Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

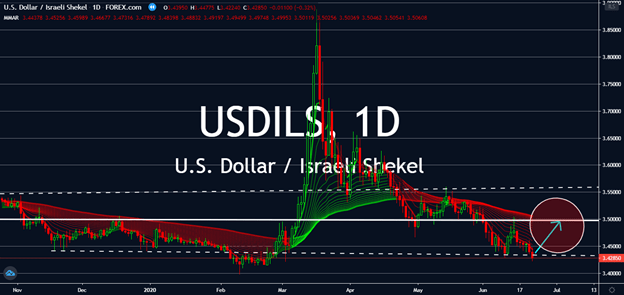

USDILS

After the USDILS stabilized back into pre-coronavirus levels, the pair is now ready to climb back up from resistance levels near 3.500. The pair is expected to trade sideways with the USD mostly in benefit after it showed results on the country’s economic growth in the first quarter in comparison to the last quarter of last year. GDP grew by 4.0% four months into 2020, including the month of the stock market crash, which will boost optimism for the dollar against other currencies in the upcoming sessions. Although initial jobless claims for this week will push the dollar down for negativity towards its economy, the promise that it’s now in recovery will help the USD boost back into familiar territory. Meanwhile, the Israeli economy’s GDP also grew in the first quarter of 2020, although it’s still in negative territory. The country is still keeping itself on lockdown as the coronavirus reemerges in the country.

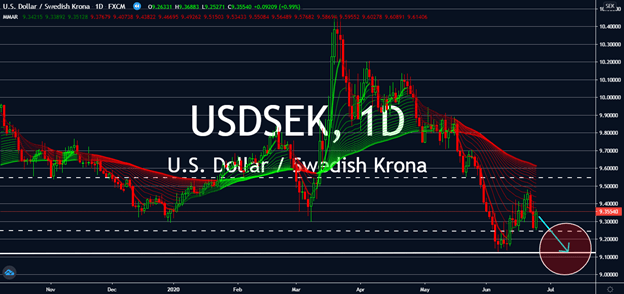

USDSEK

The USDKSEK pair experienced a half-month decline from the second week of May to early June when Sweden’s controversial move reportedly buoyed its economy and minimized coronavirus-led recessions other European countries had experienced through the same months. The Swedish government’s refusal to completely shut down its economy earned optimism from profit-centered markets, pulling the greenback-krona pair down to levels seen in early June. Now, it looks like the pair is expected to see further losses for the greenback as risk sentiment begins to boil in the forex market. The United States’ economic slump for the first quarter of 2020 was as expected, which came in at -5.0% recorded earlier today. This was a massive slump compared to the previous quarter, which had seen a 2.1% gain in three months ending March 26. Before the coronavirus came around, the US was expected to see a 4.8% uptick in GDP.

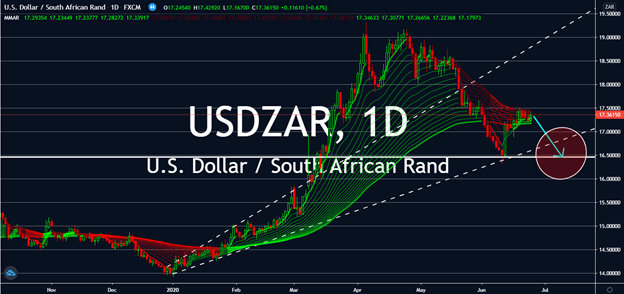

USDZAR

Investors are craving for the South African rand these past few days, and is expected to fall further down into 16.90 territories in upcoming sessions. Trials for COVID-19 vaccine candidates were reportedly starting in South Africa, which could boost optimism for its currency despite being one of the hard-hit countries for economic turmoil brought by the pandemic. Negativity from US data is expected to bleed into riskier although predictable assets like the rand, which could reach pre-coronavirus levels within the year. This is on top of the high number of initial jobless claims in the United States, which came in at 1,480,000 against market consensus of 1,300K. The fact that it had 1,540K during the last report added insult to injury. The surge in Core Durable Goods Orders also failed to reassure markets, too. For now, the lackluster update for the US’ quarterly GDP will minimize its fall, but investors shouldn’t be too optimistic.

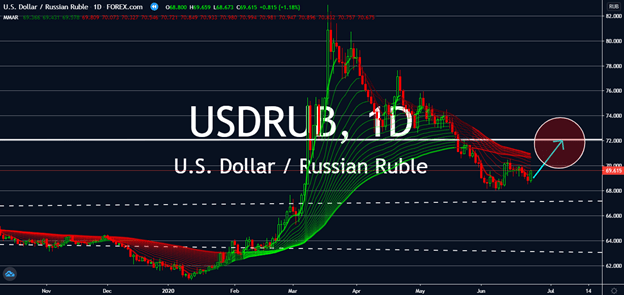

USDRUB

The Bank of Russia’s decision to cut its record interest rates last week is still taking a toll on the Russian ruble. This counts as the second time the central bank lowered its benchmark rate, starting from a cut in late April from 6.00 percent to 5.50 percent. Reports also emerged that Russia’s 1-10-year treasury curve has been the steepest since 2011. Although, it’s still notably far from the steepest level in Russian history. Economists claim that the Russian economy has still been resilient despite the lower yield curve, which could help the ruble slightly lift against the dollar. But ultimately the greenback is still expected to rise near-term largely due to the now negative but steady US interest rate. The benchmark rate has gone through three cuts since the beginning of the year: it began 2020 at 1.75% but is now at negative levels at 0.25% when the Federal Reserve cut its rate on June 10, which could be a major factor for its current uptick.