Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

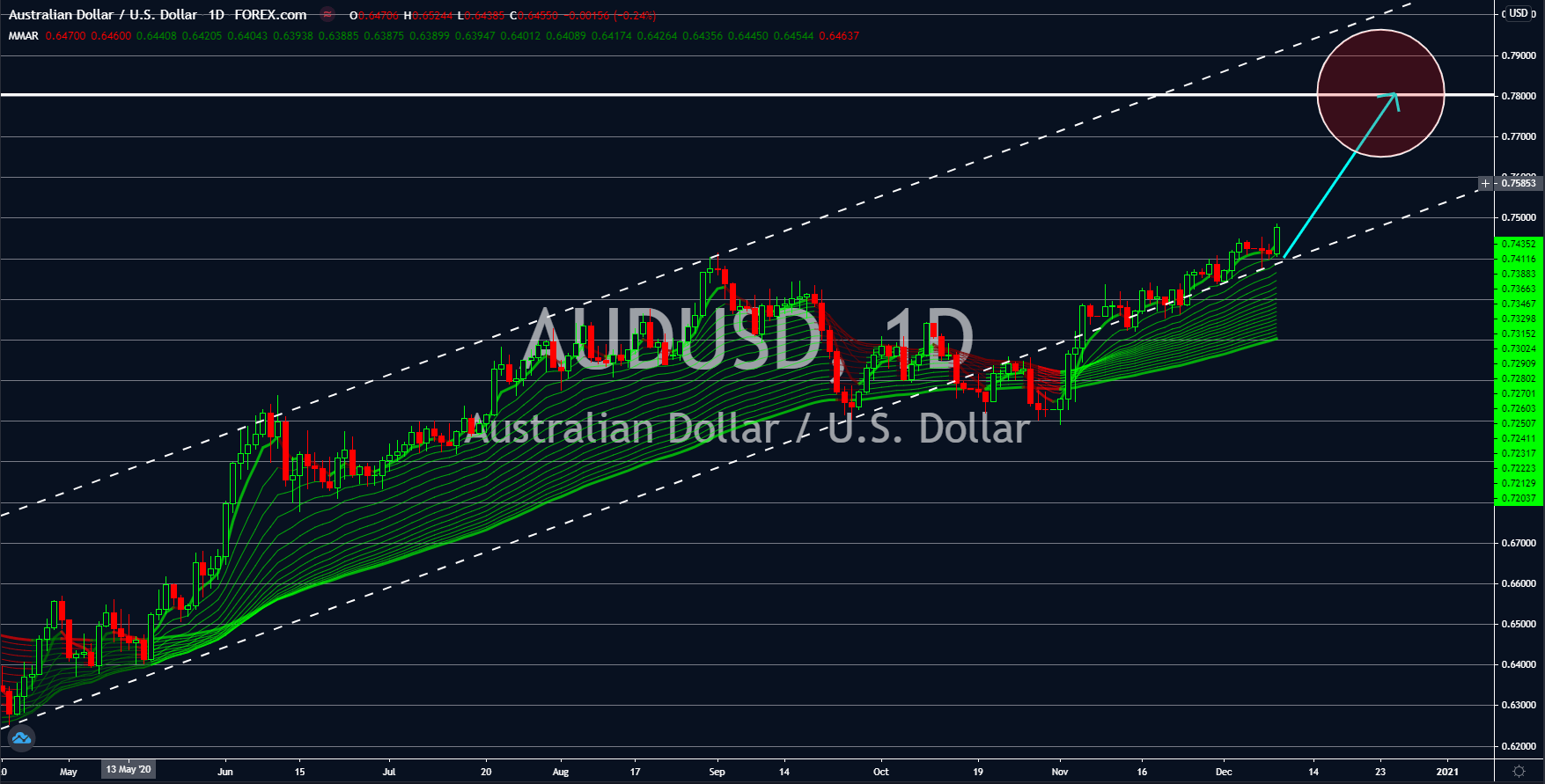

AUDUSD

Investors will continue to see an improvement in the prices of the AUDUSD pair towards the April 2020 high. The weak figures from the US labor market led investors and traders to anticipate an increased pressure for the US government to pass an economic aid before 2020 ends. In turn, the added stimulus will increase the supply of greenback in circulation, thus, a decline in the value of the US dollar. On Friday, December 04, the NFP reported the lowest jobs creation April 2020 at 245,000. The figure also represents a 60% decline from its prior record of 610,000. Furthermore, analysts expect only 6.300 million jobs opening for the month of December as companies continue to be more efficient. Meanwhile, the initial jobless claims on Thursday, December 10, is projected to report 725,000 new claimants of unemployment benefits. The current situation of the labor market will continue until a stimulus has been passed.

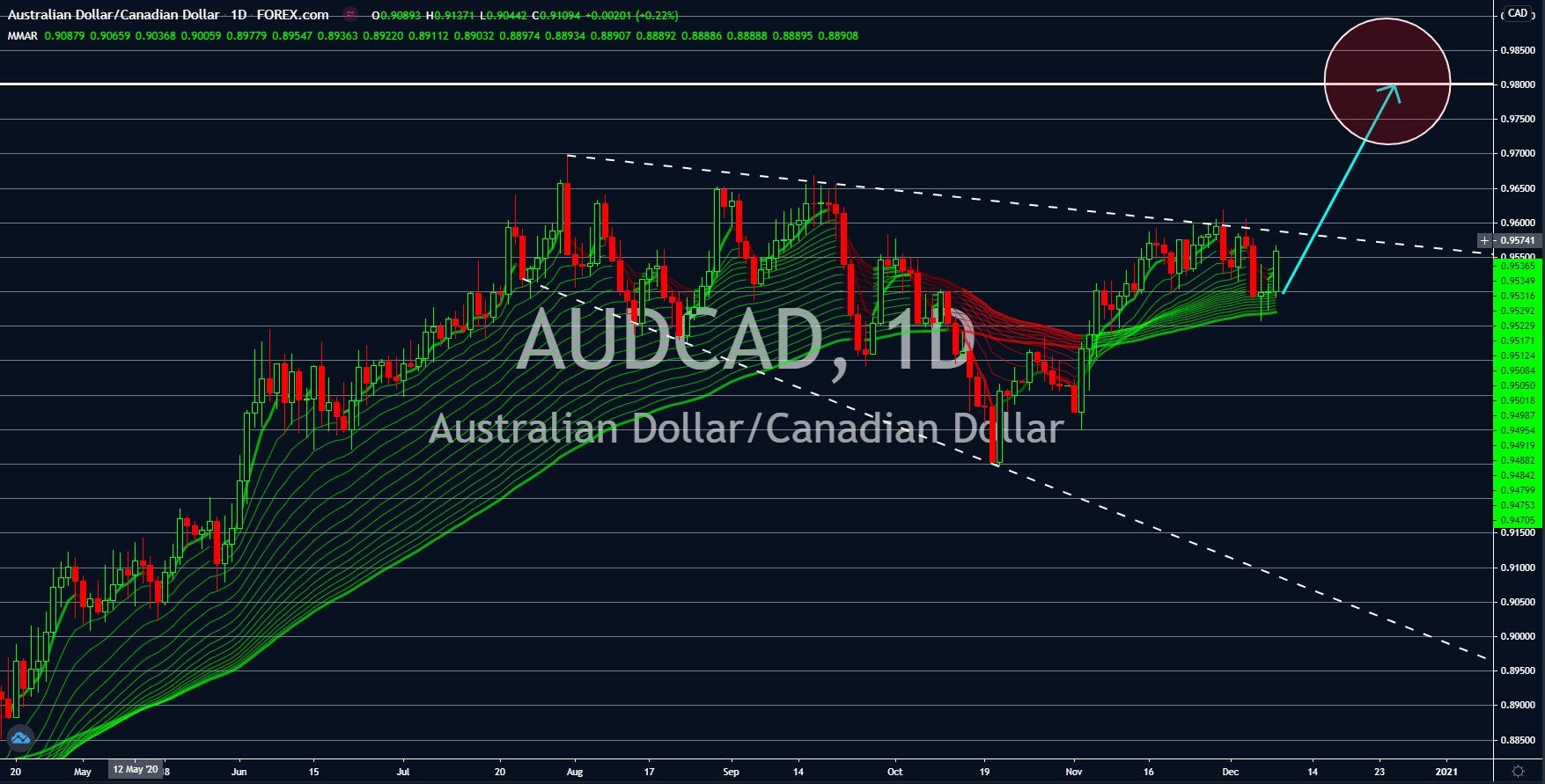

AUDCAD

Australia showed a more sustainable growth compared to Canada. On an annualized basis, Canada’s GDP surged to 44.1% in the third quarter of 2020. The previous record was 38.0% decline in Q2. However, recent reports showed that Canada’s recovery has been slowing down. The Ivey Purchasing Managers Index (PMI) report grew at a slower pace at 52.7 points. This figure represents the first target missed for the report since April 2020. On the other hand, Australia is set to end December in a positive outlook. Westpac Consumer Sentiment rose by 4.1%. Meanwhile, NAB Business Confidence and Business Survey increased to 12 points and 9 points, respectively. ANZ job advertisement also went up by 13.9%, suggesting a strong Australian labor market. The overall growth in Australia was led by the strong consumption as the country successfully contained the virus. Retail turnover in Australia was 7.1% for the month of October.

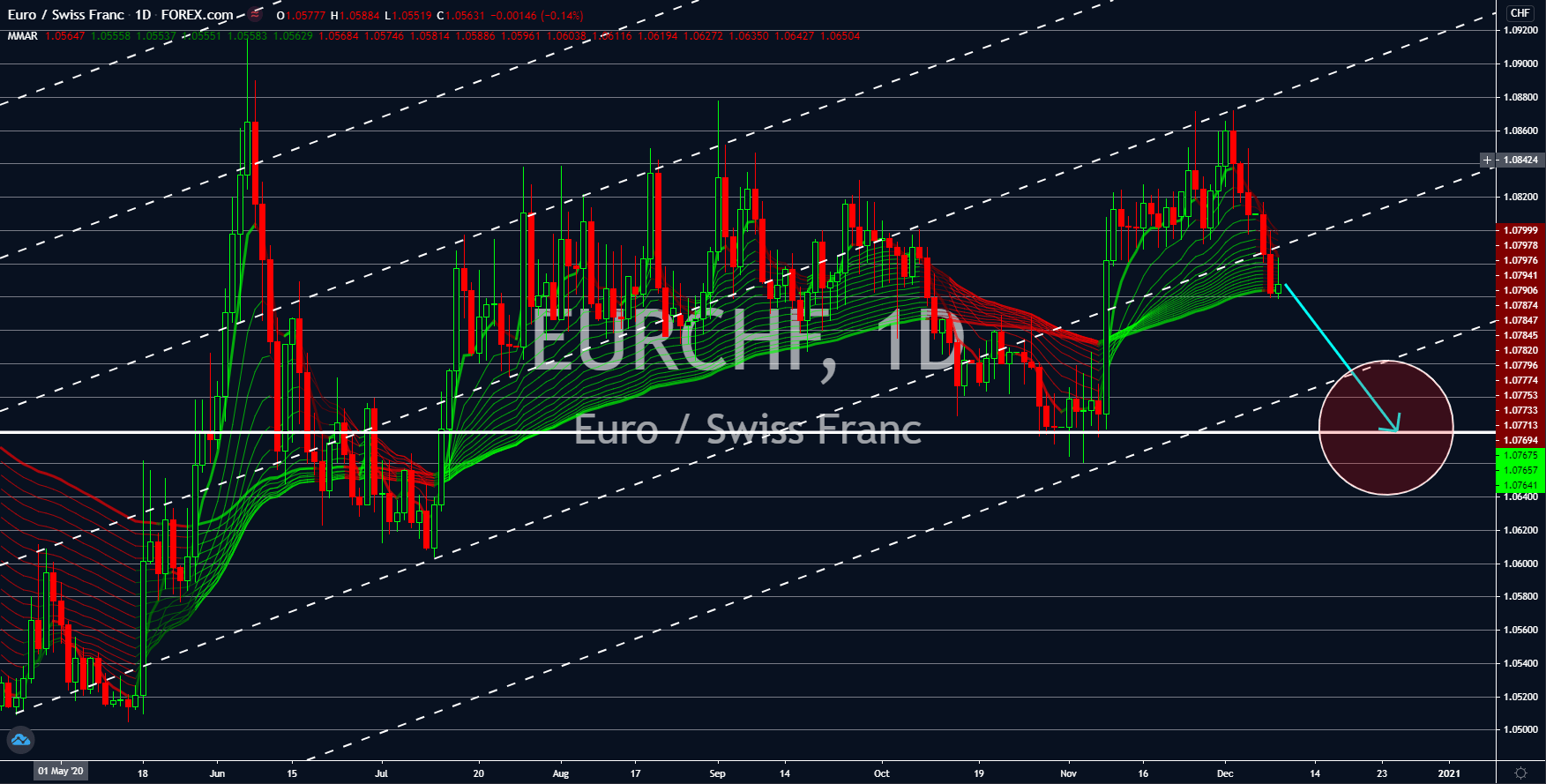

EURCHF

The Swiss franc will regain back its losses against the single currency in the next 15 days. The rising cases of COVID-19 in Europe, the looming deadline of the Brexit extension, and the veto vote by Hungary and Poland on the EU budget, will take a toll on the performance on the single currency. Germany’s cases continue to rise despite implementing a second lockdown in October. The failure by the “light” lockdown had forced German Chancellor Angela Merkel to extend the lockdown until January 10. This is expected to severely hurt businesses. In addition to this, only 23 days remain before the UK is set to officially leave the EU. However, no agreement has been reached by the two (2) parties yet. And lastly, the much-needed economic aid was stalled after Hungary and Poland disagreed with certain provisions in the 2021-2027 budget of $1.3 trillion economic budget and $910 stimulus aid, a total of $2.2 trillion.

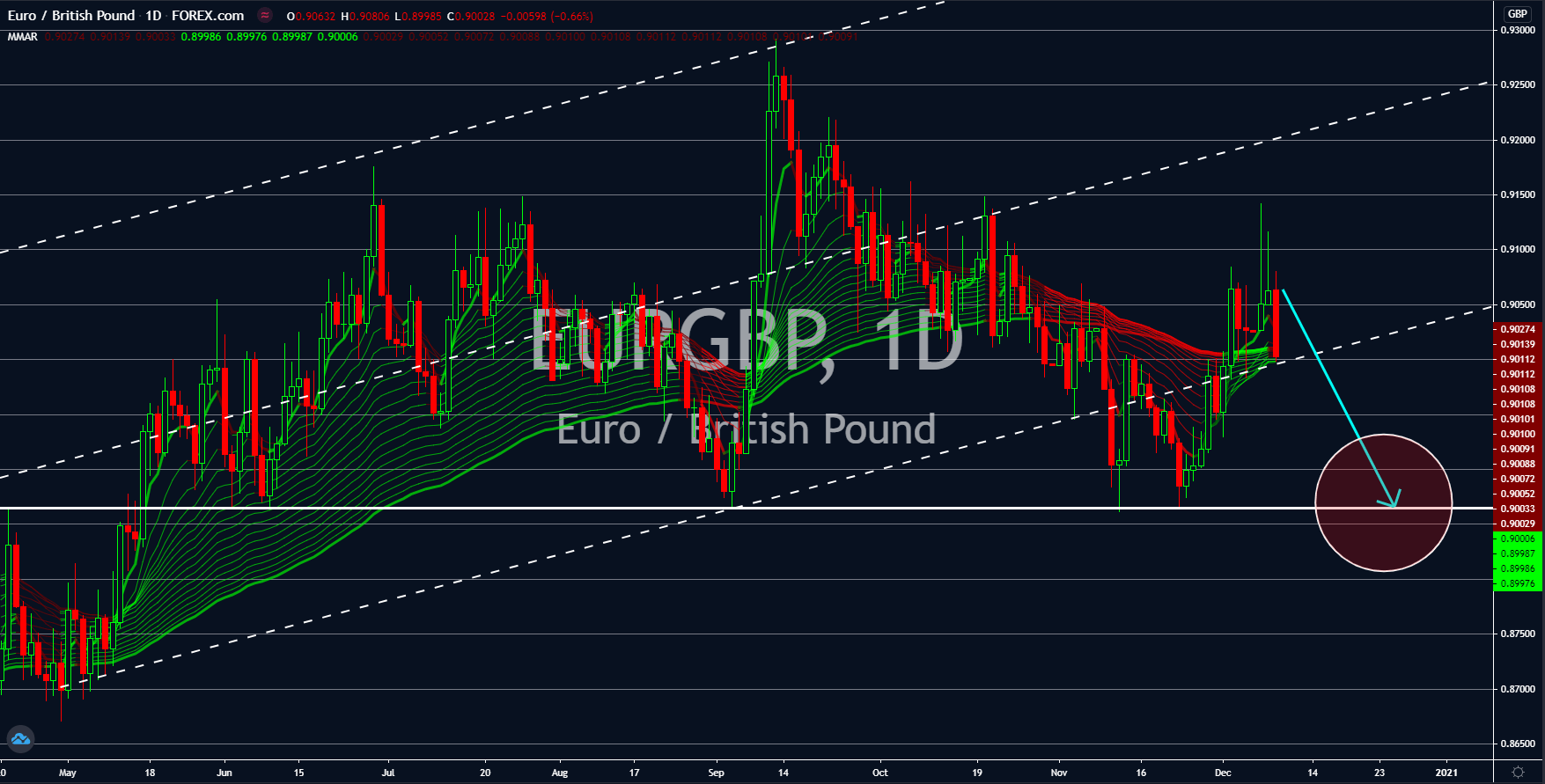

EURGBP

A sell off should be expected following the comments from Goldman Sachs. The investment banking company said that the UK economy might expand by up to 7.0% in 2021 amid the historic event on Tuesday, December 08. Britain became the first country to administer a COVID-19 vaccine to individuals outside the clinical trial test. In total, the UK has ordered 40 million doses of Pfizer-BioNTech’s vaccine, enough to cover 20 million of 35% of the country’s population. The vaccine was deemed safe by the British health authorities last week, clearing the path for the delivery of the vaccine. If proved successful, the United Kingdom could be the first country to return back to normal life, thus, it will also be the first to experience a robust growth driven by the vaccine. On the other hand, the EU is distracted by the Brexit, the lockdown extension in Germany, and the veto vote by Hungary and Poland on the EU budget.