Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

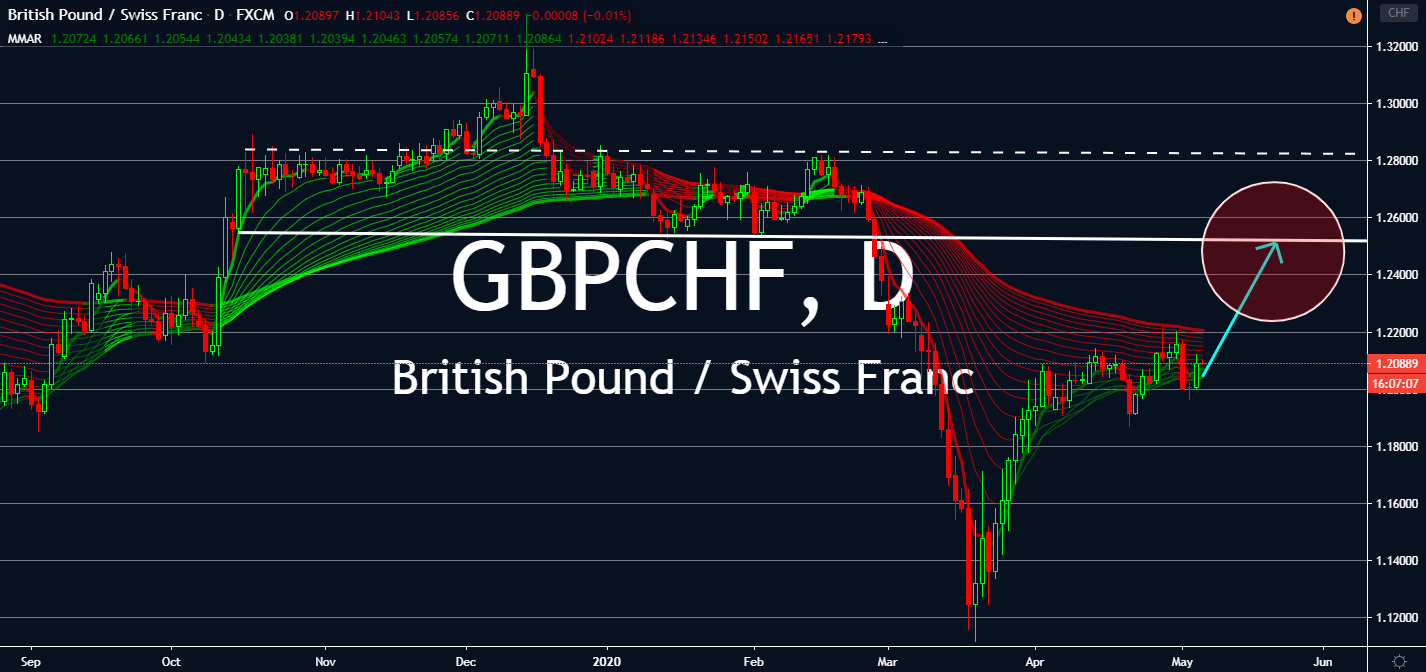

GBPCHF

Economists believe that the British pound will reach a deep V pattern against its rivals until July while it waits for the Parliament’s efforts against the economic effect of the coronavirus to take effect. In the meantime, markets are waiting for the Bank of England’s monthly interest rate decision on Thursday, the same day it will announce inflation and quantitative easing. Investors expect the agency to keep its interest rates down at 0.10% after it saw higher-than-expected results for Composite PMI and Services PMI earlier this week. Nonetheless, the UK economy is still expected to do more unless it plans to shrink its GBP down to 13% by the end of the year. The Swiss National Bank, on the other hand, reported a record quarterly loss of 38.2 billion francs in value due to the coronavirus crisis. The SNB’s biggest quarterly fall in history will keep investors engaged in GBP until it reaches a sell-off before the end of June.

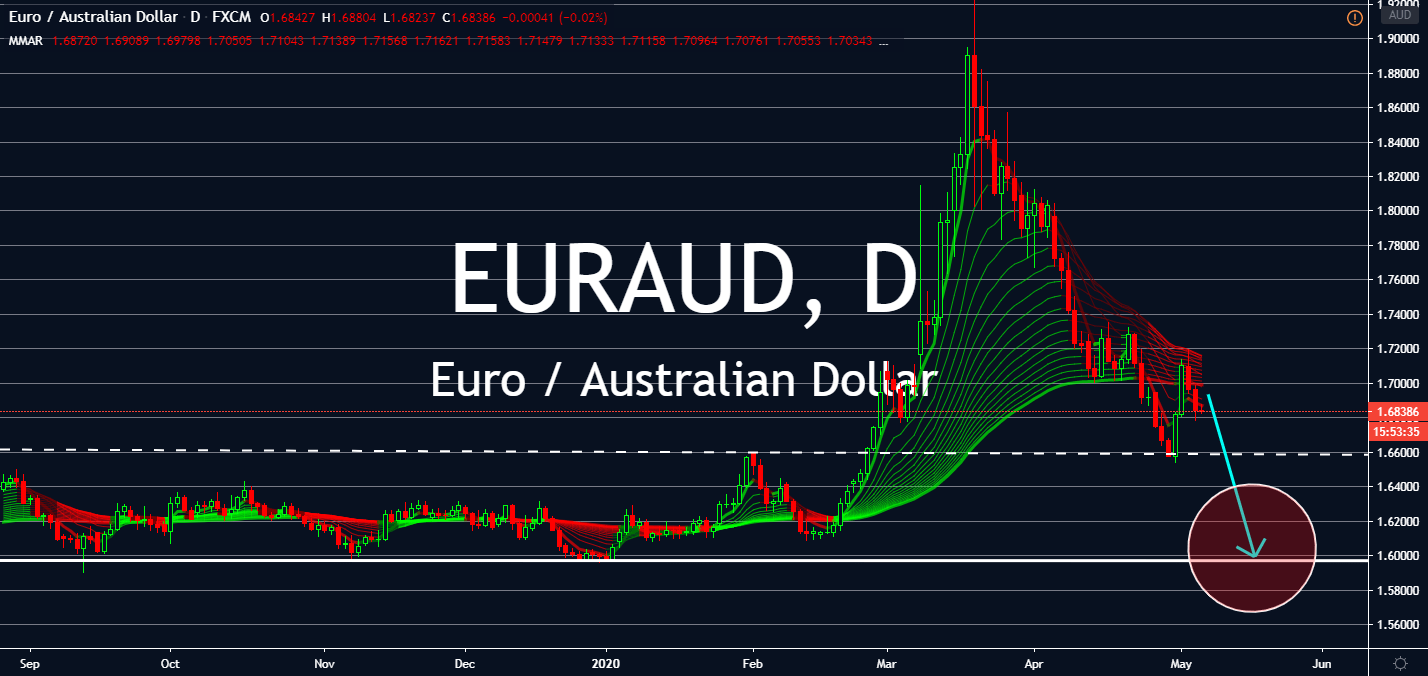

EURAUD

The coronavirus is expected to trigger Australia’s biggest economic fall since the Great Depression. The Reserve Bank of Australia kept its interest rates down at record lows of 0.25% after its monetary policy meeting yesterday, followed by an announcement that the country will have to go through a “very difficult period” according to RBA governor Philip Lowe. Saying that the eurozone is in a similar situation is an understatement – the bloc already shrank lower than what it saw in 2009 just in the first quarter of this year. Because of this, Australia is expected to see better engagement against the single currency near-term, especially after it saw a higher-than-expected retail sales figure in a monthly comparison for March against investors’ expectations to see a lower slump for the same figure in Europe. Unless the European Central Banks sees positive results for its recent urgent moves soon, the EURAUD pair will continue to see the bears.

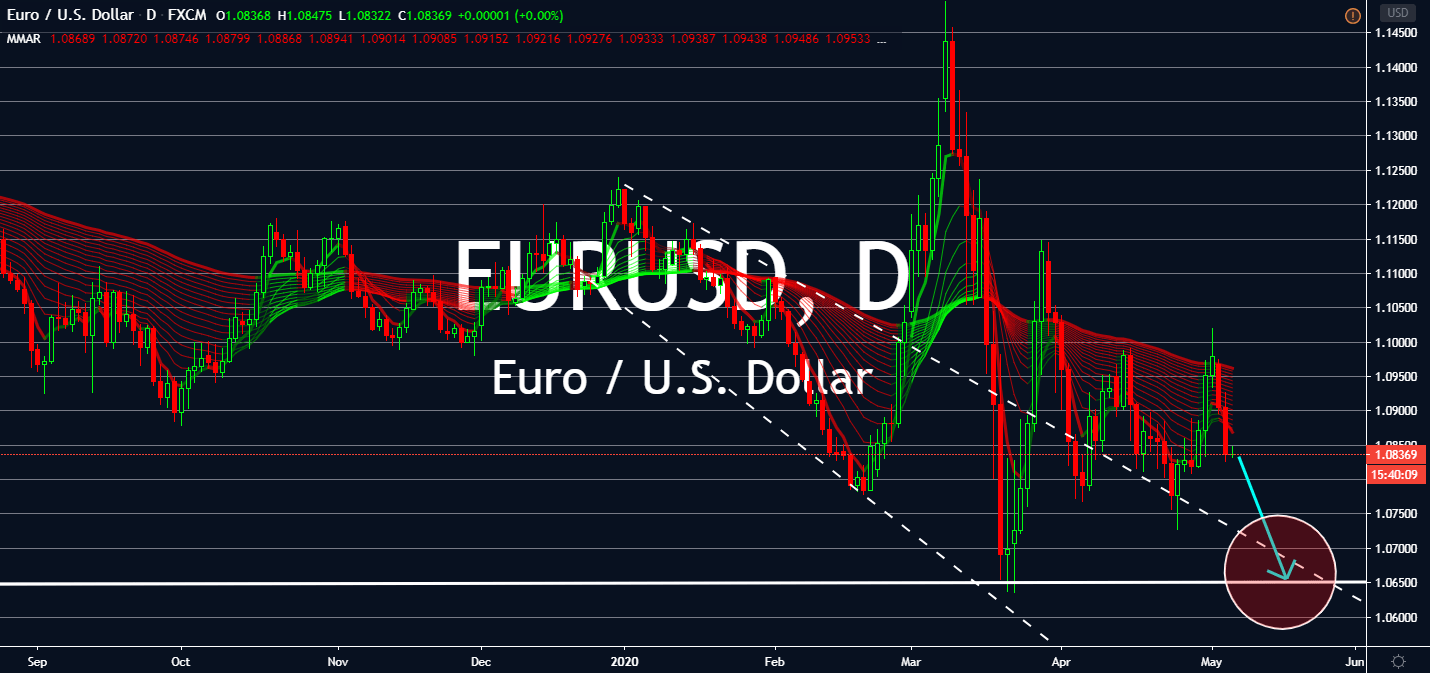

EURUSD

The euro-greenback pair has been one of the most volatile FX since the coronavirus crisis began. Germany’s claim that the European Central Bank’s stimulus program was a violation of the German constitution was proven false, but the German Constitutional Court still gave ECB a three-month ultimatum to prove its proportionality between the plan and its effects on the bloc. After the EURUSD pair performed the worst yesterday, it looks like the single currency will play mostly with the bears for the next three months until the GCC makes a final decision in July. Throughout the wait, economic re-openings in European countries are expected to dampen the fall. For now, the pair will continue to see lows similar to 2017, especially if the United States manages to reopen more of its economy amid the Federal Reserve’s actions and rising oil markets triggered by increasing demand for transportation inside and outside Europe.

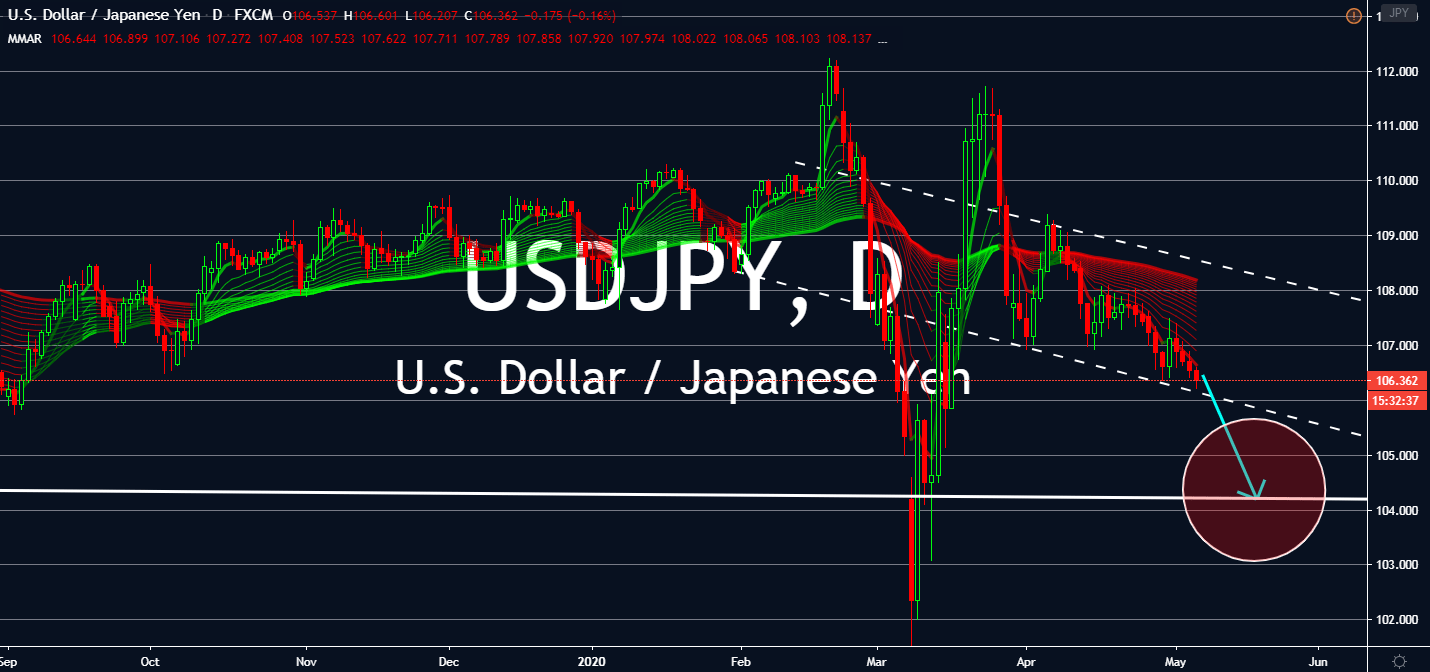

USDJPY

The United States President Donald Trump will push the country’s currency down against the Japanese yen, starting with another round of tariffs against China. The threat will possibly reignite the US-China trade war before the country could wrap up its coronavirus cases. Trump’s threats against the region pushed stock markets down yesterday as investors fear of an even deeper economic recession because of this. The safety of the Japanese yen will keep investors trading for it until Trump and his allies start to announce positive news, especially as stock markets continue to suffer anyway. Most major companies in the States are still on lockdown due to insisting protests and unsure government policies despite the Federal Reserve’s consecutively aggressive actions to counter the pandemic’s economic effect in the country. In the meantime, only movements in crude would be able to dampen the slump in the next coming months.