Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

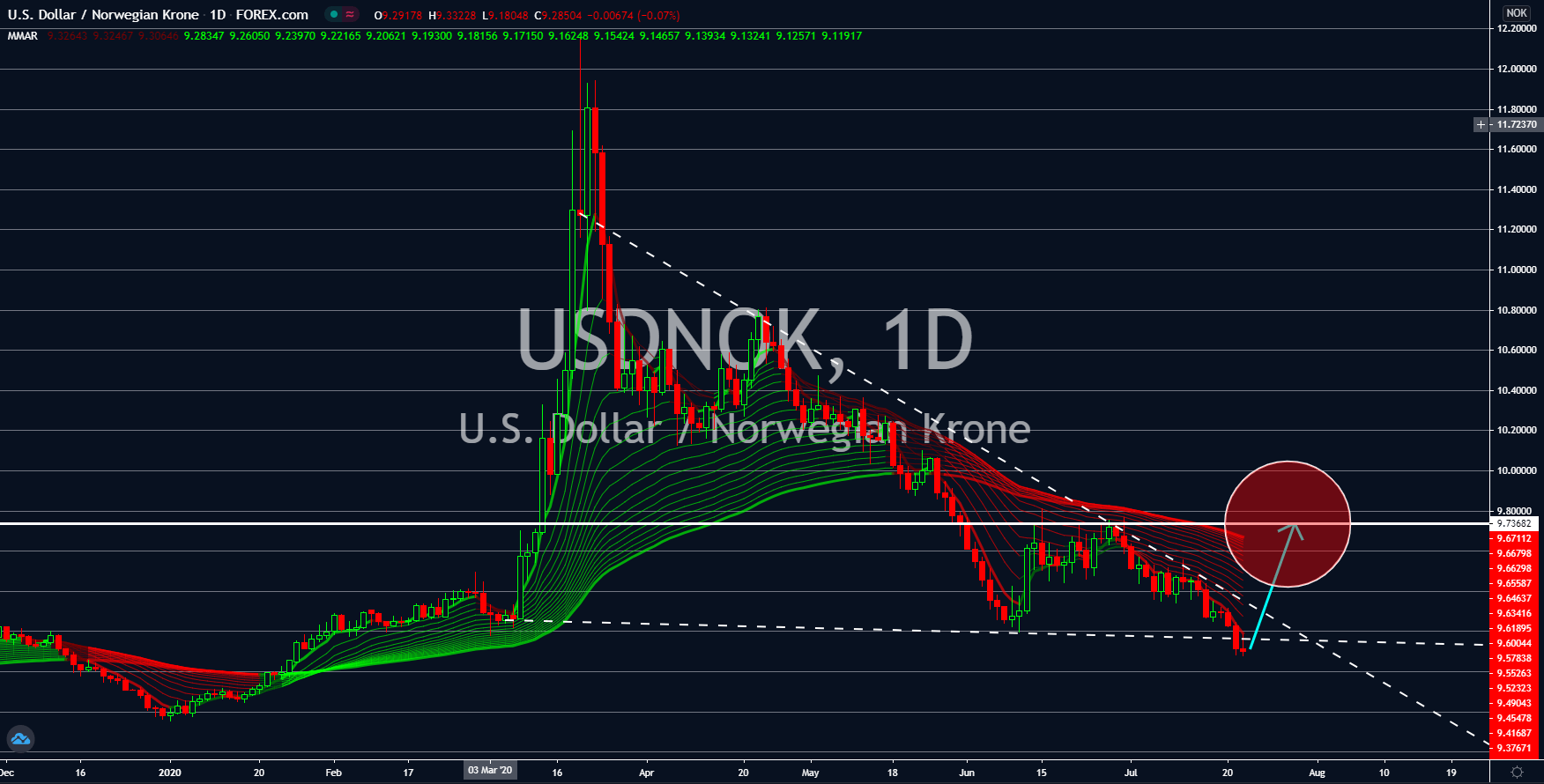

USDNOK

The strong expectations for the US Existing Home Sales report will push the greenback upward against the Norwegian krone. Figure for the US report is expected to climb by 24.5% today, July 22. The positive figure expectations came following the three (3) consecutive months of recorded decline from March to May at -8.5%, -17.8%, and -9.7%, respectively. The housing market has been a major indicator of the American economy. It was the catalyst for the 2008 Global Financial Crisis. The expected recovery in today’s report suggests that the largest economy in the world might be in for a V-shaped recovery. Another report that is being expected to post positive data is the US Crude Oil Inventories. Analysts were still hoping for a negative figure for this report at -2.088 million barrels. If the actual figure came close to expectations, this will suggest that the demand for crude oil is following the lifting of several restrictions in the United States.

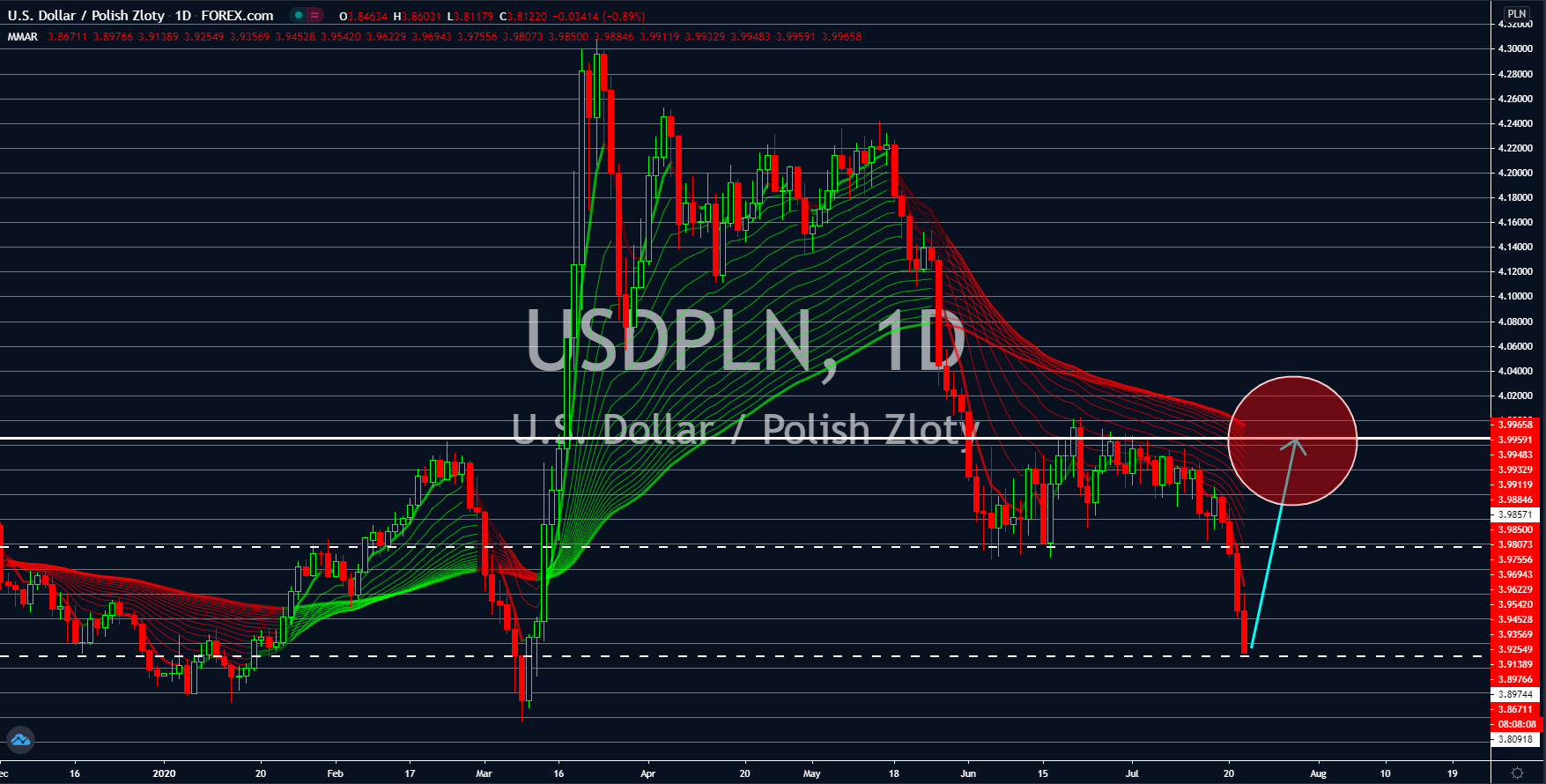

USDPLN

A strong recovery in the USDPLN pair is expected following the disappointing reports from Poland. On Monday, July 20, the country posted 0.5% growth for its Industrial Output YoY. This was compared to the declines of 2.3%, 24.6%, and 17.0% for the months of March, April, and May, respectively. This was also the only report who posted a positive growth. For the Producer Price Index (PPI) YoY and Retail Sales YoY reports, figures were weak at -0.8% and -1.9%, respectively. These were the fourth consecutive declines on these reports starting March this year. Meanwhile, due to the economic stimulus presented by the Polish government, its M3 Money Supply MoM went up 18.1% in today’s report, July 22. This was the highest figure since the 2008 Global Financial Crisis. Investors should also look at the next EU budget after Poland publicly calls for the European Institutions to increase its budget for the CEE (Central and Eastern Europe).

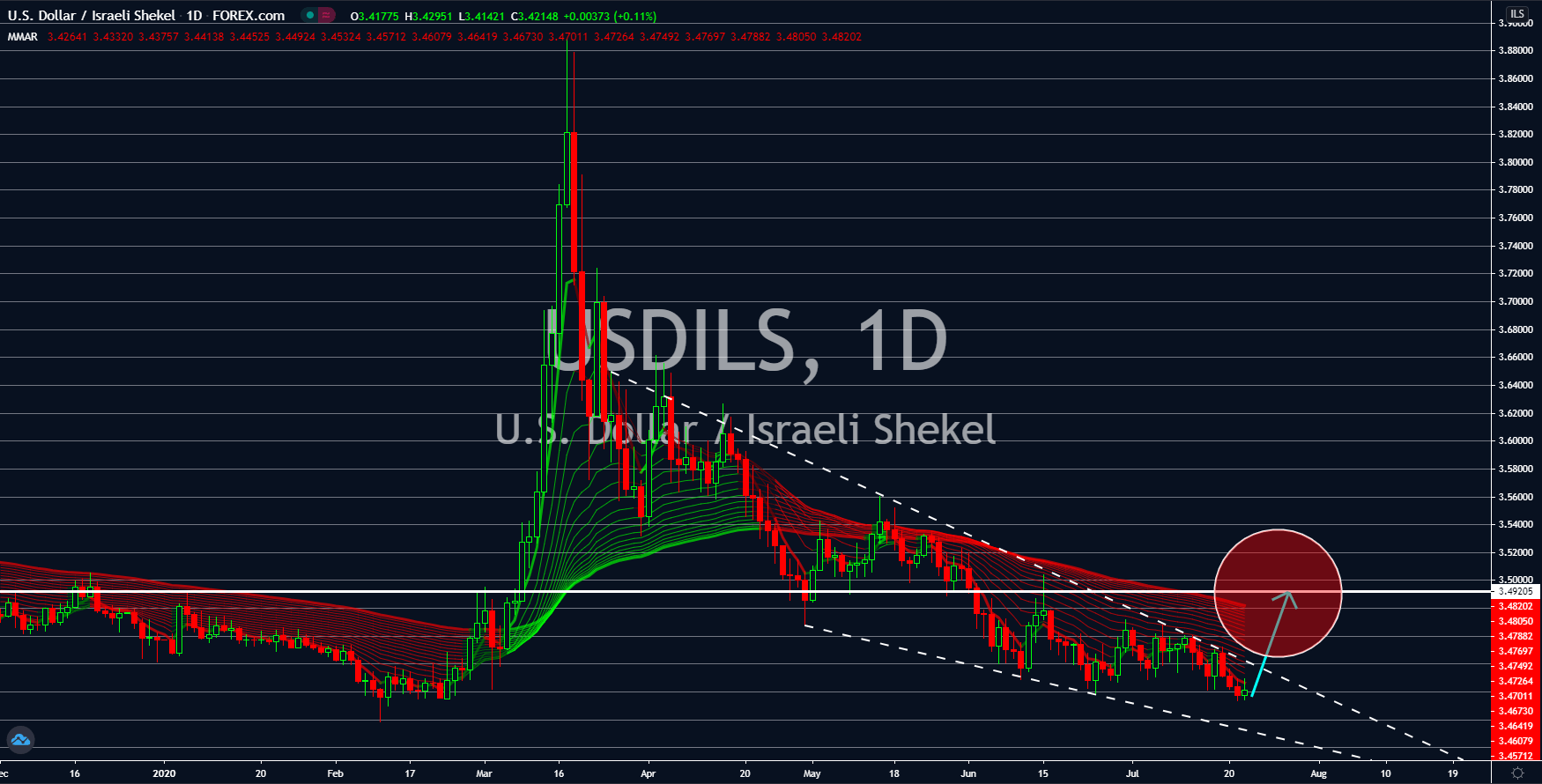

USDILS

On Sunday, July 19, Israel’s Finance Ministry gave a bleak outlook for the country’s performance this 2020. It is now expecting the economy to contract within the range of 5.9% to 7.2%. This is higher by 9.26% to 33.33%. In addition to that, the forecast for Netanyahu’s government budget is expected to incur a deficit by as much as 14.2%. Meanwhile, the Bank of Israel gave more modest expectations on the country’s budget deficit at around 13% of Israel’s gross domestic product (GDP). In line with this, the central bank already approved the phase 2 of economic stimulus by the Netanyahu government of $29 billion. Despite this, unemployment is still expected to record soar by 21%. These figures are now the reason for the growing number of anti-government protests in Tel Aviv. According to a July 12 survey, around 29.5% of Israel supported Netanyahu’s coronavirus response. The record in April was 57.5%.

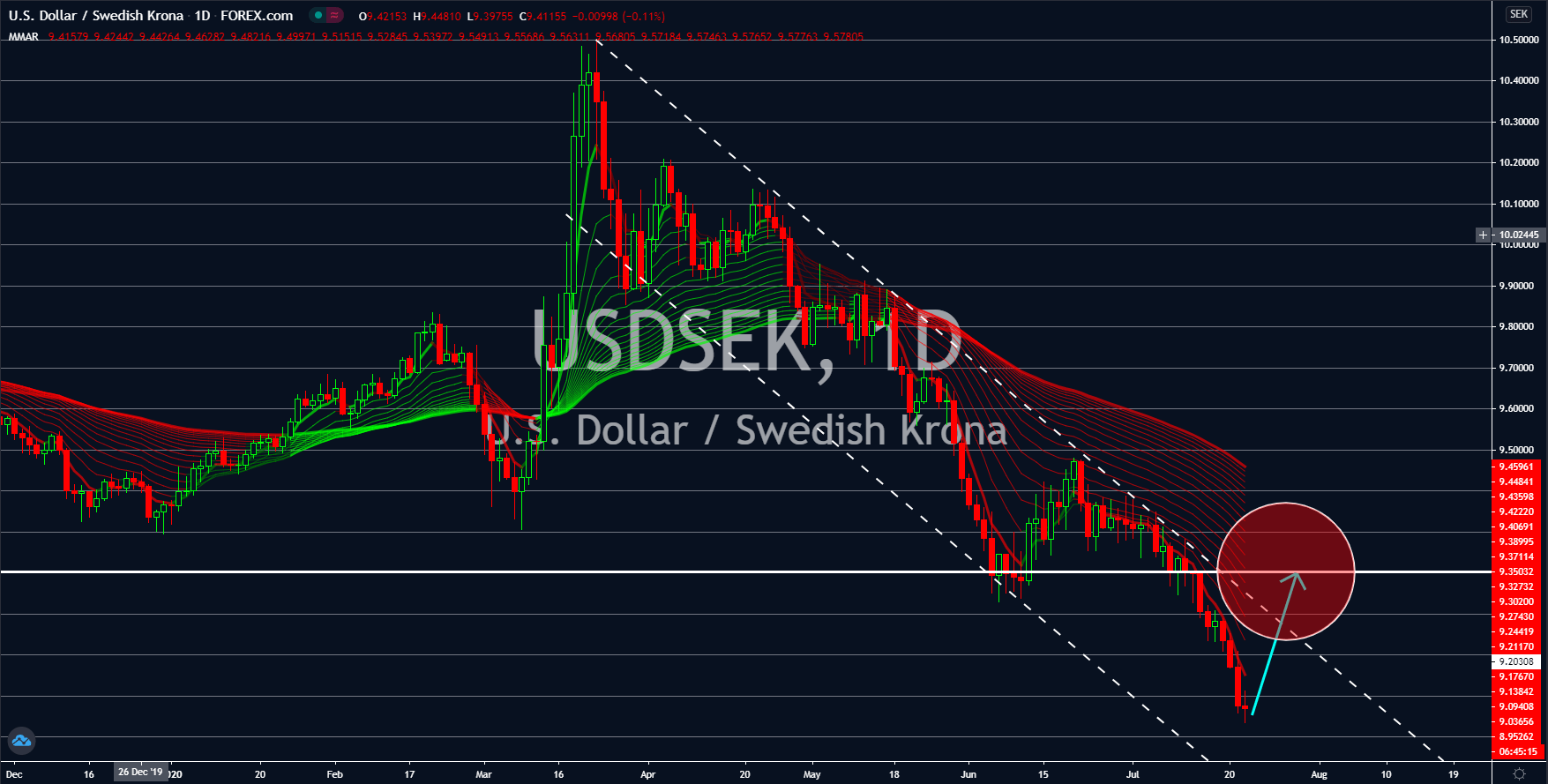

USDSEK

Despite its refusal to lockdown, the Swedish economy is still seen contracting by 8.0% this year. This figure was way higher than its neighboring countries. Also, the cases in the country were high after its plan of immunizing its citizens through herd immunity failed. Cases were high at 78,504. It also has a higher mortality rate compared to the United States. Deaths related to coronavirus were 5,667 as of today, July 22. The Swedish koruna is expected to suffer in short to medium-term, but it is expected to bounce back in the long run. The reason for this was that the COVID-19 deaths mostly include senior citizens. This means that claims for social benefits will be lower in the coming months. As for the United States, it’s strong employment rate will be the catalyst for the strength of the US dollar in the coming weeks. Initial jobless claims and unemployment rate were at their lows since the pandemic began in mid-March.