Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

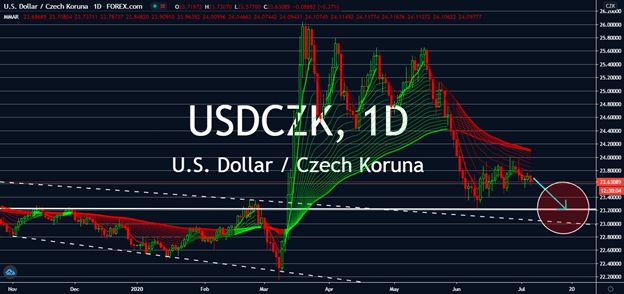

USDCZK

With strength siding with the single currency, markets expect the smaller currency pair USDCZK to see highs in the next coming sessions. EUR strength is expected to push the Czech koruna on the hope that the proposed Euro recovery fund will be agreed by all 27 EU member states. Moreover, news that the small economic slump for the Czech Republic might buoy the currency up against the US dollar in comparison to the United States’ GDP levels, both in a yearly and a quarterly comparison. That said, the greenback/koruna pair is heading towards levels similar to its sideways track last seen before March when the coronavirus was declared as a pandemic. As long as the recovery fund continues to witness market optimism near-term, or unless the US reports good news about its crude oil inventories and manufacturing sectors, the Czech koruna and its associates are expected are boost against the greenback.

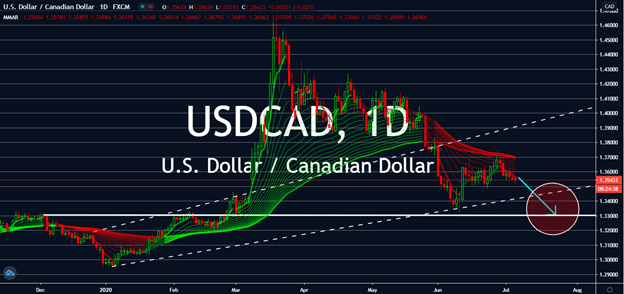

USDCAD

Investors have become increasingly concerned about the world’s decision to reopen some of its economies even while the coronavirus prevails. Fortunately, it looks like their faith in oil is set to pump up, as well – the price of the OPEC basket climbed above 40 US dollars a barrel for the first time in four months as the group manages to fulfill all of its promised cuts throughout the entire month of June. Because of this, the oil-reliant Canadian loonie is expected to strengthen near-term, especially after more researches emerged that its oil and gas industry will be critical to its economic survival. The USDCAD exchange is now set to meet its pre-coronavirus resistance levels as the economy prepares for recovery after it retracted by 12% in April. Luckily for Canada, surveys also claim that the country had seen a 3% GDP increase the following month. Although the country is on “slow recovery,” it’s expected to be better than US figures in coming sessions.

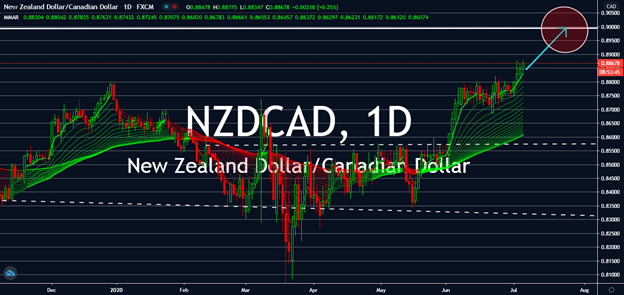

NZDCAD

Overwhelming interest for the New Zealand dollar will boost prices towards levels last seen in May 2019, especially amid the hype over the kiwi economy’s fast recovery against the coronavirus. The kiwi had been seeing weeks-long highs, and markets believe that it will only surge further into these highs, if it’s not already on track towards near 0.9100 levels against the loonie by three months. As of writing, the pair is in July 2019 levels, right when the market was in fear of a possible recession from the United States when the Federal Reserve was on the verge of cutting interest rates down by 25 basis points. The Eurozone had also been threatened with a pushback on its economic outlook halfway through the month, raising demand for currency alternatives, such as the New Zealand dollar. Now that NZ is also looking for further improvement, its currency might meet similar highs near-term once again.

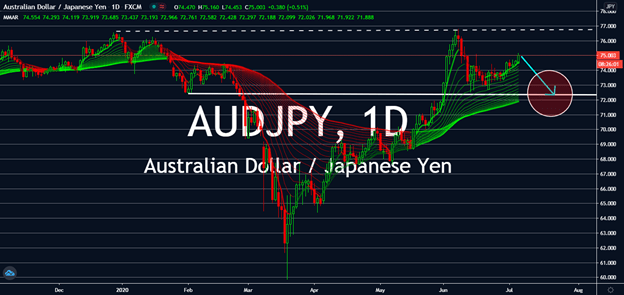

AUDJPY

It looks like the market is decided on keeping themselves risk-free. The safe haven Japanese yen has been seeing highs against relatively riskier currencies such as the Australian dollars in recent sessions as investors demand safety against the now-dangerous greenback as the threat of a deep economic session in the United States loomed over its country. Investors also have their eyes peeled on a possible digital yen to make up for sanitary concerns brought by paper currencies. Moreover, recent concerns about the negative implications of coronavirus cases in Australia have caused the AUD to trip downwards. Economic analysts claim that the second wave of coronavirus cases in Australia will take a toll on its overall economic recovery, which also emphasizes how fast the virus can return. The current slump is unlikely to be the last for AU and multiple opening and closing for a few areas, which leads investors to their opposites, much like the yen.