Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

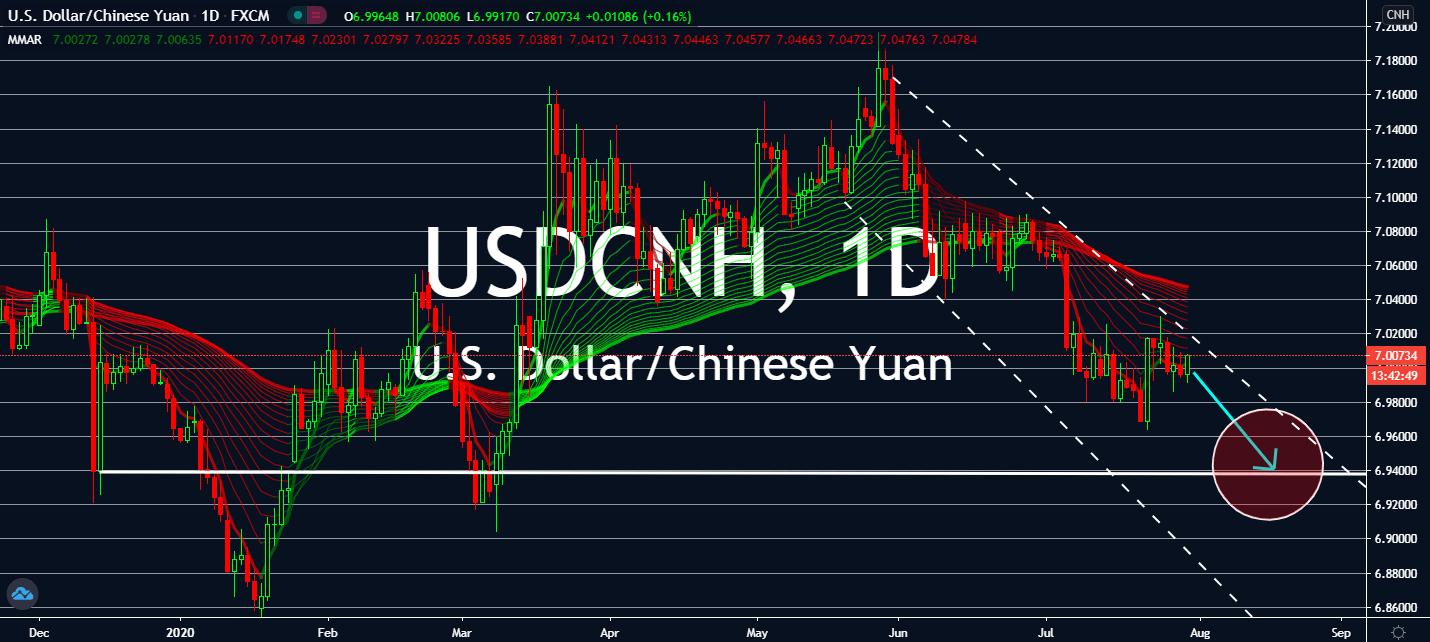

USDCNH

Economists claim that China’s official manufacturing Purchasing Manager’s Index (PMI) is expected to loosen to 50.7 from June’s three-month high of 50.9. Although this proves as bad news for the manufacturing giant, the figure is little in comparison to the anticipated worst-ever quarterly GDP record from the United States, as well as another increase in initial jobless claims for its upcoming announcement this week. In fact, the US economy is expected to contract to about -35% during the quarter ending June with a recovery far from sight. Coronavirus deaths in the US totaled 150,000 and counting, emphasizing the ominous uncertainty of the country’s economic outlook for the coming years. The greenback fell to a two-year low against a basket of other currencies earlier this week, as well. Jobless claims are expected to rise after slow increases from 1,416K last week to 1,450K on Thursday, proving that the US recovery is taking a u-turn.

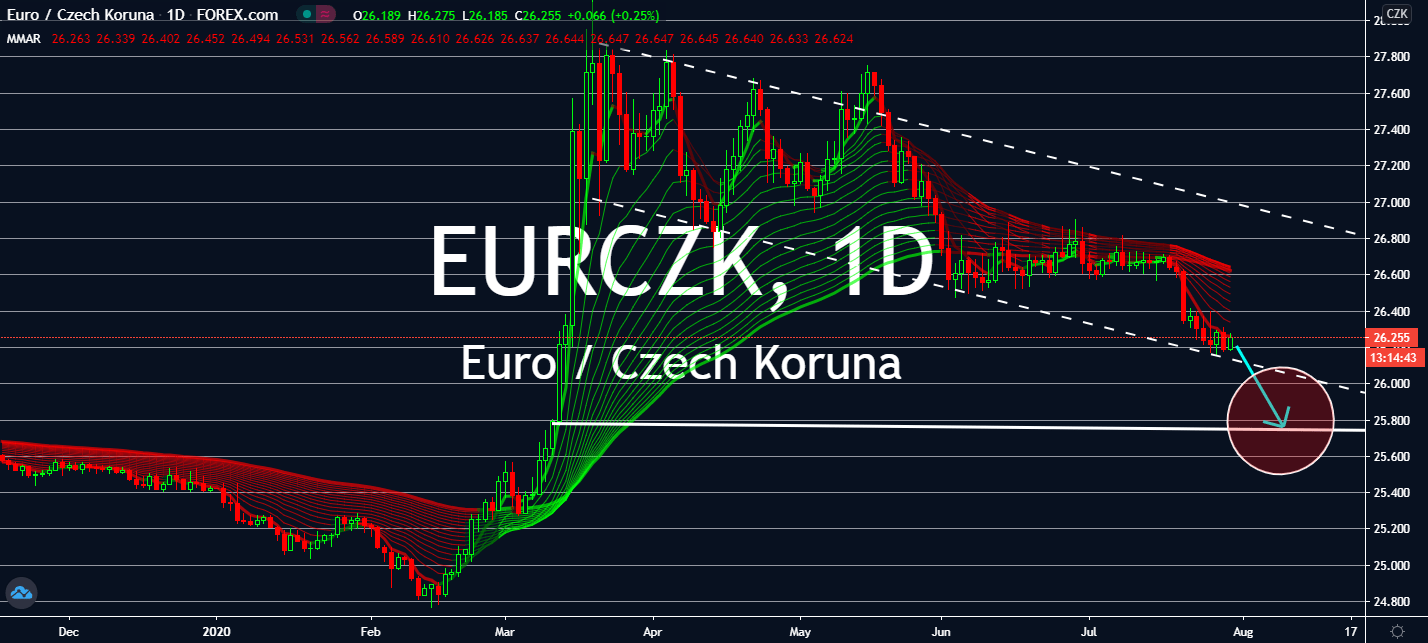

EURCZK

Spain announced a lower-than-expected CPI for both year-over-year and month-over-month comparisons. On a yearly basis, the country accounted for a -0.6% figure, down from the previous record of -0.3%. The monthly figure also fell from 0.5% to -0.9%. Spanish HICP also fell on a yearly basis. Economists had expected the figure to decrease from -0.3% in July 2019 to -0.2% until it dropped jaws with a -1.6% decline, instead. Markets are now waiting for a fall in German GDP and unemployment change for the month of July. The largest economy is expected to fall from -2.2% to -9.0% for the second quarter of 2020. Although unemployment change is predicted to show a lower number for the month of July, it wouldn’t be enough to lift the Euro currency near-term against the recovering Czech Republic economy. Unemployment change in Germany is predicted to drop from 69 thousand in June to 43 thousand in July.

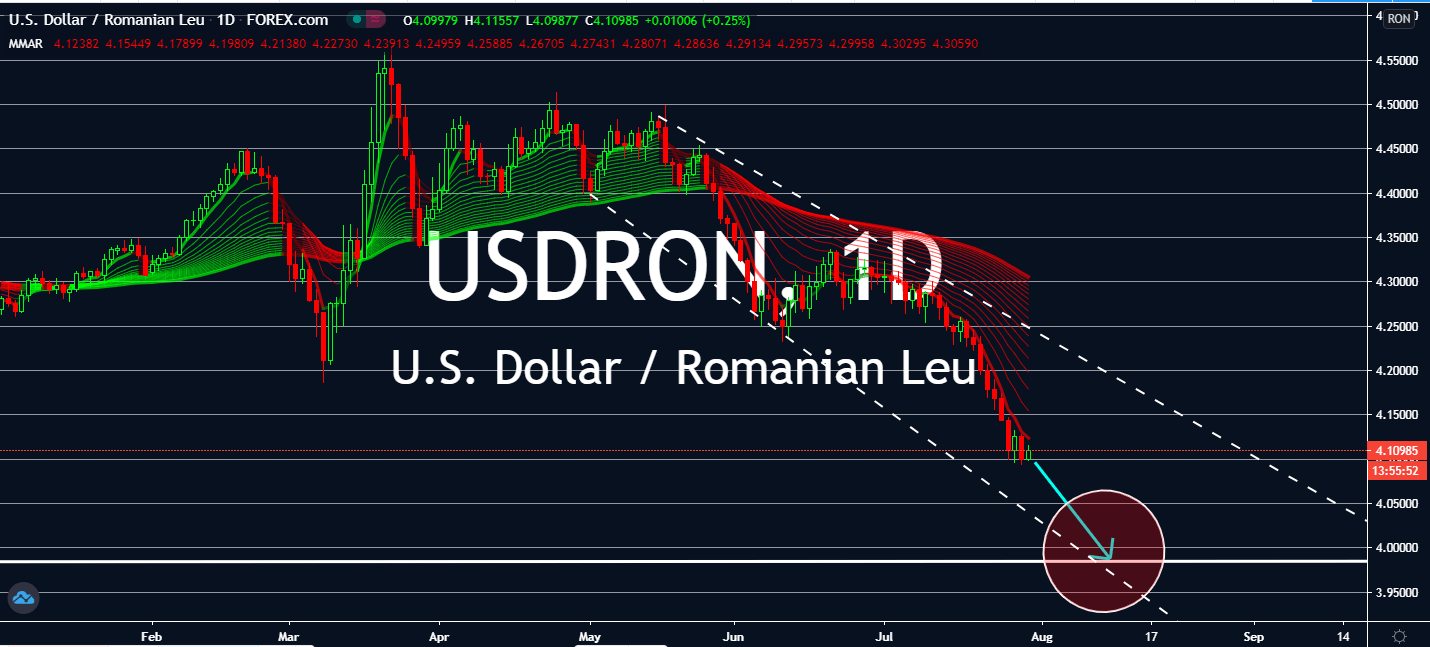

USDRON

More than 150,000 Americans have died from COVID-19, the respiratory illnesses caused by the novel coronavirus. The growing number worried the Federal Reserve of its implication for its economy as markets expect the central bank to announce the worst quarterly GDP yet. In fact, ina quarterly comparison, Wall Street analysts predict that the figure would plummet from -5.0% in the first quarter to an astounding -34.1% in the second quarter. The US is also preparing for its weekly initial jobless claims report, expected to jump from 1,416K last week to 1,450K on Thursday. The news isn’t shocking, largely because the country had been forced to reinstate strict lockdowns after a continuous resurgence in new coronavirus cases. These records alone will push the USDRON pair lower, considering that markets expect Romania’s economy to fall less than EU economies after it showed signs of resilience with a 2.4% increase in GDP during the first quarter.

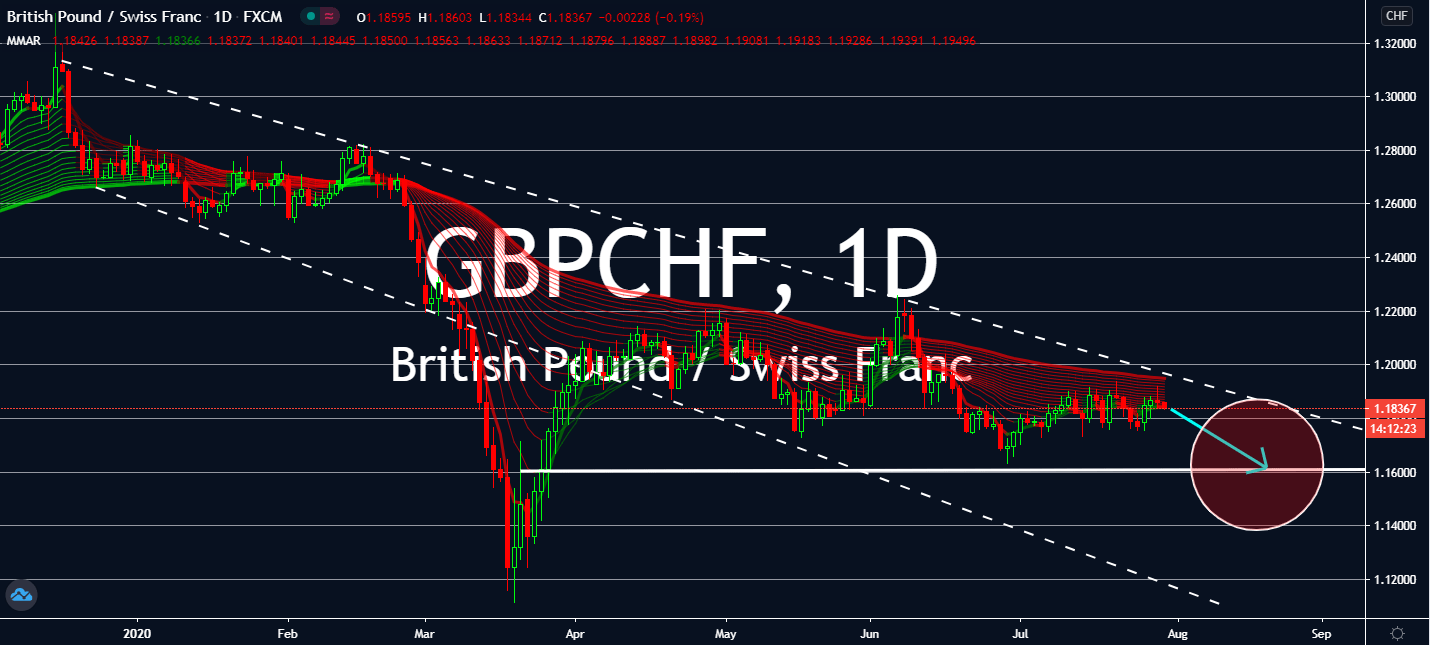

GBPCHF

Markets expect the UK to report a worse figure for its house price index for the month of June in its upcoming report later this week. From the previous record of -0.1% recorded in July 2019, markets predict it would be -0.3% this year. The month-over-month comparison isn’t looking so good, either – in June, markets had expected it to record -0.7% and were instead met with a disappointing figure of -1.4%. The monthly disappointed economists two times in a row already. Analysts claim that a further decline reflects the effectiveness of the UK economy and its lockdown, making the figure most anticipated. Meanwhile, the Switzerland KOF Leading Indicators are pointing towards a recovery for its report in the month of July, which could report a figure of 75.0 against the previous month’s record of 59.4. Although, investors are hesitant, because the figure had also disappointed markets for two months in a row already.