Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

USDINR

After India’s FX reserves saw an all-time high last week, the figure is expected to witness gains once again. The figure had been gaining up for the past year and reached 513.25 billion last week, promoting optimism for the rupee against the US dollar for the past couple of weeks. However, the market is leading the US dollar up with optimism before incoming economic reports, such as building permits and housing starts, both of which are expected to rise for June on a monthly basis. Building permits are expected to record gains to 1.290 million for the month of June against 1.216 million in May, right around the time when the country had begun reopening its businesses. Near-term, investors are expected to be more optimistic, but recent record surges in new coronavirus cases are expected to push the US down long-term. For now, trading is in favor of the safety from the US dollar, or if Building Permits figures disappoint.

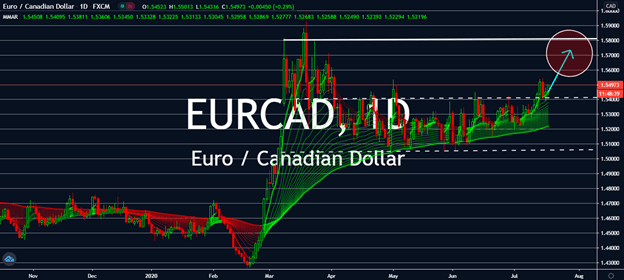

EURCAD

Both Spain and Italy reported better than expected results during today’s trading. The Spanish Trade Balance showed an increase on a monthly basis with more than a billion more this month in comparison to the last report in June from -1.52 billion to 0.12 billion. Furthermore, Core CPI surprised the market when it showed an increase in June when compared to the same month last year and last month. The evident recovery for these important figures, as well as the European Central Bank’s call to leave its interest rates unchanged months after it began pulling out powerful bullets to help its economy when the coronavirus infected the region earlier this year. Because of this, the euro is expected to rise past the loonie. Although, investors still need to watch out for the Canadian dollar – after it decided to hold interest rates as it is at 0.25%, the federal government is preparing to provide provinces with a total of CA $19 billion to help its economy.

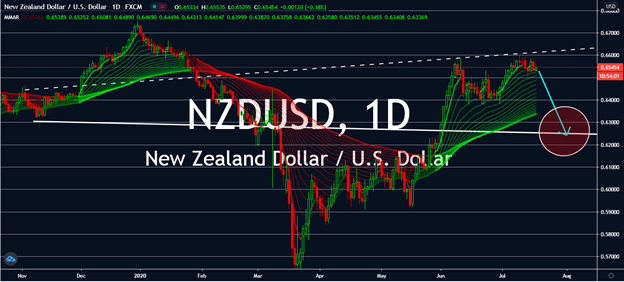

NZDUSD

The United States might have been seeing rapidly increasing cases of coronavirus in the country, the US dollar is still expected to gain with positive economic data reported today in comparison to worries emerging for the New Zealand economy. Earlier this week, New Zealand reported a massive slump for its consumer price index for the second quarter of 2020 from 0.8% to -0.5% ending June 30. CPI also fell on a yearly comparison, but that was already expected by the market. Meanwhile, recent data from the US is expected to stimulate optimism for the safe currency. Building Permits for June are expected to rise both on a yearly and a monthly basis, which shows that markets can still turn to the USD amid a trying time. However, it’s important to note that US-China tensions are rising. If China sees negativity from its diplomatic relationship with the US, the New Zealand dollar might gain against the greenback.

AUDCAD

The Canadian federal government will provide CA $19 billion to its provinces to help “restart” its economy after its months-long lockdown. Prime Minister Justin Trudeau had pledged CA $14 billion, but increased it by market demand. Investors are expected to root for the loonie as markets await for how this would actually help the economy, especially as more and more analysts believe that Australia’s “second wave” of coronavirus infections in the region will slow its economy down after it had just begun seeking economic recovery this month. Cases in the country spiked after a month of relative lows from 10+ new cases a day to a maximum of 300+ as of July 15. Investors are also worrying that the recent boost in employment change for the month of June reported this week would soon fall once again, given that the Bank of Canada had enough faith in its economy to retain its interest rate at 0.25% and hinted on no changes until 2023.