Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

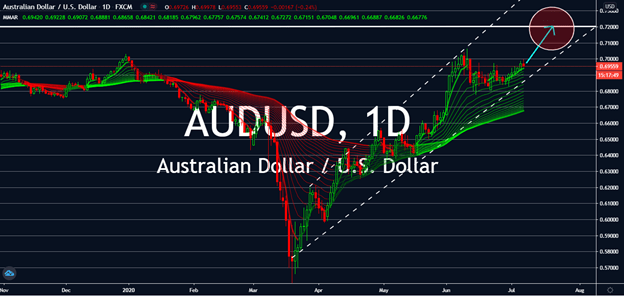

AUDUSD

The Australian dollar kicked off the week with a rally against the greenback this week. Outlook looks similar with the AUDUSD pair preparing for a five-month rally after the Reserve Bank of Australia decided to keep interest rates as it is on its record low 0.25 percent level, which is in line with market expectations. This rate remained before and so far in the pandemic, even while other central banks have been tweaking their own rates since March. Moreover, broader risk-on moods are also expected to boost the AUD. Although the US ISM Non-Manufacturing PMI’s positivity is expected to slightly put the greenback up against the Aussie, it wouldn’t be enough due to worsening coronavirus conditions in the United States. The figure was way up at 57.1 for the month of June in comparison to economist’s expectations of 50.1 and a jump against the previous record of 45.4 achieved the month prior.

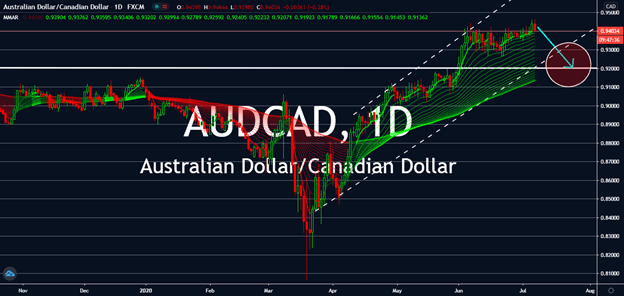

AUDCAD

Risk-on sentiments are focusing on assets like the Aussie and Canadian dollar, which could make the AUDCAD a formidable pair in upcoming sessions. The Reserve Bank of Australia chose to retain interest rates on its record lows at 0.25%, which is at the same level as it was from before the coronavirus pandemic trampled economies worldwide. Canada is also slowly reopening its economy as it looks forward to the Ivey Purchasing Managers’ Index later today, which is expected to rise even after June’s 39.1 figure from 22.8 achieved in May. Investors are looking forward to more optimism for other figures such as the employment rates that’s due on Friday. In fact, economists expect Canada’s Employment Change rate to skyrocket towards 700 thousand for the month of June, which is a little less than 500 thousand more than the recovery in May, which saw a 289,600 figure throughout the entire month.

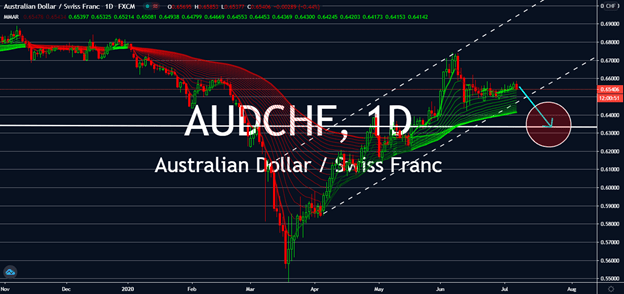

AUDCHF

The Australian dollar will take the hit against the Swiss franc in upcoming sessions leading into Switzerland’s unemployment rate report due on Wednesday, July 8. The Swiss eased lockdown restrictions last month, which helped the rate see a smaller figure than what economists expected. Although Switzerland saw a lower unemployment rate of 3.3% two months ago than the 3.4% seen in May, the relatively positive result last month is set to boost optimism for the figure, and the European country’s economy, in the near future. However, it’s also not expected to see much gain against the Aussie, because the Reserve Bank of Australia’s decision not to change its interest rates from its record low of 0.25% might be able to buoy its prices. Plus, if Australia’s conflict with China sees positivity, this will weigh better and heavier than upcoming economic data reports from Switzerland and would inevitably benefit the Aussie dollar, instead.

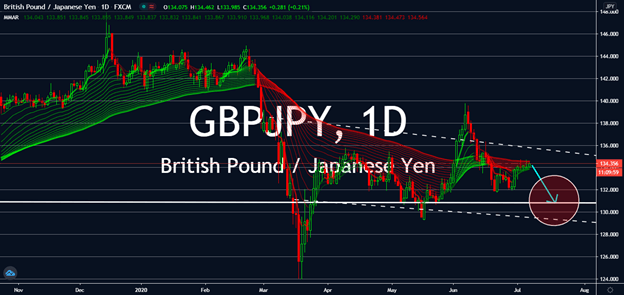

GBPJPY

Despite the optimism revolving around British figures last week, the sterling pound is anticipated to swim down. It looks like the Bank of England is considering negative interest rates, determined by the upcoming Monetary Policy Committee (MPC) Treasury Committee Hearings on Wednesday. If the MPC decides that the City needs more stimulus to hit the central bank’s 2% inflation target within the year, this could determine the GBPJPY’s track long-term. This includes having the bank lower its interest rates, which was at 0.75% in January and eventually dropped to 0.10% by March, this could push the currency down near-term. The UK government is also under pressure to unveil a possible $250 billion stimulus plan to help businesses afloat from the economic effects of the coronavirus pandemic. The already negative interest rate from the Bank of Japan will also uproot the currency against the sterling pound.