Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

AUDUSD

The AUDUSD pair has undeniably been stagnant for the past of couple months or ever since it approached pre-coronavirus levels right around the second week of May. Still, the pair is expected to continue its uptrend in upcoming sessions thanks to rising risk appetite from the forex market. The rise comes after the Reserve Bank of Australia approaches the date to report is monetary policy, which the market widely expects to remain unchanged at 0.25% until next year. In America, initial jobless claims disappointed investors when it saw 1,427 thousand more people registering for unemployment benefits against the 1,355 thousand figure they expected. Although unemployment rates and non-farm payrolls saw an increase for June that was better than estimates, these wouldn’t bear as much weight as the clear fact that the United States’ business-based economy is recovering much slower than investors are willing to trade for.

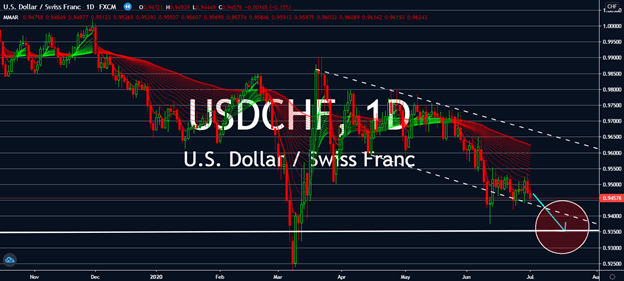

USDCHF

Switzerland showed worse economic results today. In fact, it had failed to record an improvement for a month-over-month comparison for its CPI. The figure came in 0.0% instead of the market’s expectations of 0.1%. It also reported a stagnant -1.13% with the same year-over-year comparison. Even with this, the American dollar is still expected to meet with the bears when it comes to the USDCHF pair. Why? Because the United States just recorded a new record for new coronavirus cases on a daily basis, recording more than 55,000 more cases earlier today. Further, more Americans filed for unemployment benefits since last Thursday than the market expected. Initial Jobless Claims came in at 1,427,000 on Thursday, up against 1,355,000 expected prior. The fact that the number remains above 1 million was pessimistic for the dollar already. Hourly earnings also fell in the US, both on a yearly and a monthly basis.

USDZAR

The coronavirus will worsen the greenback sell-off across multiple currency opposites in upcoming sessions. The United States’ lack of urgency toward the pandemic is still taking a toll on its economy despite better than expected economic data reported today, especially against the relatively successful South African rand. The emerging currency will continue to benefit from better than expected GDP results from its June 30 announcement, on top of now-positive figures for its current account percentage of GDP for the first quarter of 2020. The figure stands at 69.7 billion by a massive gain against the expected -34.9 billion and the -68.1 billion recorded previously. The percentage recorded 1.30%, up against the predicted -0.70% and double the -1.30% recorded during the fourth quarter of 2019. With 800 thousand new cases reported just last month, it looks like the rand will continue to bask in its glory near-term.

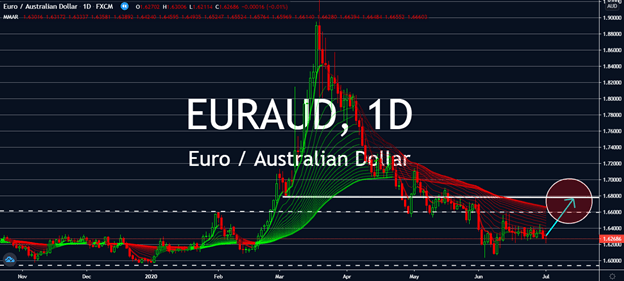

EURAUD

The EURAUD pair is expected to quiet down in upcoming sessions, but the safer bet looks like it would be towards the euro currency. As the Australian economy sinks back into another possible wave of coronavirus cases in the country, the reemerging eurozone is expected to rise right behind Asia. Apparently, the bloc reported a lower unemployment rate for the month of May than what was expected: when it recorded 7.4%, it had exceeded market expectations of 7.7%. The European Union now predicts its inflation had risen to 0.3% in June, which was up from 0.1% in May. The good news will help the euro currency to buoy up against the Australian dollar in upcoming sessions or until the bloc announces otherwise. Although it’s important to note that Australia still recorded relatively better economic data today, such as the reported retail sales figure for the month of May, which came in way up to 16.9% against April’s -17.7%.