Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

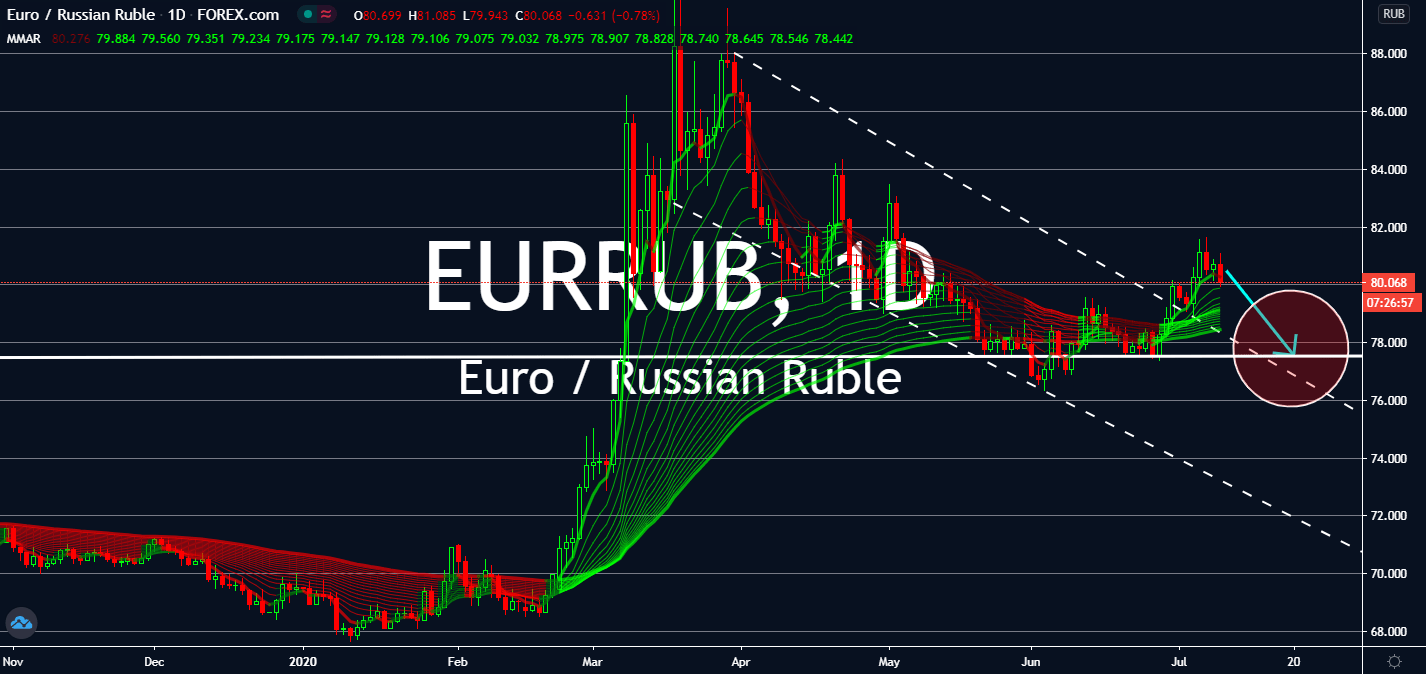

USDJPY

The US Initial Jobless Claims is in center focus on Thursday. The US government reported another 1.31 million Americans to file for unemployment. Notably, this week is down from 1.43 million from last week, making the deceleration is at its thirteenth consecutive week. Millions of workers are being rehired at a much faster pace than anticipated. However, investors are hardly impressed – more than 48 million Americans have filed for unemployment insurance for the past 15 weeks. Meanwhile, business sentiment for Japan is increasing on the daily as expectations for its recovery grew with lifting lockdown measures nationwide. The Cabinet Office said Wednesday that confidence jumped to 38.8 in June, up from 23.3 points in May, as the sharpest increase since the Office launched the data gathering in January 2002. Plus, the reading is up for the second month in a row, which will help the Japanese yen near-term.

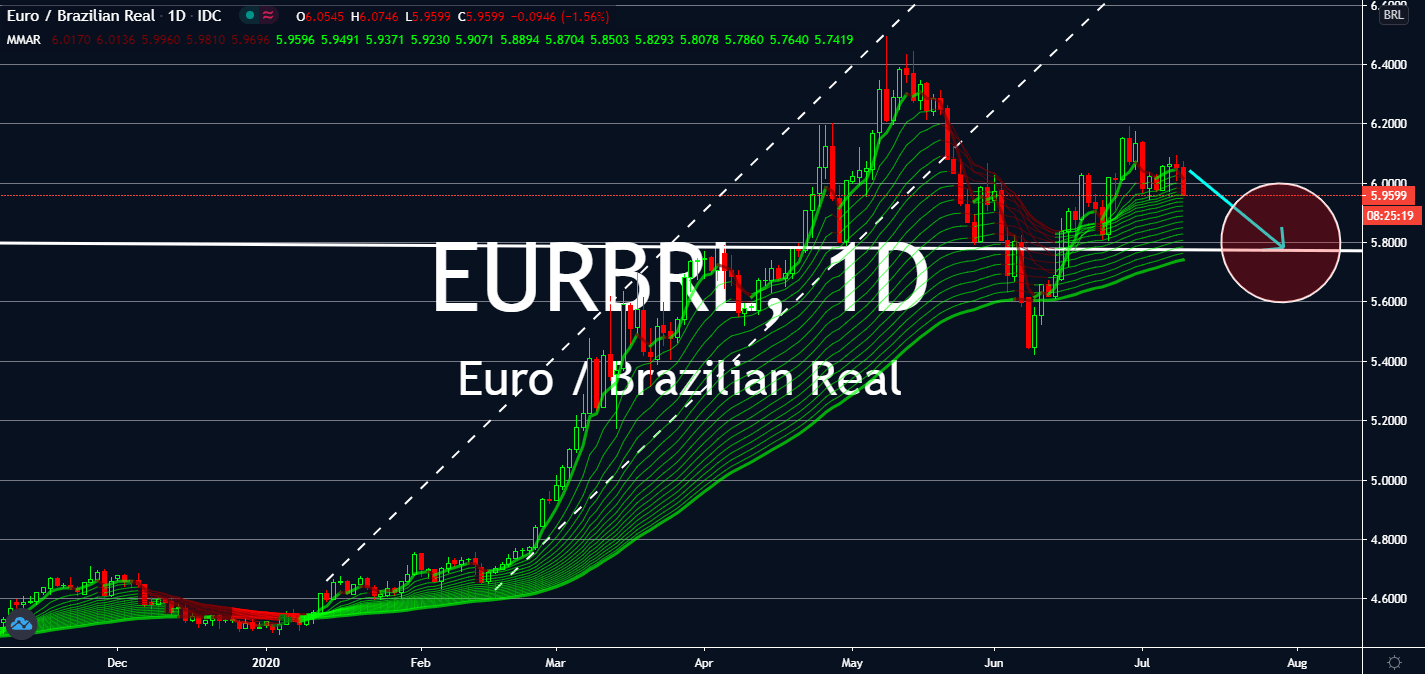

EURBRL

The Central Bank of Brazil’s recent decision to cut its interest rates by 75 basis points from 3.00% to 2.25% is still taking effect on the Brazilian real, which will push the Brazilian down in upcoming trading against the single currency. However, it looks like the real’s rise will come around sooner than expected – although Germany announced a higher trade balance of 7.6 billion in May in comparison to both market consensus (5.2 billion) and that of what was seen in April (3.2 billion), the most powerful economy in Europe has seen too many added coronavirus cases this week to bring optimism into the market. The number of confirmed cases rose to 442 this week and the reported death toll is now up 12 at 9,048. Both German exports and imports were also seen dropping on a monthly basis in May, which only increased to 9.0% against the expected 13.8% and 3.5% against 12%, respectively.

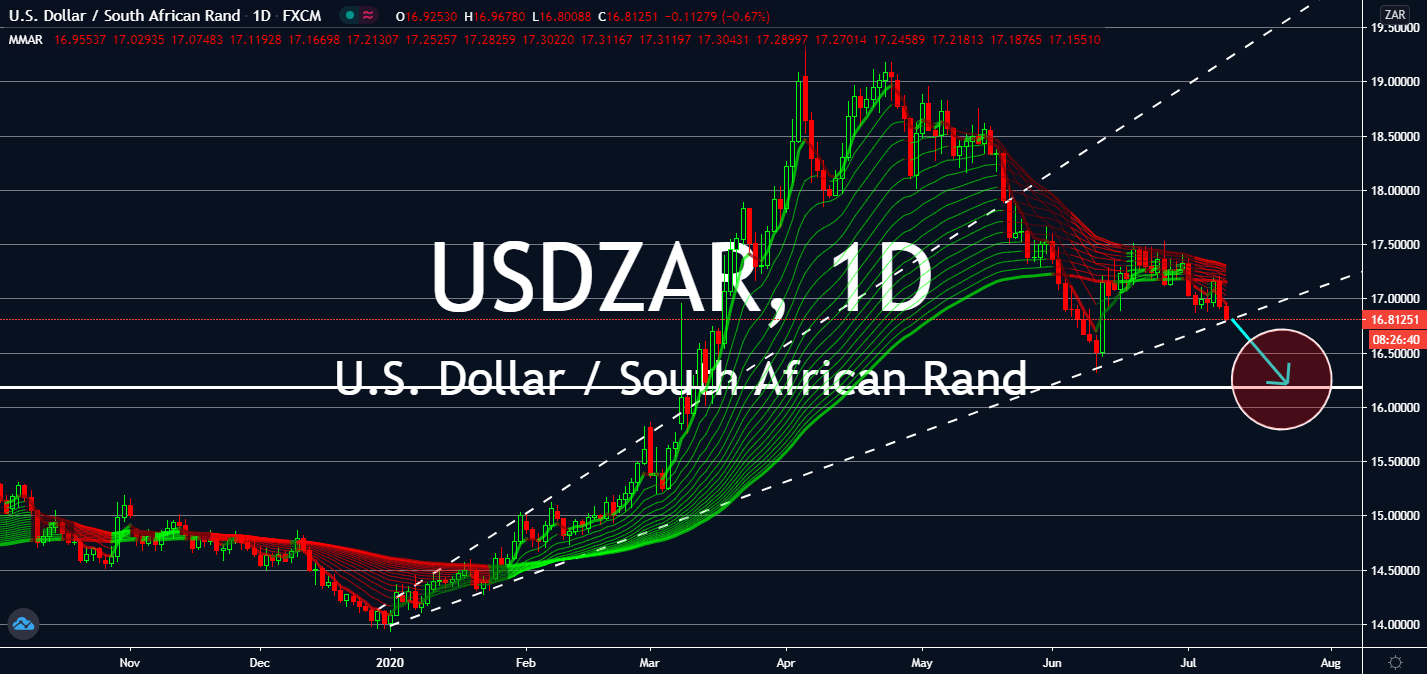

USDZAR

South Africa saw its Manufac turing Production plummet on a monthly basis this afternoon, which came in at -44.3% in April in comparison to -1.2% recorded in March. The figure is expected to lower even further for May and June. Similarly, the manufacturing output has fallen by 49.4% on a yearly comparison during a nationwide lockdown Although that isn’t to say the US dollar is doing any better – the economy failed to motivate investors to root for the greenback as per their expectations on the initial jobless claims report this week, which boosted gold prices as its safe haven. The yellow metal’s leap will influence engagement for emerging market currencies such as the South African rand, although investors should still take note that the USDZAR pair will have to flatten near-term unless both coronavirus centers begin to report positive economic data, most especially the US employment.

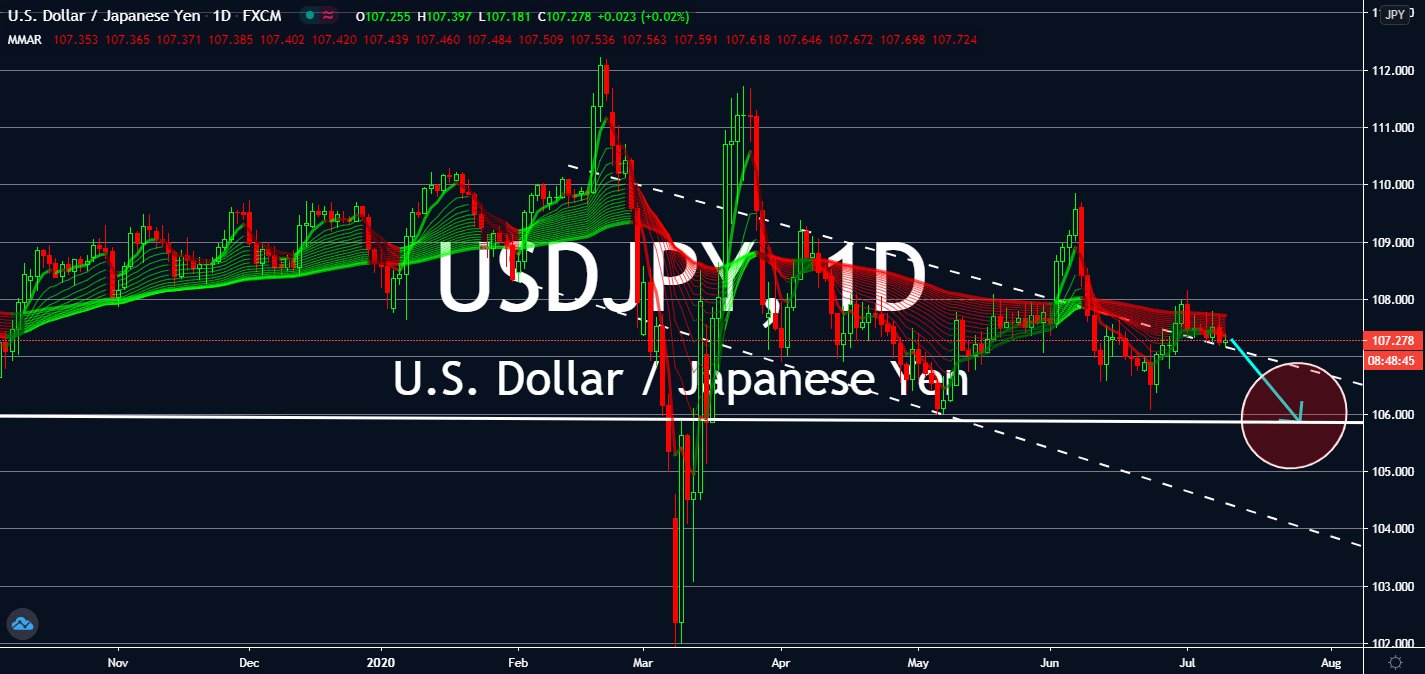

EURRUB

Germany and Russia both announced their trade balance reserves from the month of May, and the former got out way more successfully. German Trade Balance came in 2 billion more than the market expected, which was 7.6 billion in May from 3.4 billion from a month ago, and is above the 5.3 billion US dollar consensus. Although Russia’s increase comes off as lackluster with barely a billion increased on a monthly basis, it’s still astoundingly better at 569.8 billion for the current report, against 568.3 billion USD recorded a month prior. This is expected to help the Russian ruble to gain up on its rival currencies, like the euro, especially after Germany reported disappointing imports and exports figures month-over-month on Thursday. Investors should look out for euro figures, still, because Eurogroup is still looking forward to an agreement on the 750 billion-euro rescue package to restore confidence in the single currency.