Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

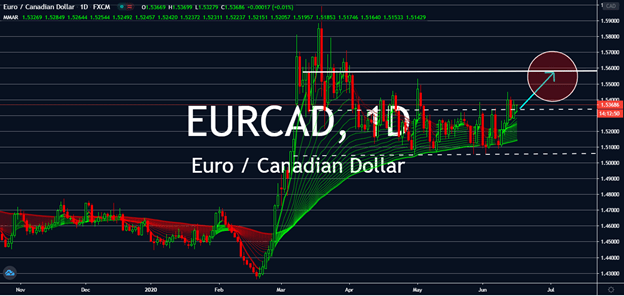

EURCAD

Investors are looking at a historical turn for the EURCAD pair. Single-loonie could witness its first long-term bullish trend since the 1990s. But as oil recently collapsed and global rates largely collapse, economies and trade appeal has been almost completely wiped out. The pair has been trading a somewhat stable sideways pattern since the beginning of the pandemic. Investors are looking forward to a possible inch upward for the pair in the short- to medium-term term, which could be unprecedented after the previously constant trendline prior to the Great Lockdown. Although, it is important to note that this is subject to change depending on how European indices and euro portfolios perform within the next three months. With that in mind, if the Federal Reserve decides to change interest rates unprecedented, the Bank of Canada is expected to follow suit, which could benefit CAD in the much longer term.

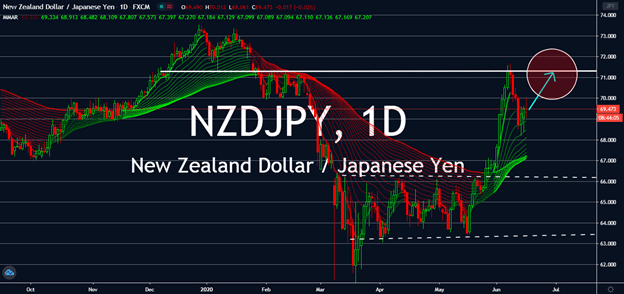

NZDJPY

The market remains uncertain, and safe havens are the best currencies to choose. The kiwi-yen pair has been one of the most valuable for the past few weeks while the coronavirus roams free across reopening economies. When New Zealand’s commendable, aggressive, and health-centered approach to its battle against the pandemic proved fruitful, investors swarmed over its currency, and it looks like this boost won’t fade anytime soon. Prime Minister Jacinda Ardern was proud to announce that the country no longer had coronavirus cases 24 days ago, which ended after two travelling women from the United Kingdom tested positive earlier today. Fortunately for the country, the kiwi was bound to gain against the yen anyway. Nonetheless, this raises the stakes for New Zealand, so investors should still take note of the NZ dollar’s status long-term. For now, it’s set to gear back up to resistance levels last seen in late February.

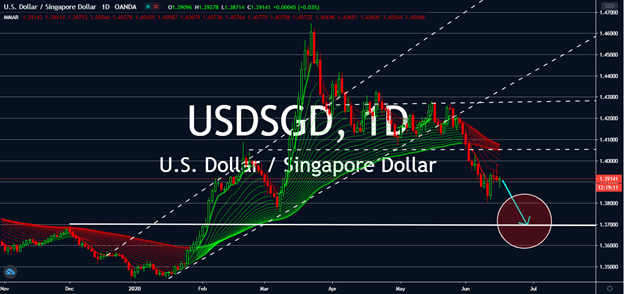

USDSGD

Singapore is expected to see its economy contract by more than 5% by the end of the year, but would recover to 4.8% in 2021. This ignited mixed feelings in the USDSGD market following recent announcements from US economists who claim that it’s already in recovery with easing lockdowns. But in comparison, this is nothing but a smidge, once the market found out that the United States’ economy is expected to plummet by nearly 53% in the second quarter alone. This is due for a revision, to be announced on June 30, which estimates a 35.5% drop for Q2, not that it would significantly help itself agianst Singapore. Rising oil demand will buoy the US dollar, but it wouldn’t help much. That siad, while the country renders its supposed “recovery,” the Singapore dollar is set to benefit from its near-term weakness, especially while the Black Lives Matter movement continues to rattle its economy.

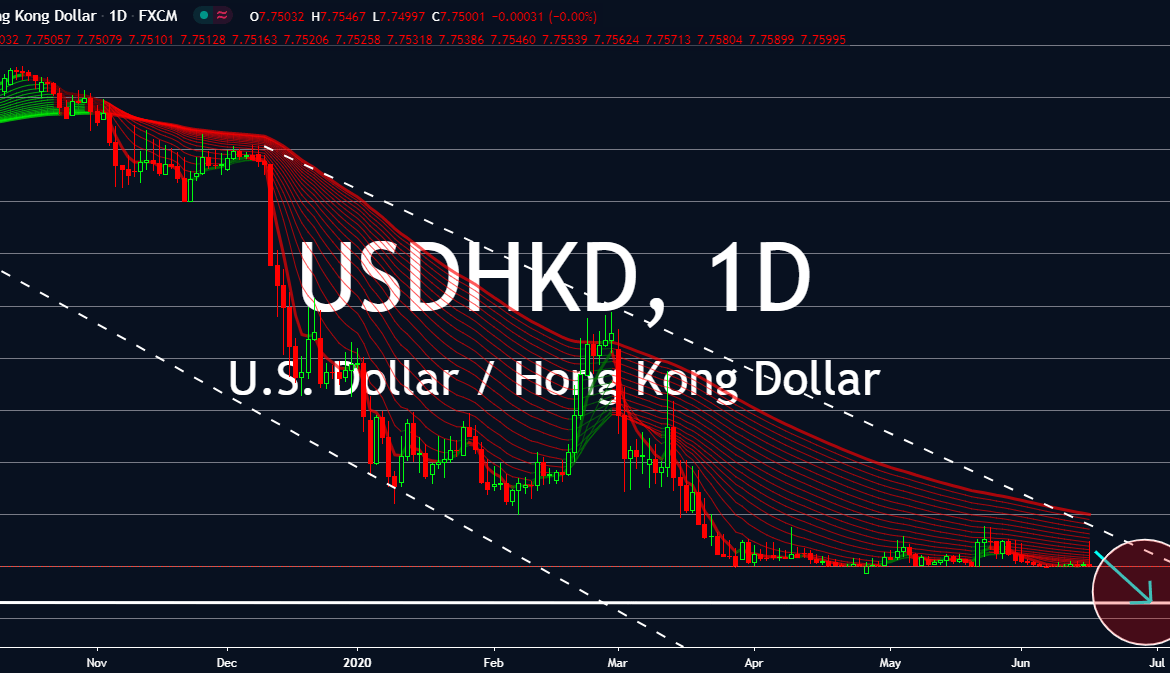

USDHKD

The Hong Kong dollar remained flat against its US rival since early April after the exchange surged by almost a full point in end-February to early March. It doesn’t seem like that nowadays, though: the most notable boost between the two is the contrast between their coronavirus cases, with Hong Kong seeing enough of a decrease to open several public parks in the region. Unfortunately, things go complicated from there: Hong Kong is lifting more lockdown restrictions on the daily as more signs point to a deadly second wave, while the US reopens even while its cases and death toll continues to rise. Both economies are expected to perform badly near-term as they suffer under booming nationwide protests, but the potentially safer bet has become the Hong Kong dollar when it comes to its currency tag-of-war with the greenback. After all, the US is still on track towards a 35-53% economic decline for the second quarter of 2020.