Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

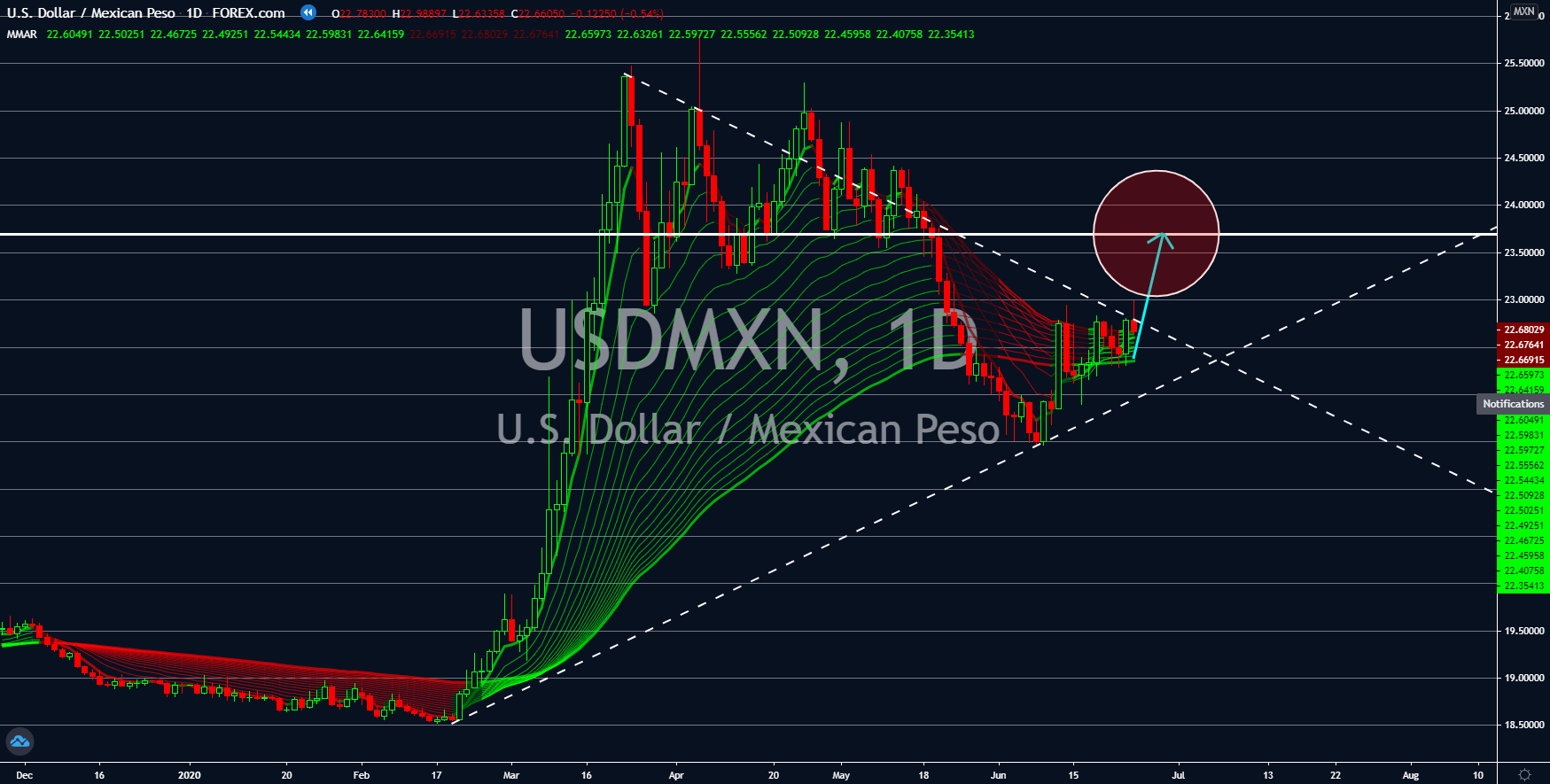

USDMXN

Mexico and the United States took different paths with their coronavirus pandemic response. Mexico closed its border with the United States on March 20 after the virus became pandemic. However, recent reports show that this decision actually hurt Mexico’s economy. America was Mexico’s largest trading partner. In 2019, their trades totaled to $614.5 billion. Shutting its border caused its economic activity to shrink by 19.90% in April. A bigger decline is also expected in July by as much as 25.0% once it revealed its economic activity for the month of May. Moreover, the retail sales report for April suffered the same fate after it posted a 23.8% decline in just a month. On the other hand, the US shrugged off threats from the deadly virus. This resulted in millions of Americans being infected. However, keeping the economy open helps US indices – S&P 500, Nasdaq 100, and Dow 30 to reach record highs.

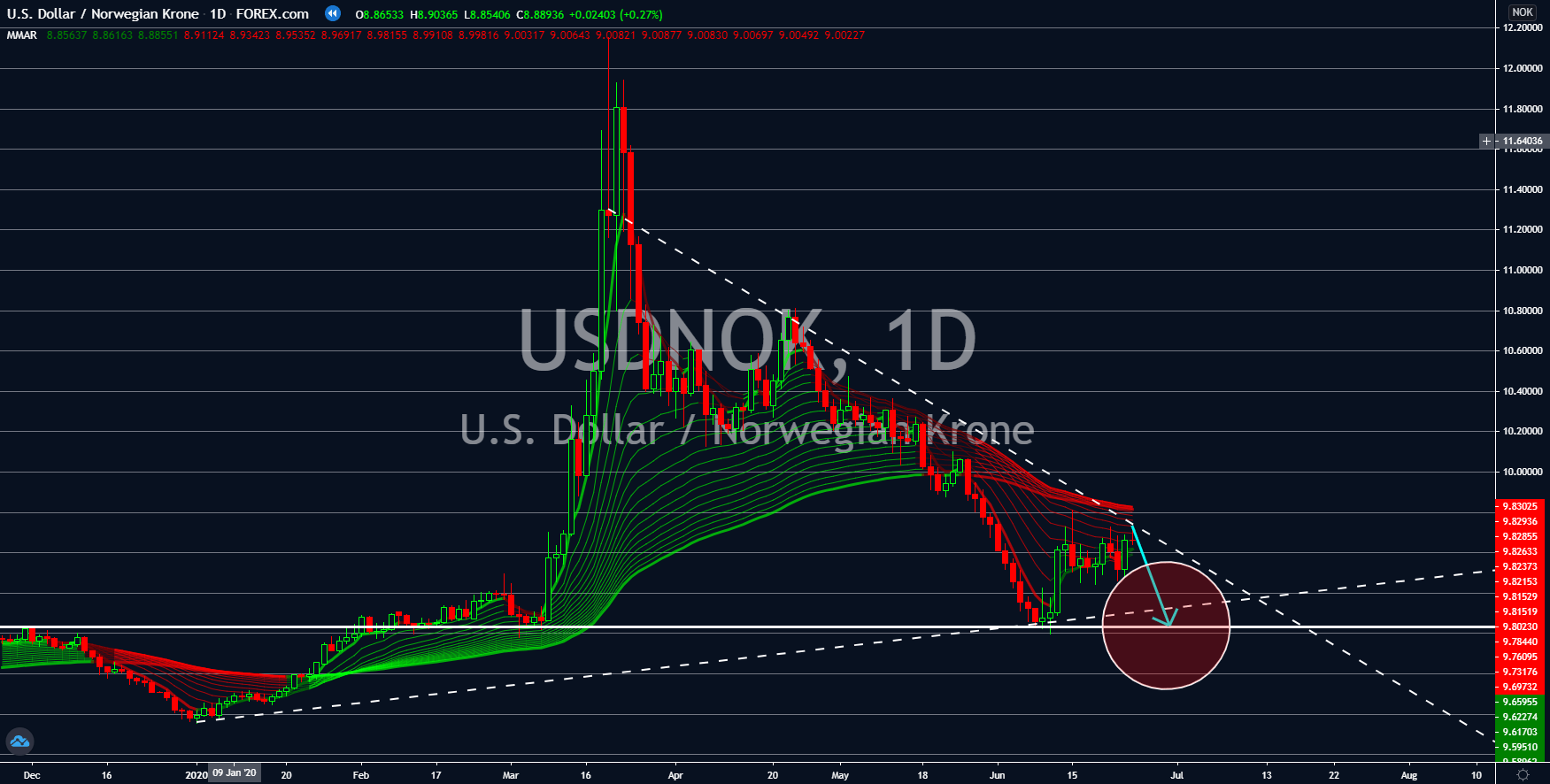

USDNOK

Norway’s unemployment rate rose to 4.2% on Wednesday, June 24. This was the highest recorded figure since September 2017. Meanwhile, the US initial jobless claims report saw a continued decrease in number every week. Yesterday, the figure reached 1,314K, down from 1,427K the week prior. The US also published a report for its GDP quarter-over-quarter (QoQ) report which recorded a -5.0% decline. The figures from June’s report were the same from May. Despite the positive reports from the US, the greenback is bound to fall. The catalyst for this was crude oil. The US is the largest consumer of oil in the world. On its inventory report, figures climbed to 5.654 million which indicates an oversupply. This, in turn, will decrease the value of oil in the market. Meanwhile, for oil producing countries like Norway, this is actually a positive news. Exporters could delay the shipment of oil until prices stabilized.

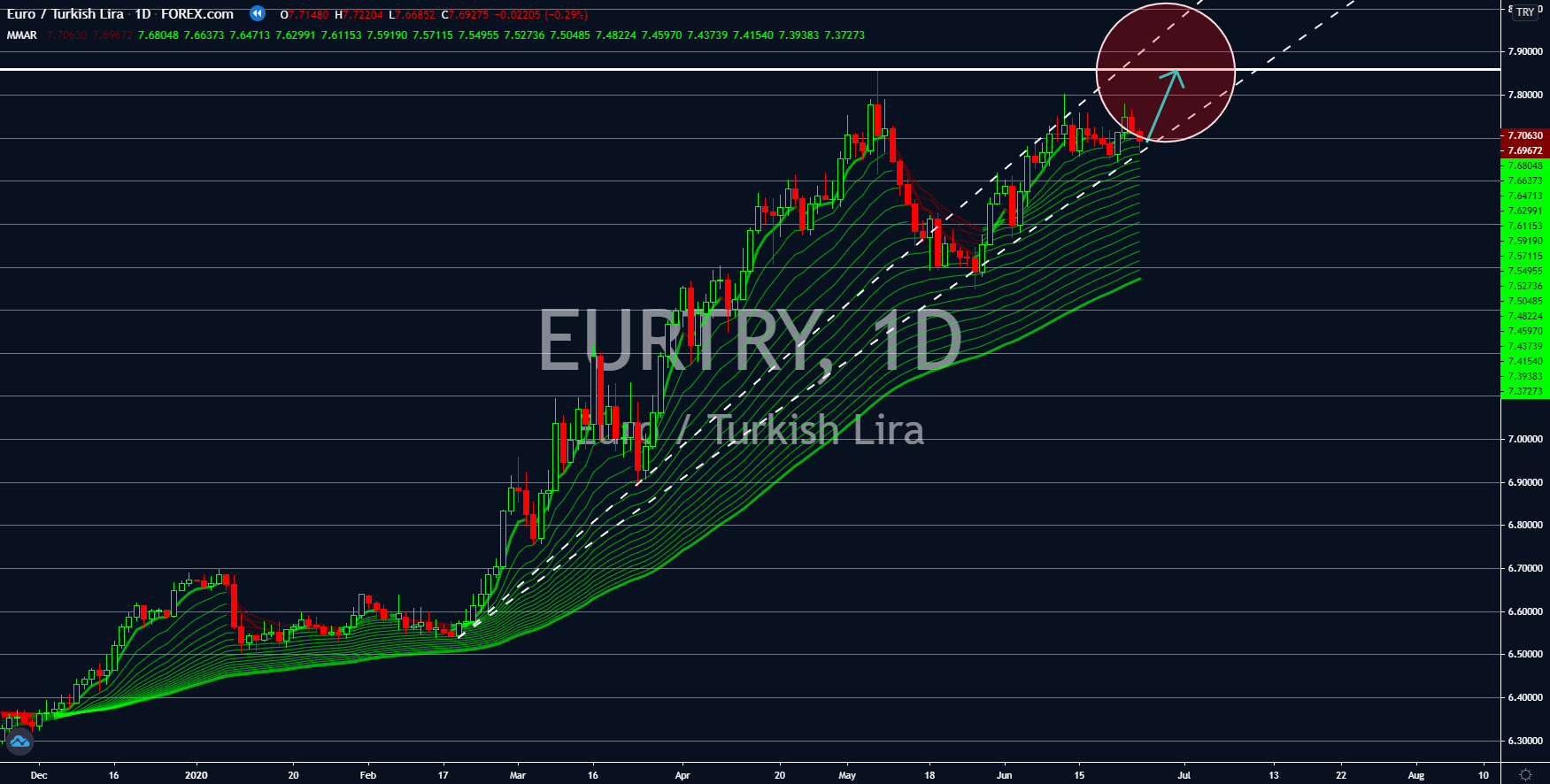

EURTRY

President Recep Tayyip Erdogan’s refusal to both allow trading lira against western currencies and taking loans from international financial institutions is hurting Turkey’s economy. MSCI, an influential index provider, is planning to end Turkey’s position as an emerging market. Institutional and foreign investors use the outlook given by MSCI to deploy their capital abroad. Also, Turkey’s relationship with both the east and the west are falling. For almost two (2) decades, Turkey has been applying to become a member of the European Union. However, some member states are blocking the country’s entry to the bloc. Meanwhile, despite the growing division in the bloc, the EU will continue to be influential in politics and global economy. Its currency, the euro, will also thrive against the Turkish lira in coming sessions. Business expectations in Germany, the EU’s economic powerhouse went up by 4.4 points to 91.4, a bullish news for the single currency.

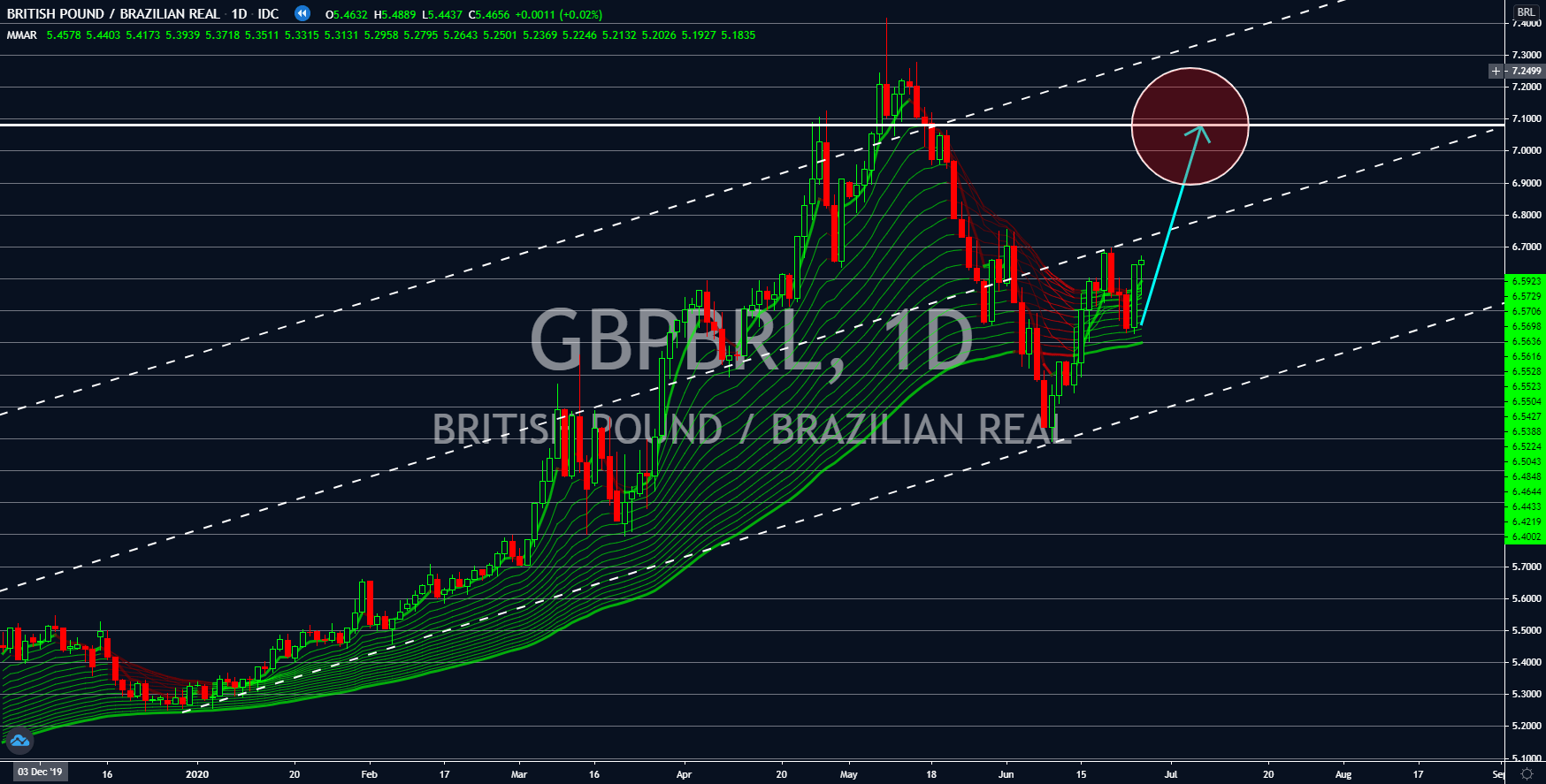

GBPBRL

Financial problems sent Brazil’s economy spiraling downwards. The 90-day ratio for personal credit rose to 3.9% in May. Meanwhile, household lending narrowed to 37.2%. Also, the government’s budget incurred deficit at 11.0% of the country’s gross domestic product (GDP). Due to these figures, expectations for the country’s annual GDP growth was now at -7.0%. On Wednesday, June 24, the International Monetary Fund revised its growth outlook in Brazil by extending the possible contraction to 9.0%. The continued rise of COVID-19 cases in the country could further extend this financial crisis and economic recovery. Just like Brazil, the United Kingdom is having problem with the growing the number of coronavirus cases and falling economy. However, Britain is expected to thrive as the end of the Brexit transition means freedom for the United Kingdom to create trading deals with non-EU countries.