Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

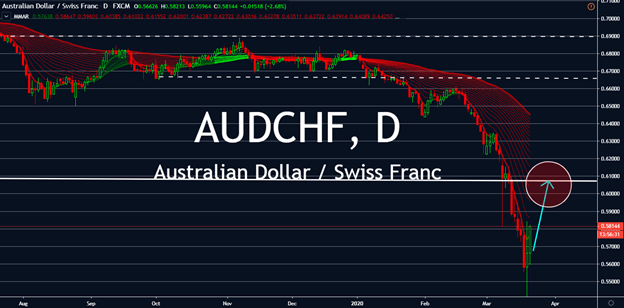

USDZAR

The rand strengthened against the greenback yesterday when the South African Reserve Bank cut its key policy rates by 50 basis points. After its price breakout on March 9th over rising expectations of said rate cut, the pair is continuing to face intermittent resistance in highs similar to those achieved in 2016. However, the US dollar is enjoying fresh demand over most markets after the US president unleashed stimulus to help boost movements against negative effects in both welfare and economic effects of the coronavirus. Although the rand’s value is still heavy on its interest rates, US President Donald Trump’s decision to pull out a $1 trillion budget for his cause is expected to pull investors into the US dollar train. If the rate cut serves its purpose for the South African economy, the USDZAR pair might reach familiar highs in the long term.

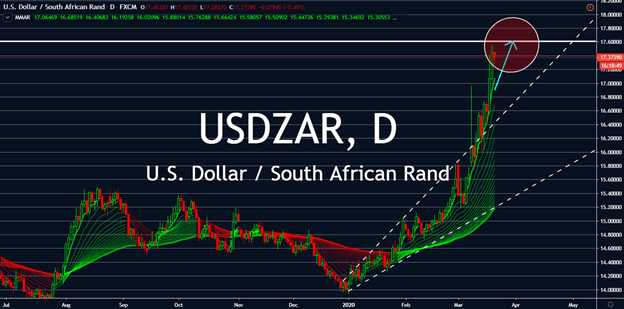

USDSEK

The Swedish krone has been facing high volatility in several markets for a long time, USDSEK especially. The SEK is expected to continue facing this uncertain trope against larger and safer currencies until the crisis diffuses. The Riksbank surprised markets on Thursday when it unveiled further measures to shield the Swedish economy from the coronavirus impact, including offering more loans to banks on discussed terms and increasing asset purchases, as well as a reduction in overnight lending rate to banks to 0.2% above its repo rate. The bank also increased purchases of securities by up to 300 billion Swedish Krona. A major Swedish pension fund also announced that it will no longer invest in fossil fuels in accordance to the Paris Agreement, which kept investors uncertain of rooting for the krone. For now, the country’s questionable CPI is still pushing the currency down while the market waits for any reports on the package.

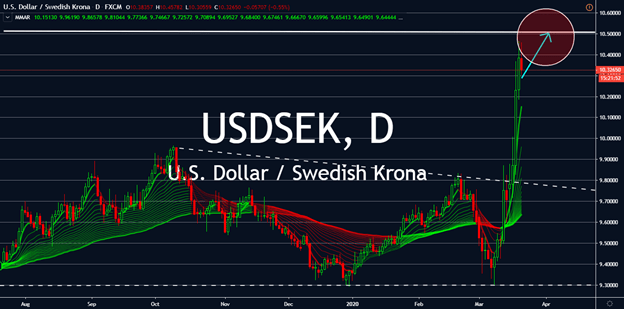

AUDCAD

In crises that could lead to global recession, investors are taking a turn on the currencies they value. The Australian dollar is now expected to rise against lows seen in 2009 after the Reserve Bank of Australia unexpectedly cut its interest rates down by 25 basis points on Thursday, with a possible quantitative easing just around the corner. RBA Governor Philip Lowe said the bank and government were working together to ensure the smooth operation of Australia’s financial markets. With positivity that the region is well placed to deal with the effects of the coronavirus, the central bank is ready to purchase Australian government bonds in the secondary market to support the smooth functioning of that market. Still, the economy is still on the verge of its first recession in nearly three decades. And because of this, Prime Minister Scott Morrison announced that the country will not release its federal budget until October.

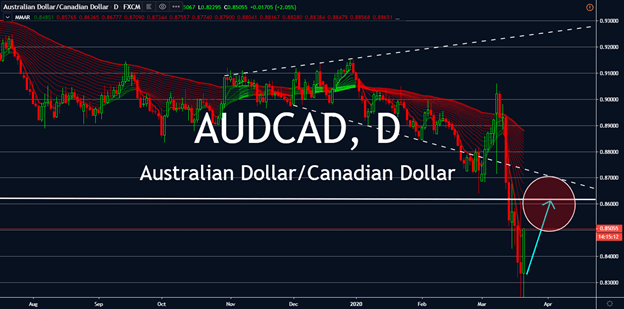

AUDCHF

The almost equal AUDCHF pair first broke down its sideways trend in early February as oil prices began to decrease amid the coronavirus’s transition into becoming a global emergency. The pair is now expected to climb its way back to that pattern as investors root for better financial stimulus in the region. The Reserve Bank of Australia’s unexpected rate cut down to record lows by 25 basis points on Thursday triggered high-volatility trading in the session. The central bank also announced the intention to issue quantitative easing, shocking investors into buying its Swiss counterpart. Analysts previously expected the region to experience its first recession in nearly three decades if RBA refuses to issue fiscal policies to help its declining economy. Now, investors are waiting for the effect of a fresh 0.25% interest rate. The Reserve Bank is now ready to purchase Australian government bonds to support a key pricing benchmark for the local financial system.