Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

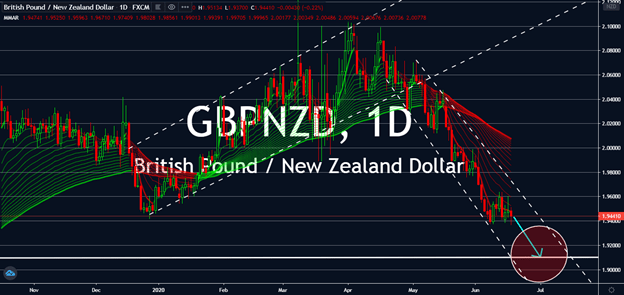

GBPNZD

Most factors will push the GBP down against the NZD this week after news emerged that the European Parliament refused watered-down trade deals with the United Kingdom. Post-Brexit blues are expected to weigh sterling down throughout the next three months, especially against its kiwi counterpart as long as the United States and China continue bettering their trade deal after their conflict earlier this year. Britain’s increasing unemployment rates will also be a major factor for its losses, even as the market waits for its retail sales figure due tomorrow. Its opposite, the New Zealand dollar, is benefitting over talks between the US and China, and will continue to rise in medium term as risk appetite begins to rise with better updates from New Zealand. The only way for the sterling to see green is with its retail sales figure tomorrow, but wouldn’t retain it for long until the kiwi would catch up once again.

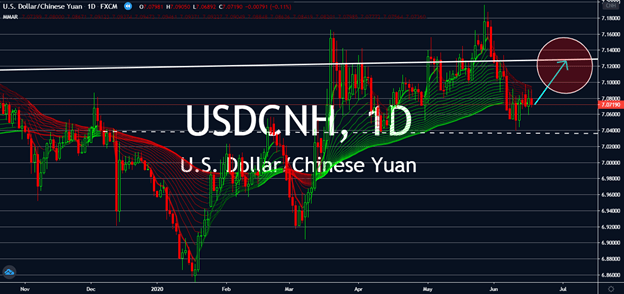

USDCNH

Sentiment for the Chinese yuan is losing its rhythm. The second-most powerful country in the world will lose against the greenback after it reported disappointing economic figures for May alongside rising numbers of coronavirus infections in Beijing. Industrial sales and production both went lower than expected for May, both year-over-year. Although industrial production increased, it was still lower than what the market predicted. Retail sales also went down against expectations for the same month and comparison. Furthermore, the USDCNH is experiencing a sell-off; this means that in the near future, the US dollar is set to recover in the broader perspective. The Bank of China is also still under pressure amid circulating rumors that the bank is manipulating its currency to create an advantage. This means that after testing the current resistance level, the USDCNH could surge past within the next few months from now.

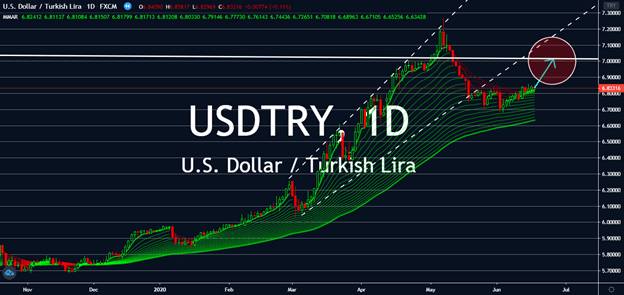

USDTRY

Technicals call that the USDTRY bias will remain bullish over near-term periods, although the exchange could still move flat like it always has. The United States just reported better figures for several economic factors this week, which would benefit the greenback in medium term or at least until the middle of July. This increase is also backed up by the US Federal Reserve Chairman Jerome Powell, who is continuing his efforts to buoy the American economy while the government begins to see common ground with Beijing. Although the good news between both economies remain uncertain, this could still give way for the US dollar to gain against the Turkish lira. For now, the pair is set to test 7.00 levels in the next couple of weeks, which could then reach back into the resistance levels similar to what was seen in early June. If the US doesn’t meet good news about the trade deal, the USDTRY could meet red instead of green, near-term.

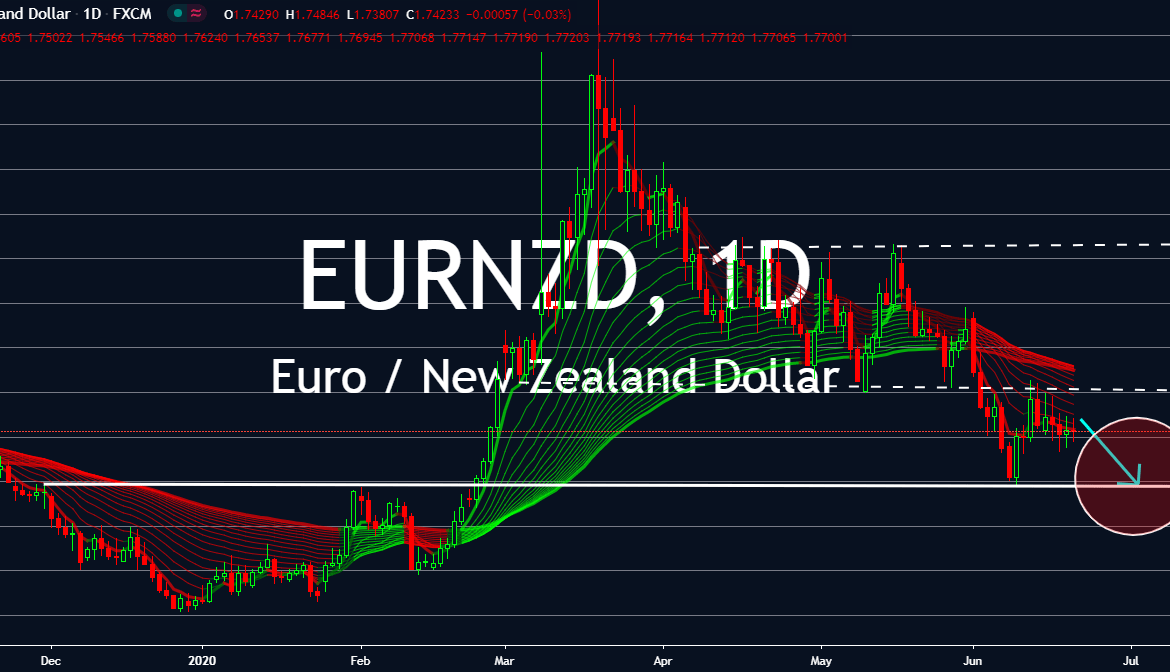

EURNZD

The euro-kiwi pair looks like it’s set to meet up with pre-March sell-off levels near- to medium-terms. As the world, central banks most especially, render the effects of changing fiscal policies and economic stimuli forced by the spread of the coronavirus pandemic, the EURNZD will approach its pre-coronavirus levels as a risk-neutral exchange to reset its previous, rather flat pattern after it met high volatility throughout the last few months. That’s not to say the pair won’t test its current levels within the next three months – in fact, it’s most likely. To predict more of its movements, investors would have to focus on other global rates. If expectations and official interest rates continue to lower, the euro currency will continue its bearish trend against the New Zealand dollar. On the other hand, a collapse in oil prices, wherein the eurozone imports more than it exports, would benefit the euro currency instead.