Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

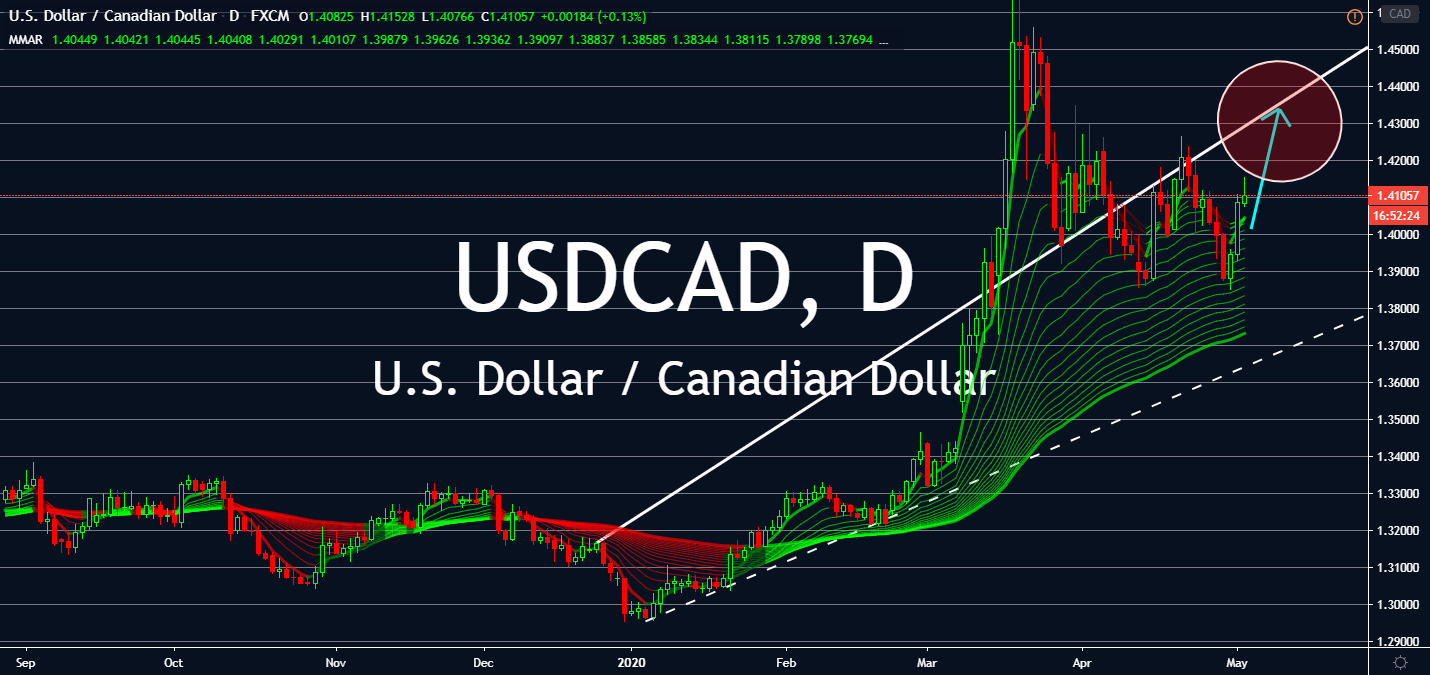

USDCAD

Both the United States and Canada are setting up to announce their employment change for the month of April later this week. After Canada’s devastating unemployment reports for March, investors expect to see an even lower reading for April from -1,010.7K TO -2,750.0K. Its unemployment rate would then be jumping from 7.8% of the country to 16.0%. Meanwhile, the US is forcing itself to go back to work. As some states reopen to stimulate its economy, ADP nonfarm employment change is expected to increase from -27,000 to -20,000 for April. Nonfarm payrolls could then drastically lower from -701,000 to -21,000 for the same month as well. Even though the unemployment rate in the country is similarly expected to plummet down to 16% for April, these aforementioned figures will push the greenback up against the loonie near-term, at least until Canada is able to report good news for oil or its overall economy.

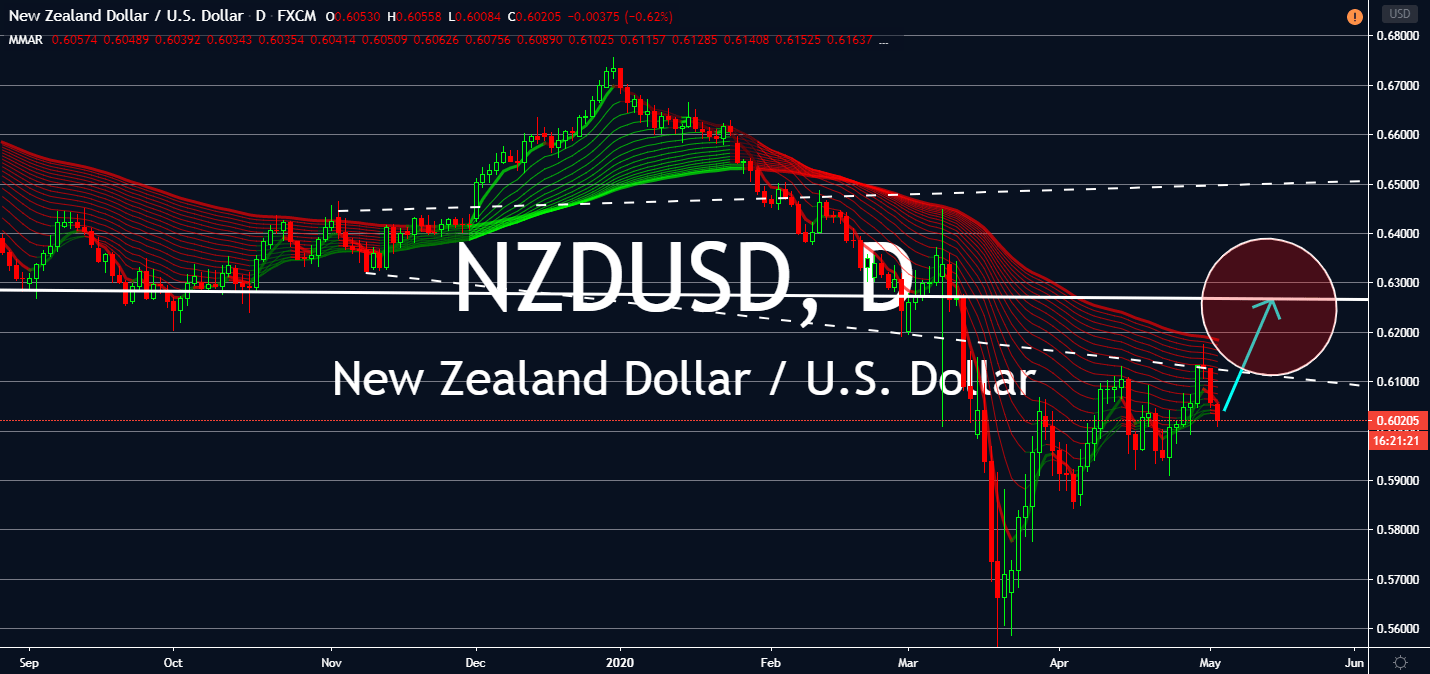

NZDUSD

Employment change is this week’s trend, apparently, as investors brace themselves for New Zealand’s figure for the first quarter of 2020. The figure is expected to lower by -0.3% against the previous quarter, which is surprisingly low for a country on lockdown against the coronavirus pandemic. When comparing the same change for the United States, the figure declined by -113.3% against employment changes seen during the last quarter of 2019. The land of the Kiwi also saw its first day without new coronavirus cases today as it carefully exits from a complete, transparent lockdown in the country. The safe haven currency is expected to see highs against the US dollar in the next coming session, especially as soon as it finally heals completely. The US will only see gains if it sees positive news, starting with decreasing cases, about the coronavirus pandemic that could stimulate its economy without the help of the Federal Reserve.

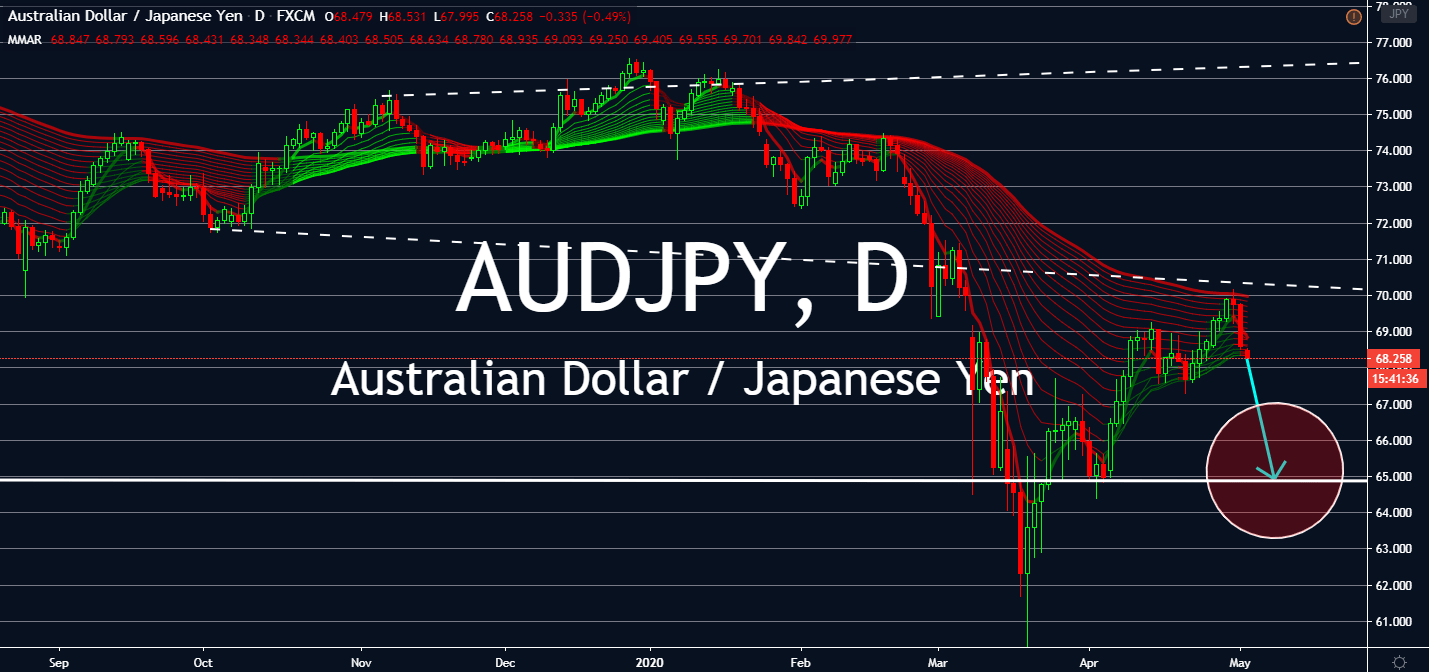

AUDJPY

Japan initially eased its coronavirus lockdown with the conclusion that its cases have already reached its peak, but last week proved it otherwise. Prime Minister Shinzo Abe will formally decide on a roughly one-month extension to the state of emergency in the country to help contain its newly emerging cases, especially as its medical system stretches thin and the economic activity depressed due to stay-at-home and business closures. As per its groundwork laid down last week, the country might not even come back to normalcy anytime soon. Nevertheless, its status as a safe haven currency is expected to help the Japanese yen against its main rivals while Australia is gradually descending into its worst economic recession yet. The Reserve Bank of Australia is expected to announce retention for its record-low benchmark rates later this week, even with plummeting housing markets and employment rates.

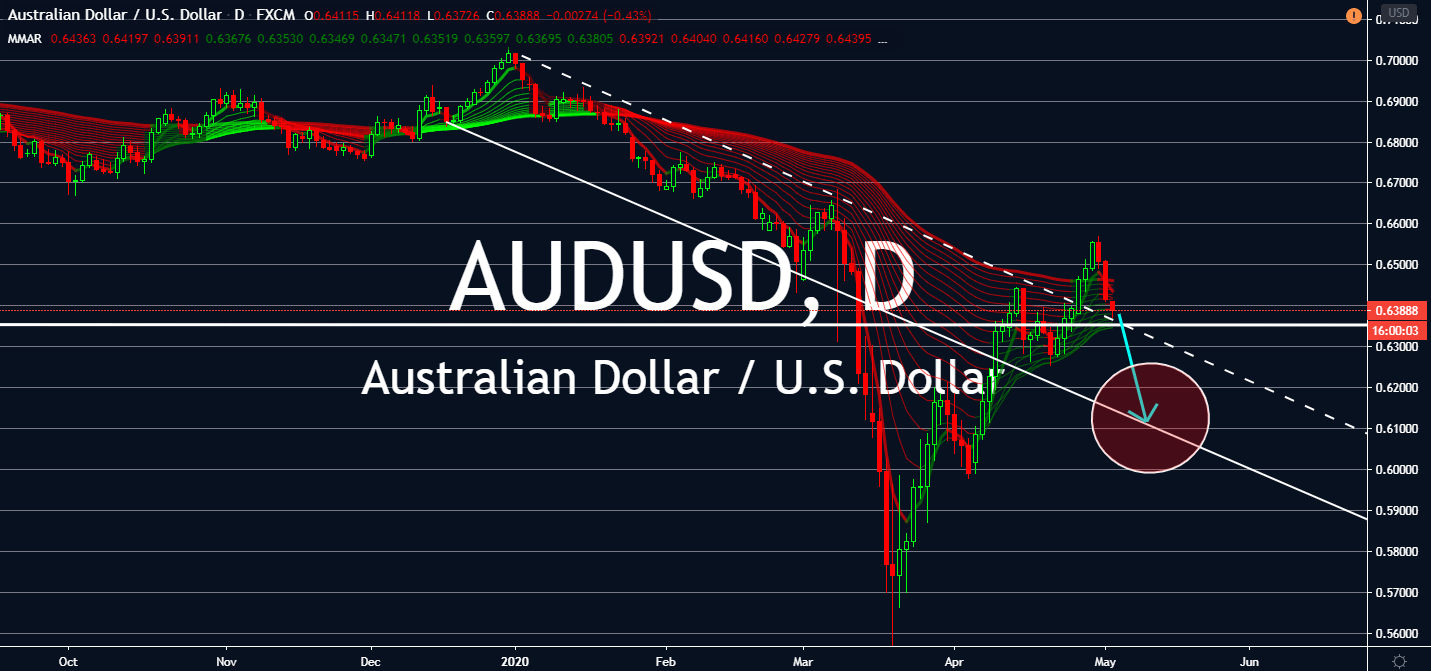

AUDUSD

The Reserve Bank of Australia is set for a monetary policy meeting tomorrow, which will determine the effects of its movements against the coronavirus by far. The “wait-and-see” approach of the central bank is taking a toll on its currency as experts believe the region is already slumping into its worst economic recession since the early 1940s. Investors expect the central bank to retain its 0.25% benchmark rate despite the possibility of a 20% plummet in housing markets, which reversed all the gains of last year’s property recovery, as well as lowering CPI and PPI figures in a quarterly and yearly comparison. Investors are worried about the RBA’s announcement of its economic forecasts on Friday as more analysts believe the country is already on its way to finally feel the fall. These will lead the Australian dollar to slump against the proactive approach of the Federal Reserve unless the RBA begins to take more aggressive measures to compete.