Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

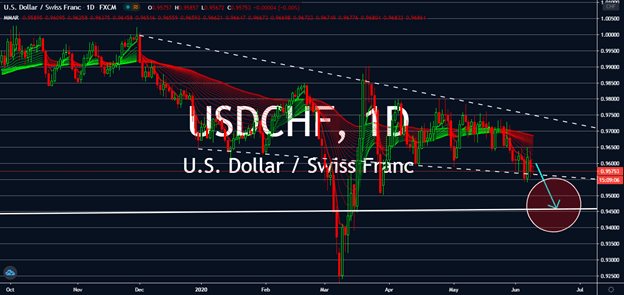

USDCHF

The Swiss franc performed well on Monday as safe haven assets dominate the market. This was despite the better-than-expected figures for non-farm payrolls and rising stock markets in the United States. It looks like the recent Chinese export and import figures influenced the drive upward for the franc, after the country reported lower exports and higher imports. As the world’s largest exporter, the results didn’t bide well with investors, which drove them towards the franc. While markets wait for the Federal Reserve’s meeting for monetary policy this Wednesday, the US dollar is expected to rise, but will then fall thereafter. Tentative investors should take note that economists are strongly recommending another unprecedented interest rate cut, which could raise the dollar’s appeal for borrowing, but critics claim this would penalize people who are trying to save money while big banks loan with profit.

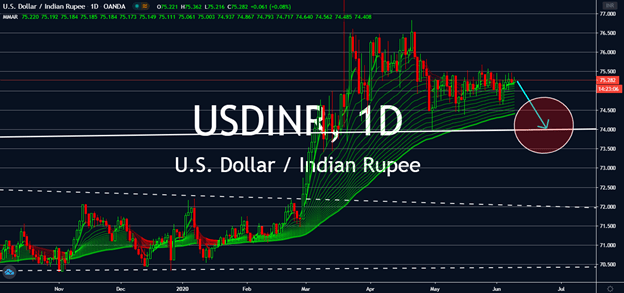

USDINR

The global economy will never be what it used to be, but the USDINR is on its way back to its pre-coronavirus levels amid world uncertainty. It looks like the dollar’s appeal is fading away now that other countries around the world are opening back up to stimulate their economy, which obviously isn’t the case for the United States despite gradual lockdown easing. The bears are expected to take control of the pair, as per technical analyses. In fundamental terms, the next three months is expected to see high volumes following studies forecasting Indian GDP contraction to as high as 5.0% for the fiscal year 2021 with the 20 trillion rupee package under scrutiny. Short-term, the pair is favored to face rejection by its current resistance levels around 7.500 but would then decline, depending on the Federal Reserve’s announcement regarding its fiscal policies tomorrow with an expectation of possibly lowering rates.

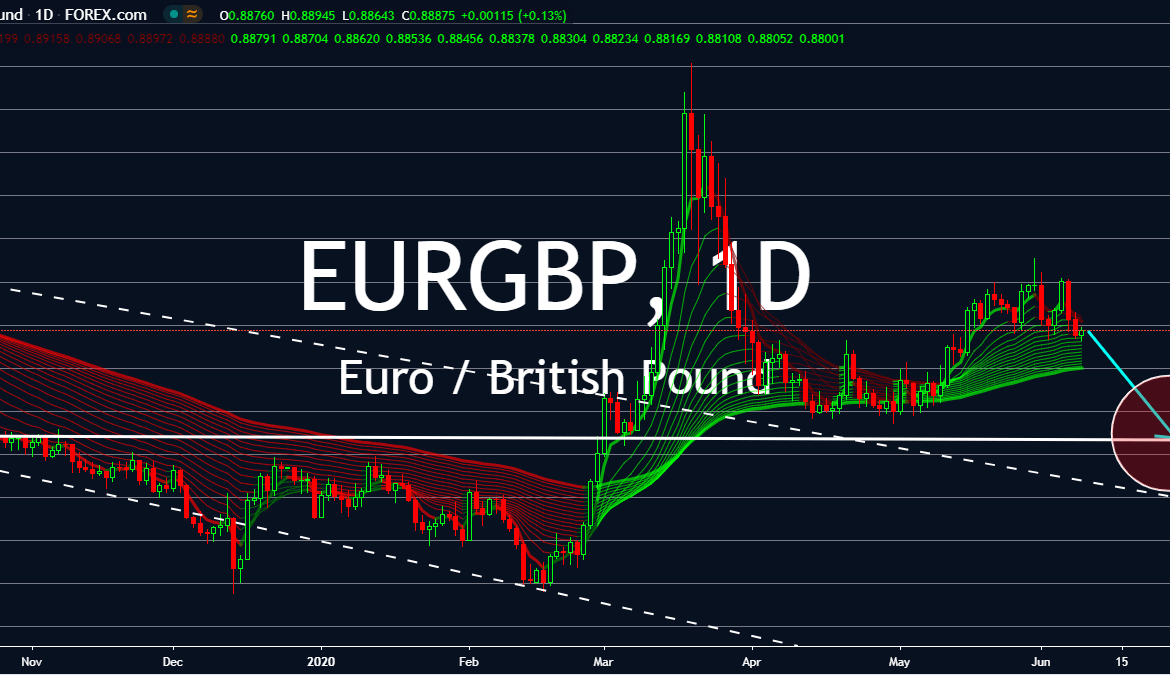

EURGBP

The EURGBP pair is on selling pressure after the eurozone’s manufacturing capital reported lower than expected figures for its export and import figures. Germany saw a 24% contraction for exports for the month of April, which is much lower than the expected 15.6% deduction from economists. Its imports then saw a 16.5% contraction in the same month. The strongest country in the bloc is set to pull the euro sterling pair down with it as the UK begins its trade talks with Japan even amid its conflict with the bloc. Both powers’ deadline approaches, but they still haven’t made an agreement on even the basic structure of how Brussels and the UK could negotiate their terms. Although the coronavirus is still hitting the UK economy hard, some parts of the regions are showing optimism over easing lockdowns. If the pair continues to disagree on any trade deals, the euro-sterling pair is expected to swim down into the bear market for the next couple of months.

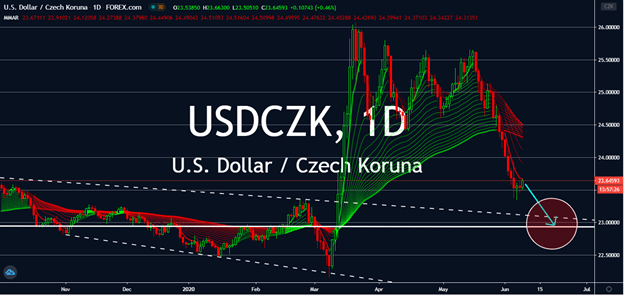

USDCZK

American economists are calling for an unprecedented rate cut from the Federal Reserve after its meeting on Wednesday after they discovered that the US economy began its first recession since early 2010 in February, lowering the safety of the dollar against its rivals. Investors are taking advantage of the situation with buying their counterparts, which includes the Czech Republic’s koruna as it slowly reopens its economy, as well as its borders to Croatia. Needless to say, the Czech currency is risky as per its GDP’s largest quarterly decline since 2010 during the first four months of the year, but it’s still set to crawl back into resistance levels last seen in early March that was followed by a surge in the dollar. The Czech economy slowed down by 2.0% during the said quarter. After the US’ longest economic expansion, its drop will push the dollar down against the Czech Republic through the next few months until the US economy finds stable footing.