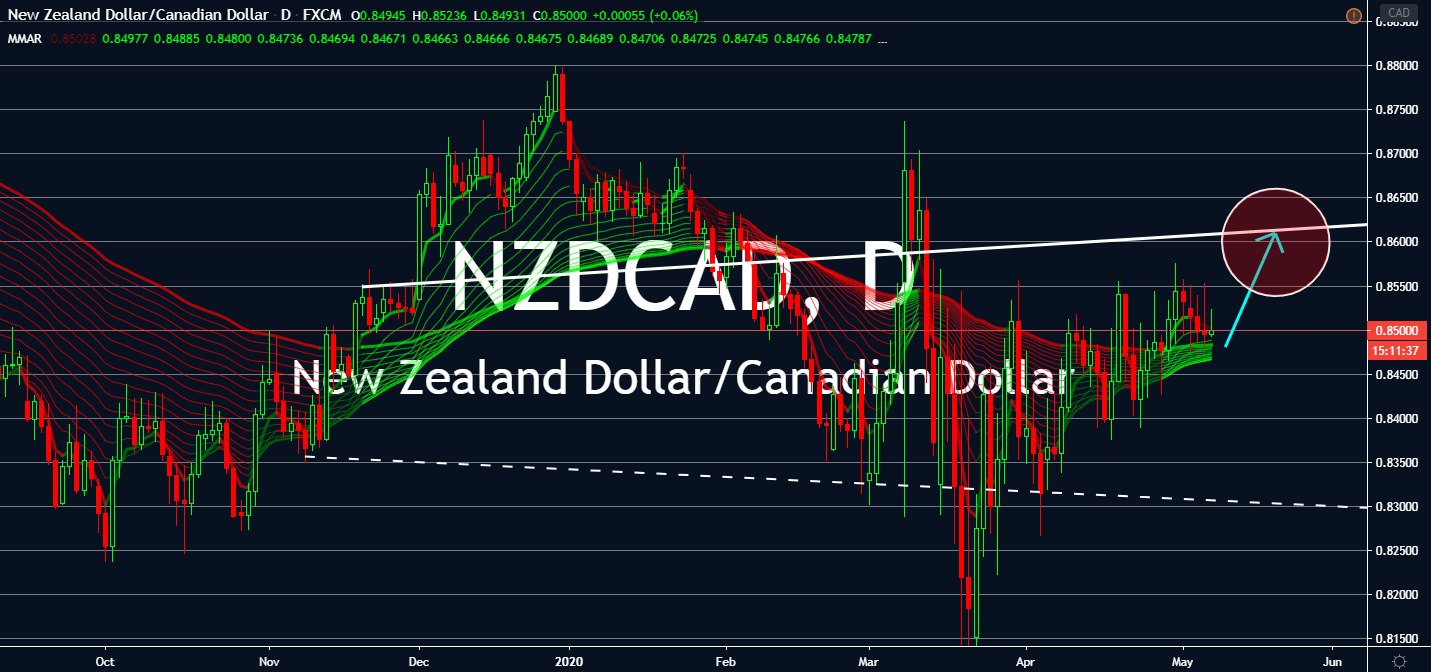

NZDCAD

The risk-sensitive kiwi-loonie pair made a volatile reversal in early March, showing a wide U pattern that started late August last year. As some countries reopen their domestic economies to stimulate fiscal stimulus, the Canadian dollar is expected to see gains long-term as per its dependence on oil for its own economy. Investors waiting to trade long are advised to trade for the Canadian dollar since the financial giant Goldman Sachs predicted oil prices to reach $51 by next year. In near-term, however, investors will be more interested in the New Zealand dollar for its country’s better core CPI and employment change figures against Canada. Until the oil market starts to see consistent gains signaling economic recovery worldwide, pushing the Canadian loonie up against non-oil dependent countries slumping against the coronavirus, the NZDCAD is expected to trade sideways with NZD in advantage for the next few months.

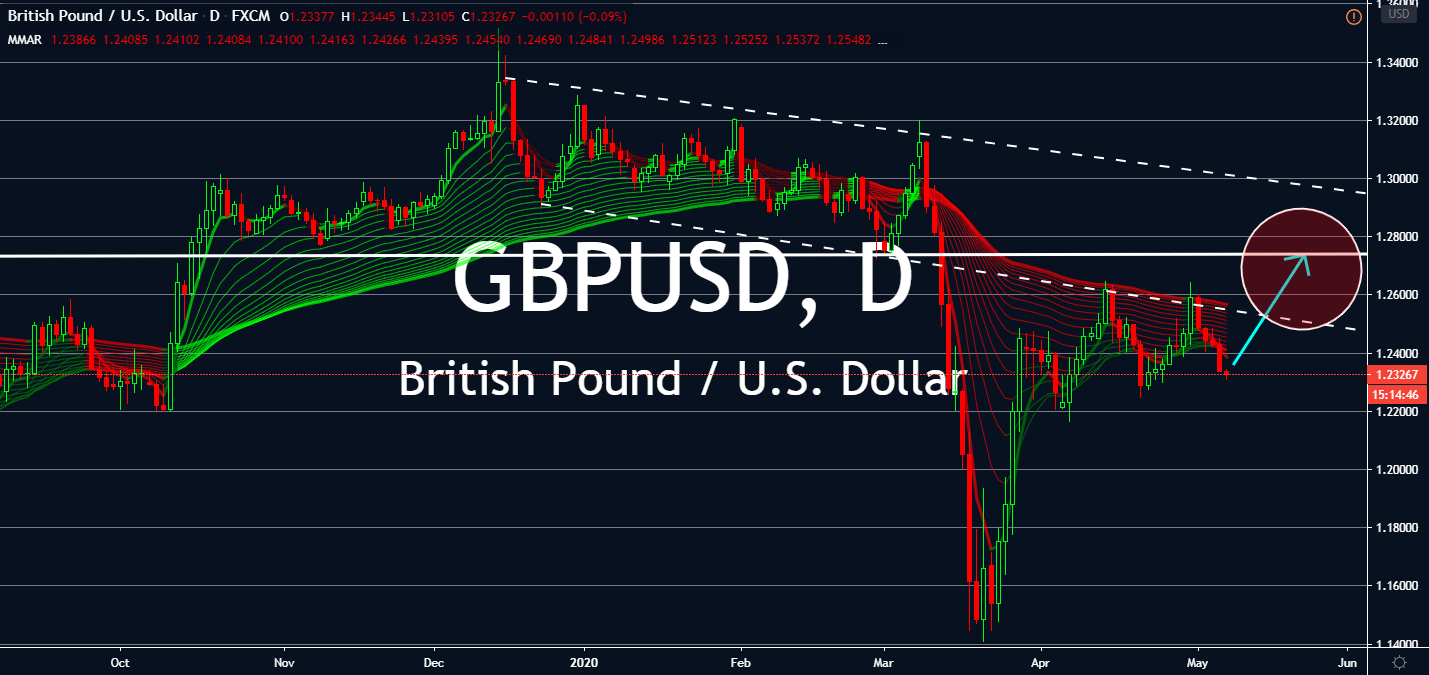

GBPUSD

The GBPUSD pair sneaked back into its previous support levels in early April after a sharp, massive drop in early March. After the month-long rally, investors seemed to have bought dollars in exhaustion. But the pound-greenback pair is expected to tread through the same levels near-term, showing a bullish pattern until it manages to stabilize three months from now. That said, the pair has always had a slightly bearish pattern – once the pair treads predictably, it will continue through this path in the long-term. As the United States waits for the effect on the Federal Reserve’s aggressive economic decisions against the coronavirus, it retains its interest rates as it is. This stirs the market’s attention to the same monetary policy decision from the Bank of England to come this week, which is also expected to stay put due to its record-breaking asset purchase program of 200 billion pounds to push the GBP slightly higher than USD.

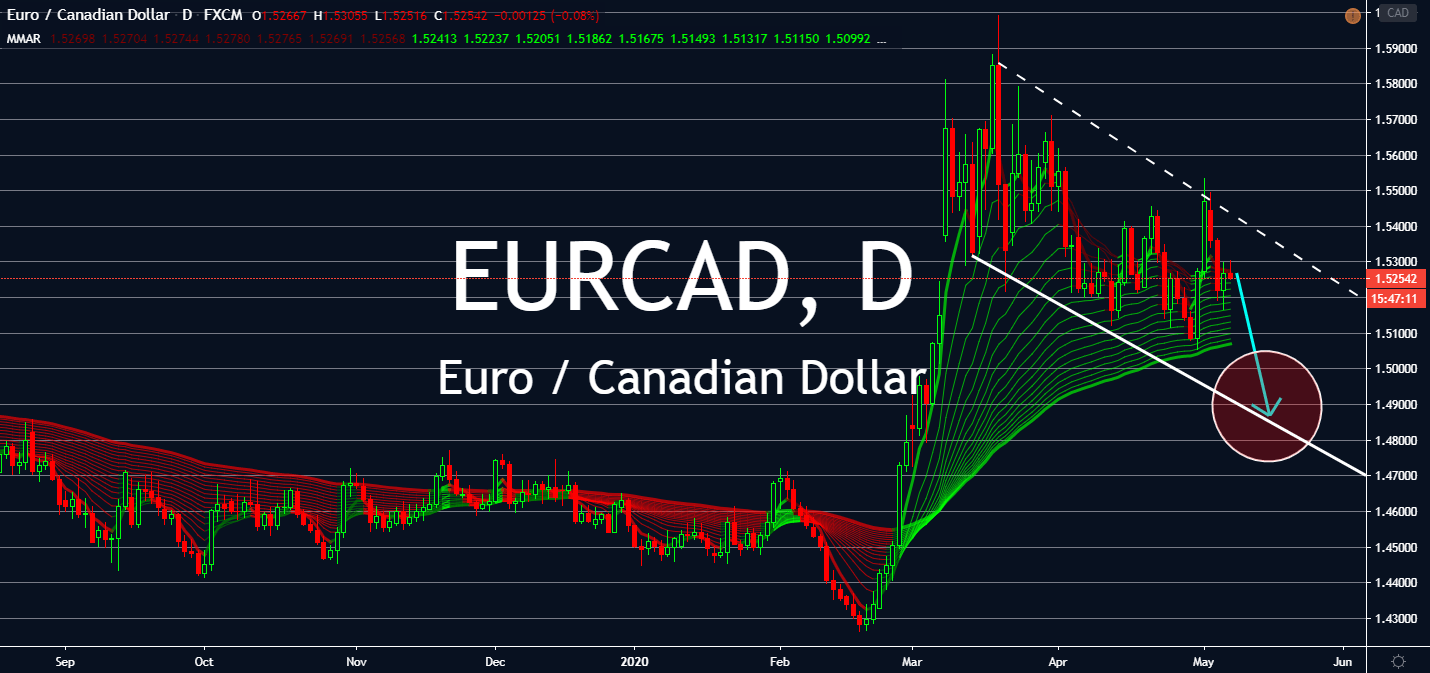

EURCAD

After seeing euro-refreshing highs in early March over worries of the oil market, the EURCAD pair looks like it’s going to fall back into its August 2019 resistance levels in the long term. Although more Europeans are starting to reopen their economies to stimulate their economies, investors will pay more attention to global oil prices to see how transportation, therefore health, is faring amid the coronavirus economy. Now, euro investors are looking at how the European Central Bank is handling Germany’s accusation that it violated the German constitution with the stimulus programs used against the coronavirus. The German Constitutional Court will continue to observe the effects of ECB’s movements in the next three months, raising the single currency’s sensitivity to risk in the financial markets, which could prove as an advantage to the Canadian loonie during a highly volatile oil market environment.

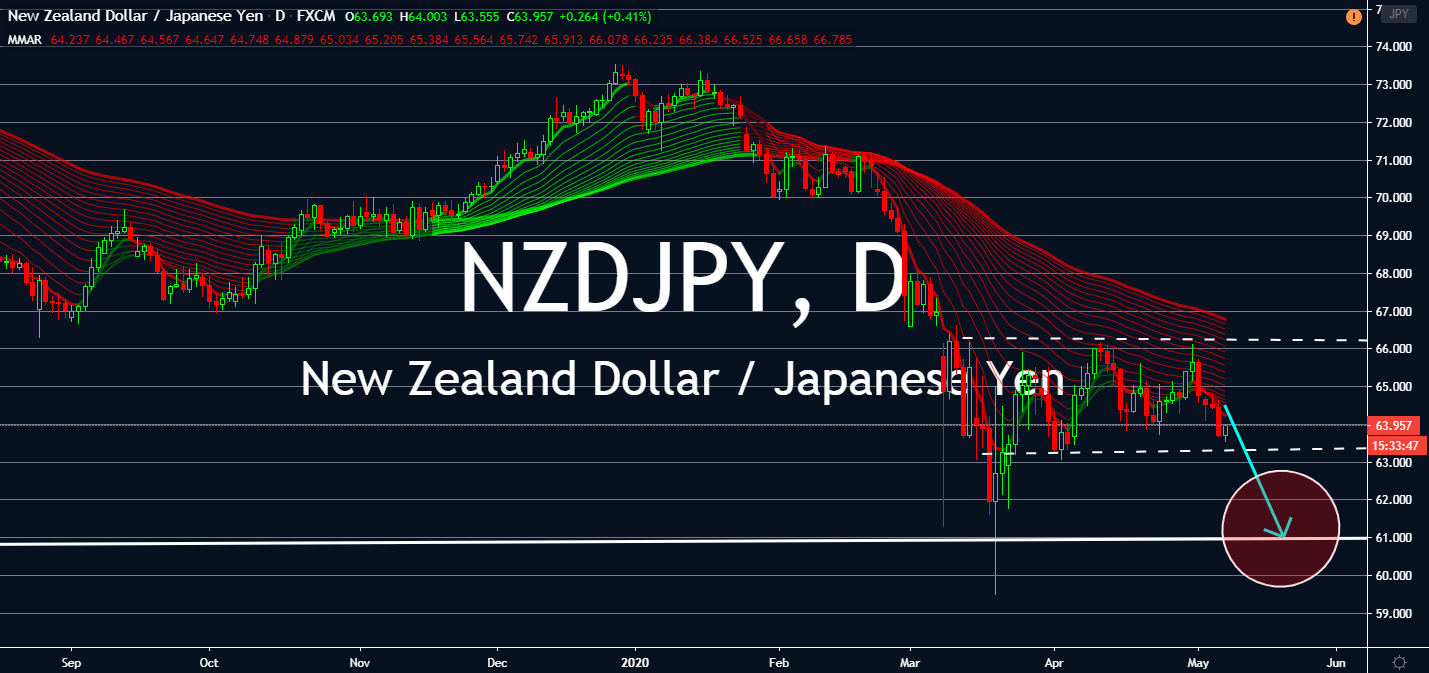

NZDJPY

The gloomy season in Australia is expected to take a toll on the kiwi against the yen near-term. One million Australians lost their jobs as per its announcement on May 6. Ahead of employment in the US and Canada, New Zealand beat employment data expectations for the first quarter of 2020, but it’s important to note that the data failed to include the sharp rise in unemployment driven by the coronavirus lockdowns that instigated a Level 4 lockdown law in the country. By year end, analysts claim that its unemployment rate will jump to 10% by the end of this year. Although NZ is looking to ease its lockdown from Level 3 to Level 2 by next week, experts also don’t believe this would be enough, especially with a possible quantitative easing program from the Reserve Bank of New Zealand already brewing in the background. If US President Trump goes through with his tariffs threat against Beijing, the yen will see even more gains long-term.