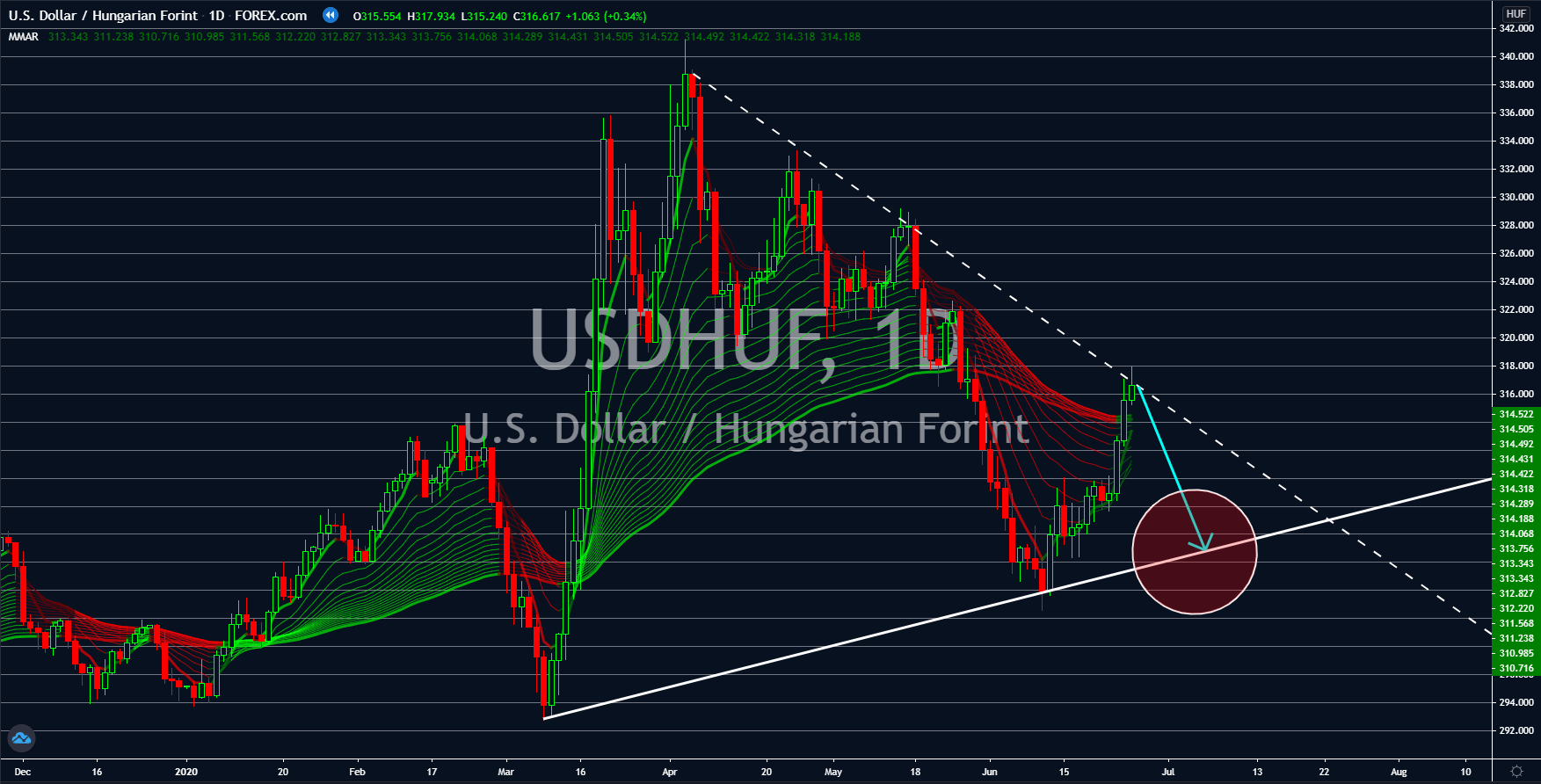

USDHUF

Hungary’s unemployment rate rose by 20.59% for the first five (5) months of the year. This was due to the coronavirus pandemic which laid recession and unemployment not only in Hungary but in the entire world. Today, the country had its largest unemployment rate since August 2017 at 4.1%. This is almost 8% higher compared to the 3.8% record for the month of April. Despite the disappointing data, the Hungarian forint will continue to thrive against the US dollar in the coming weeks. The largest economy also posted several reports this week and one of the key reports was initial jobless claims. On the report, jobless claims added 1,480K, down from 1,508K in the prior week. This figure was the narrowest change in jobless claims since the onset of COVID-19. Many analysts are worried that a possible rise in jobless claims next week might derail the US recovery. This, if true, investors should expect a sell-off in the US dollar in coming days.

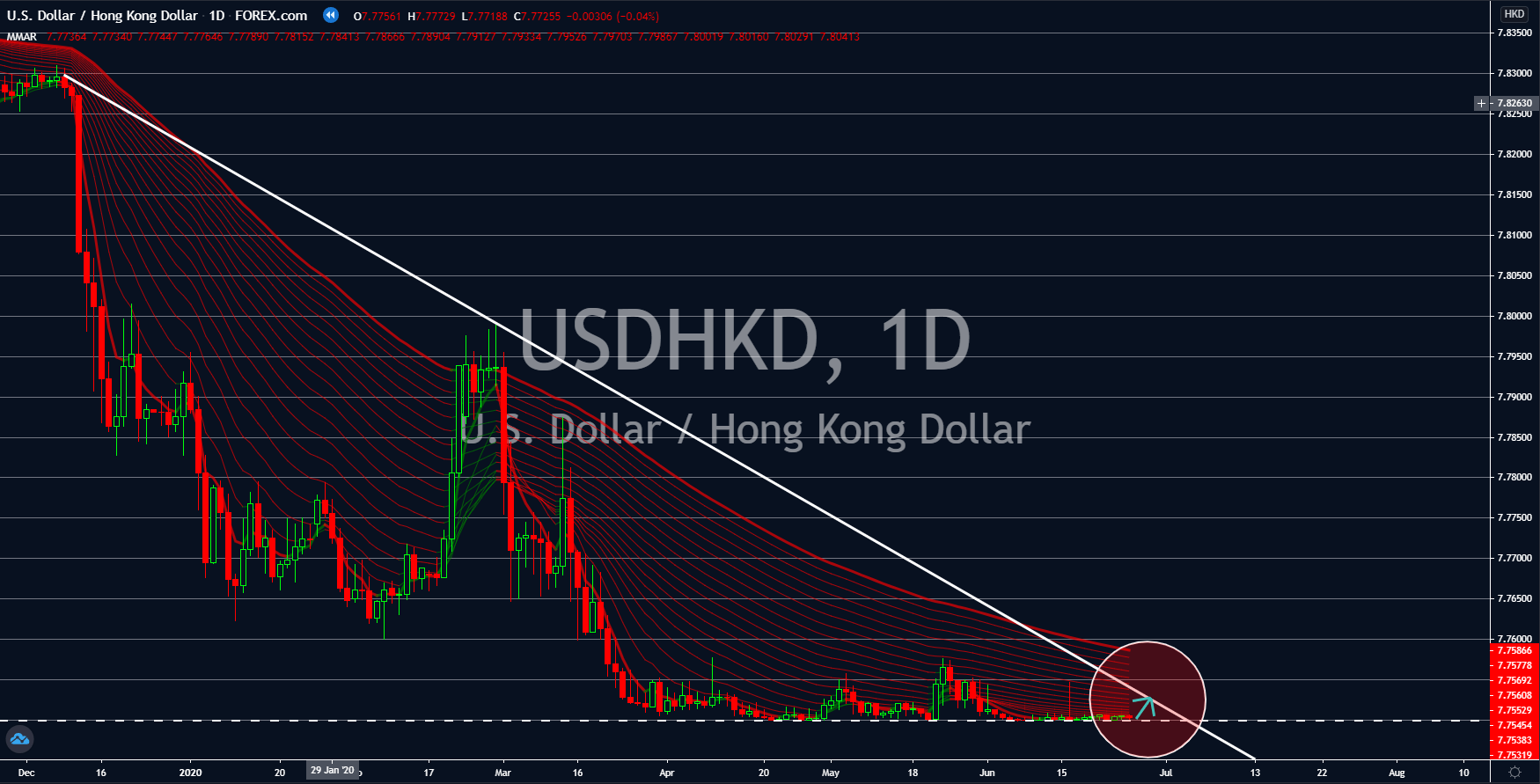

USDHKD

China passed the controversial Hong Kong security law today, June 29. This move is expected to shake the world balance especially between the United States and China. Hong Kong was a former British colony but was handed out to the Chinese government in 1997. Imposing Chinese rules on the city state was like ending the special status of Hong Kong to which the US heavily relies on its trades. The US has a special trading status with Hong Kong as part of the handover. Since China became aggressive with its intervention, the US slowly moved away from Hong Kong. This, in turn, has caused recession in the SAR. Hong Kong has been in recession since Q2 2019 and recent reports suggest that this will continue in the coming quarters. Due to the pandemic, imports and exports shrink to almost 10%. HSBC analysts said these figures will likely decrease the GDP growth for 2020 which is now expected to be at -5% before a rebound in 2021 of 4.3%.

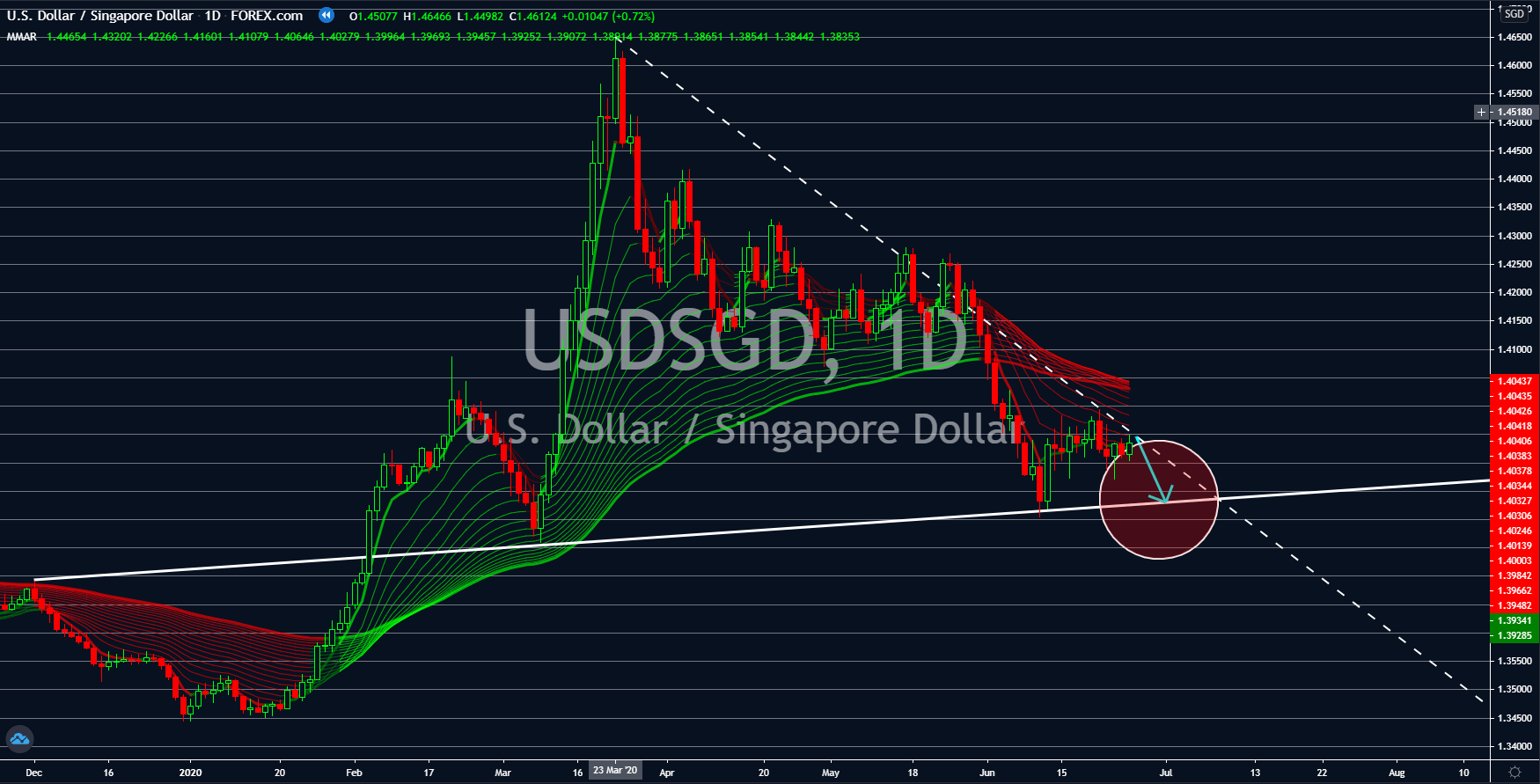

USDSGD

Uncertainty is surrounding Singapore’s economy with the coronavirus continuing to infect more people and with the upcoming general election. Singapore’s manufacturing output dropped by 7.4% year-on-year (YoY) in May, ending the two (2) consecutive months of expansion. This was still due to the ongoing COVID-19. Meanwhile, for its 5G network, the country has chosen European companies Nokia and Ericsson. However, this might result in retaliation from China which was home to Huawei. Aside from that, elections might be affected on how well Singapore is coping with coronavirus and its economic implications. This might as well end the decades-long rule of the Lee family. Meanwhile, the continuous intervention of the US government and the Fed bazooka will continue to support the US economy. Today, the US recorded its biggest monthly rise in home sales at 44.3%, more than the slump of 21.8% and 20.8% combined in May and April.

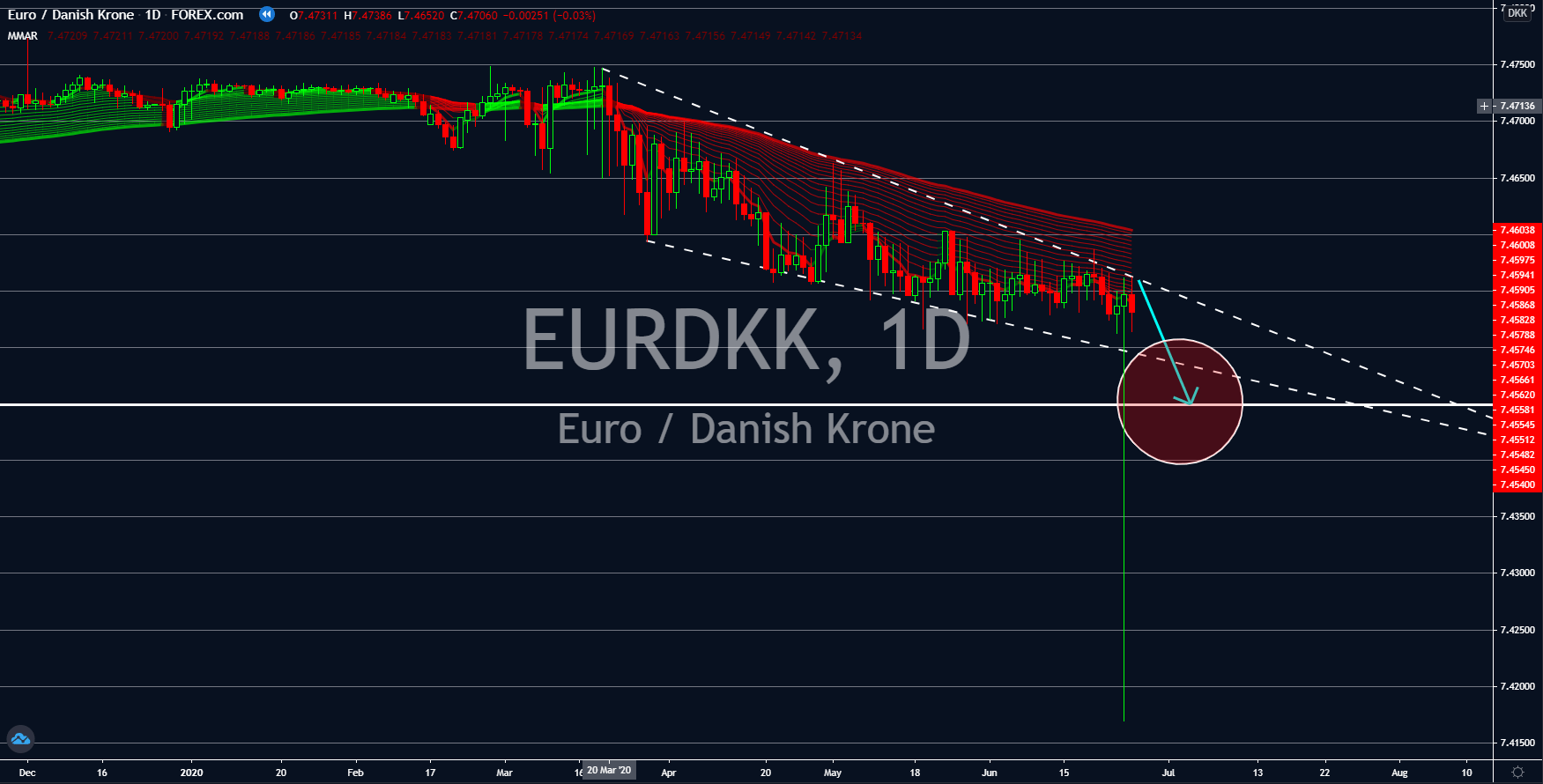

EURDKK

The coronavirus pandemic magnified the growing division among EU member states. Europe is now beginning to see the light as the region heads toward economic recovery. In the EU, however, not all member states agree on the Germano-Franco leadership’s plan. Germany and France are forcing some members to contribute more budget for the bloc. They argued that since their economies faced the worst decline, some countries need to step up. However, this plan didn’t sit well with Europe’s Frugal Four – The Netherlands, Denmark, Austria and Sweden. Denmark is the best performer in the group during this pandemic after it saw its retail sales massively jumping by 9.4% after the lockdown ended. Its GDP decline for 2020 is seen at 5.2%, also a positive figure when comparing to other EU member states. France, the second largest economy in the EU is projected to deliver 12.5% decline, just a few percentage points from Spain and Italy’s 12.8%.