Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

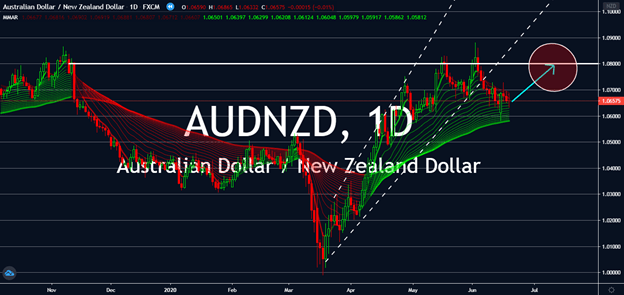

AUDNZD

The Australian dollar is going to see a volatile market next week, but it doesn’t mean it’s no unpredictable. The S&P 100 index is expected to strengthen against the greenback since its plunge in March. The overall forex market fell into the arms of risk sentiment, which doesn’t help most currencies. Moreover, world fiscal policies and interest rate differentials are pointing optimism towards riskier markets. Because of this, as well as the SP’s increase, the euro is set to decrease with sterling alternatives most especially the Australian dollar, near-term. Moreover, Britain’s public debt is now larger than the size of its economy, which will raise interest in alternatives. Investors’ appetites are set to move for the Aussie currency instead of the kiwi as investors look to diversify their portfolio against what used to be safe havens. The AUDNZD will then meet levels similar to before it crashed into a bearish market in late November.

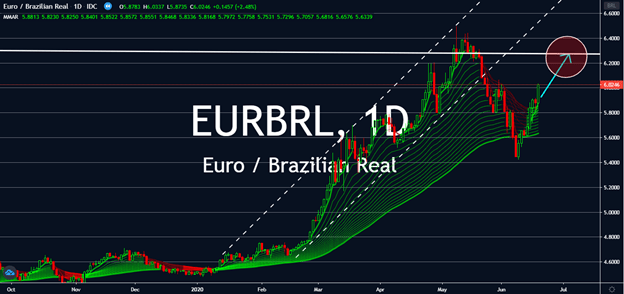

EURBRL

The increase of coronavirus cases in Brazil will push its currency down against most markets. This is most especially the case for the real against the recovering euro, which has seen multiple regions in the block reopen for business and economic stimuli. Further, there’s a lot of selling pressure for the real, as investors worry of whether or not Brazil could even reopen within the next few months. Brazil’s government stopped reporting numbers when it continued to see huge spikes in domestic cases. As investors start to focus on the attitude of global markets in general and global growth, the Brazilian real will undoubtedly suffer unless it sees positive news in comparison to the single currency. If this goes on, the EURBRL pair will see levels near 6.400 last seen in early May before it saw a consecutive bear market to show a deep V after it saw 5.400 levels in early June. The pair is expected to trade sideways through the next few sessions before it reaches back up.

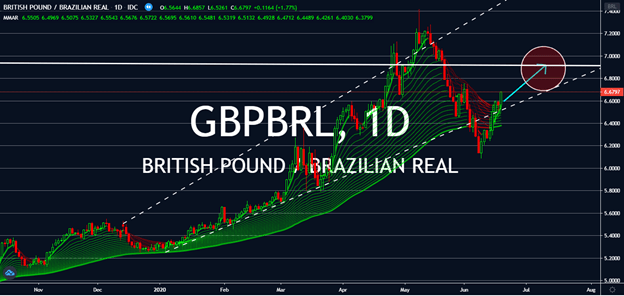

GBPBRL

Sterling hasn’t been performing well for the past week. The sterling failed to promote relief from improvement in the Brexit talks, as well as the fact that the Bank of England is much less likely to implement negative rates for Britain. On the other hand, Brazil’s real has been underperforming throughout the week with weak economic data. The Brazilian central bank is signaling more potential interest rate cuts, which could prompt a strong sell-off near term. Moreover, another wave in coronavirus cases cut down the thought of possibly reopening the Brazilian economy anytime soon. While both pairs are expected to see weak gains this week, it’s expected that the GBP should see more gains than the real, considering that the British parliament is considering more lockdown easing decisions with lowering coronavirus rates in the country. This could be part of rising sentiment for the pound after several weeks-worth of sell-offs.

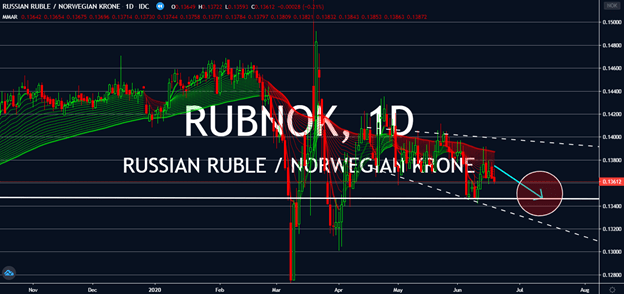

RUBNOK

Both Russia and Norway are reporting disappointing news this week. The Central Bank of Russia cut interest rates by 100 basis points on Friday to their lowest since the fall of the Soviet Union, guaranteeing short-term slumps against major currency rivals. The fact that it had already cut its rates by 50 basis points in April wouldn’t help the case – after the country confirmed that it could further reduce lending costs, its GDP dropped so far as 28% in April alone. On the other hand, Western Europe’s largest oil producer’s wind turbine production was skidded to a halt. Norway began reviewing the regulatory framework to double its installed capacity by the end of this year, but uncertainties regarding new developments could prevent Norway to progress for one of its largest and most successful industries to date. Although this would affect the Norway krone greatly, Russia’s news and figures will lead the ruble lower than its Norwegian counterpart.