Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

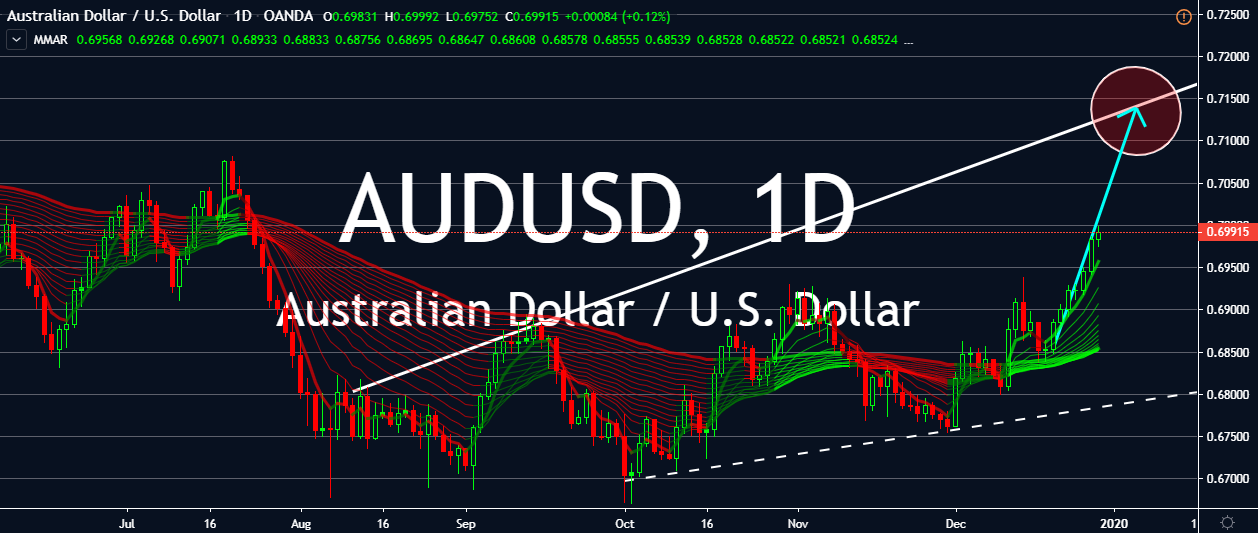

AUDUSD

The Australian dollar started its uphill climb two weeks ago following the good employment change and unemployment results from November. But bulls were able to hold on the upward momentum and successfully continue to gain altitude against the US dollar. The big absence of economic reports from the country is, of course, not the reason for the pair’s uphill climb. Bulls are harnessing their strength from trade war progress and are taking advantage of the greenback who is currently losing its safe-haven appeal as traders see more clarity for the trade war. On top of that, the week results produced by the US economy isn’t helping the US dollar at all. Just last week, America’s monthly core durable goods orders for November fell to 0.0% from 0.3% prior, slipping lower against 0.1% expectations. While the November new hole sales failed to reach expectations of 734K and only went up to 719K from 710K.

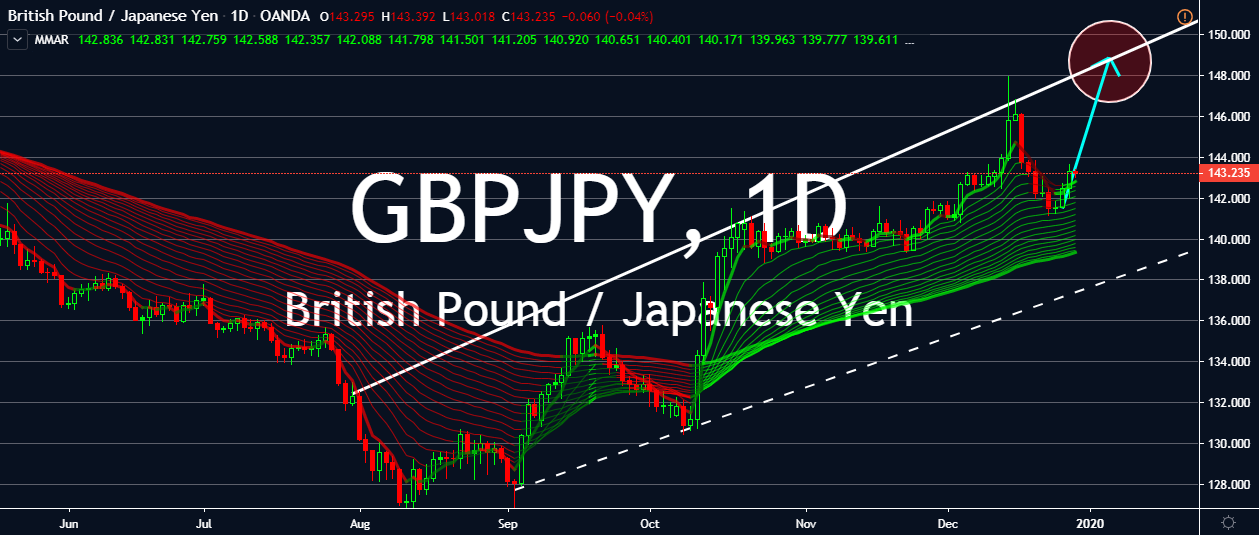

GBPJPY

As of writing, the pair is flatlining as bears take advantage of the thin and silent market, forcing the GBPJPY pair to steady. As evident in the market, traders are relatively silent this Monday as the majority of them are preparing for the New Year’s celebration this week. Still, the pair is expected to climb as the British Prime Minister’s divorce promise lies just around the corner. The pound sterling is expected to maneuver against the Japanese yen once the trade agreement between the United States and China gets inked next month. The pair is expected to jump higher if the two economic giants actually sign the trade agreement in early January. Meanwhile, pound traders are waiting for Boris Johnson and his Brexit pursuing team to return for the next chapter of the Brexit saga. Recently, European Commission President Ursula von der Leyen expressed genuine concern about the feasibility of the deadline, saying that the transition period may need an extension.

EURUSD

The EURUSD is poised to keep its bullish momentum in coming trading sessions as the bloc’s single currency seizes gains while the greenback continues to stumble. The trade agreement between the United States and China could play in as a double-edged sword for the US dollar; it could go in both directions looking at the situation. It could regain its footing and reel the euro lower if traders believe that an agreement would lessen the chances of the US fed easing its monetary policy. And it could continue to struggle as it loses its safe-haven appeal once the two giants, who caused the global economic slowdown, finally reconcile. But as long as traders remain uncertain of the buck’s outlook, the euro will continue to take advantage of the moment to attain gains against it. However, the single currency’s gain today was limited as Spain fails to reach GDP and HICP expectations.

NZDCAD

Disappointments from Canada’s economy and the loosening tension between the United States and China paving the way for NZDCAD bulls to rally in sessions. The pair is still widely expected to continue its uphill climb in coming sessions Washington and Beijing’s trade pact will most likely be inked early next month. Just recently, Canada’s economy produced a series of discouraging results from various reports, which paved the way for the kiwi to gain. Last week, Statistics Canada issued the country’s monthly gross domestic product growth which topped helped NZDCAD bulls to keep their momentum. The Canadian GDP unexpected contracted to -0.1% from 0.1% while experts were initially expecting it to remain unmoved. Then prior to that, Canada’s October retail sales, core retail sales, budget balance, and new housing price index were all released, and all reports showed contraction.