Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

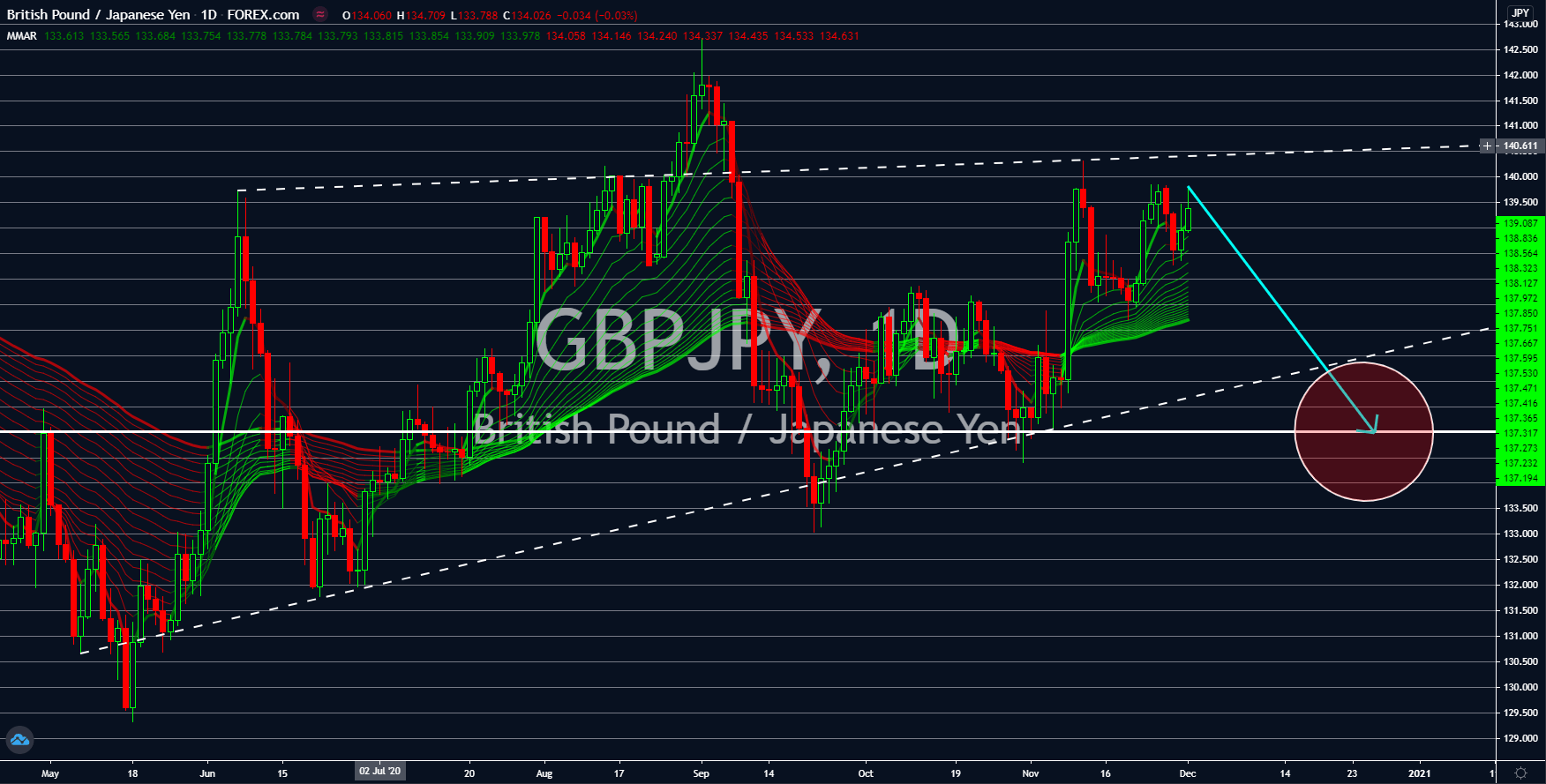

GBPJPY

The United Kingdom outperformed its peers in the European Union but lags behind advanced economies in Asia. In January 2021, the UK is set to leave the EU bloc. With only 30 days remaining before the deadline for the Brexit extension, the UK and the EU are trying to come up with a deal that will be acceptable for both parties. However, this could also lead to more confusion and uncertainty once the UK officially leaves the bloc. On the other hand, Japan joined with China, South Korea, Australia, New Zealand, and the ASEAN in forming the world’s newest and the largest trading bloc, the RCEP. As for the most recent reports, lending in Britain becomes stricter as banks weigh on the possible effect of the resurgence of COVID-19. Mortgage approvals for October increased by 97,530. However, the mortgage lending dropped to $4.29 billion while lending to individuals entered a new low at $3.7 billion.

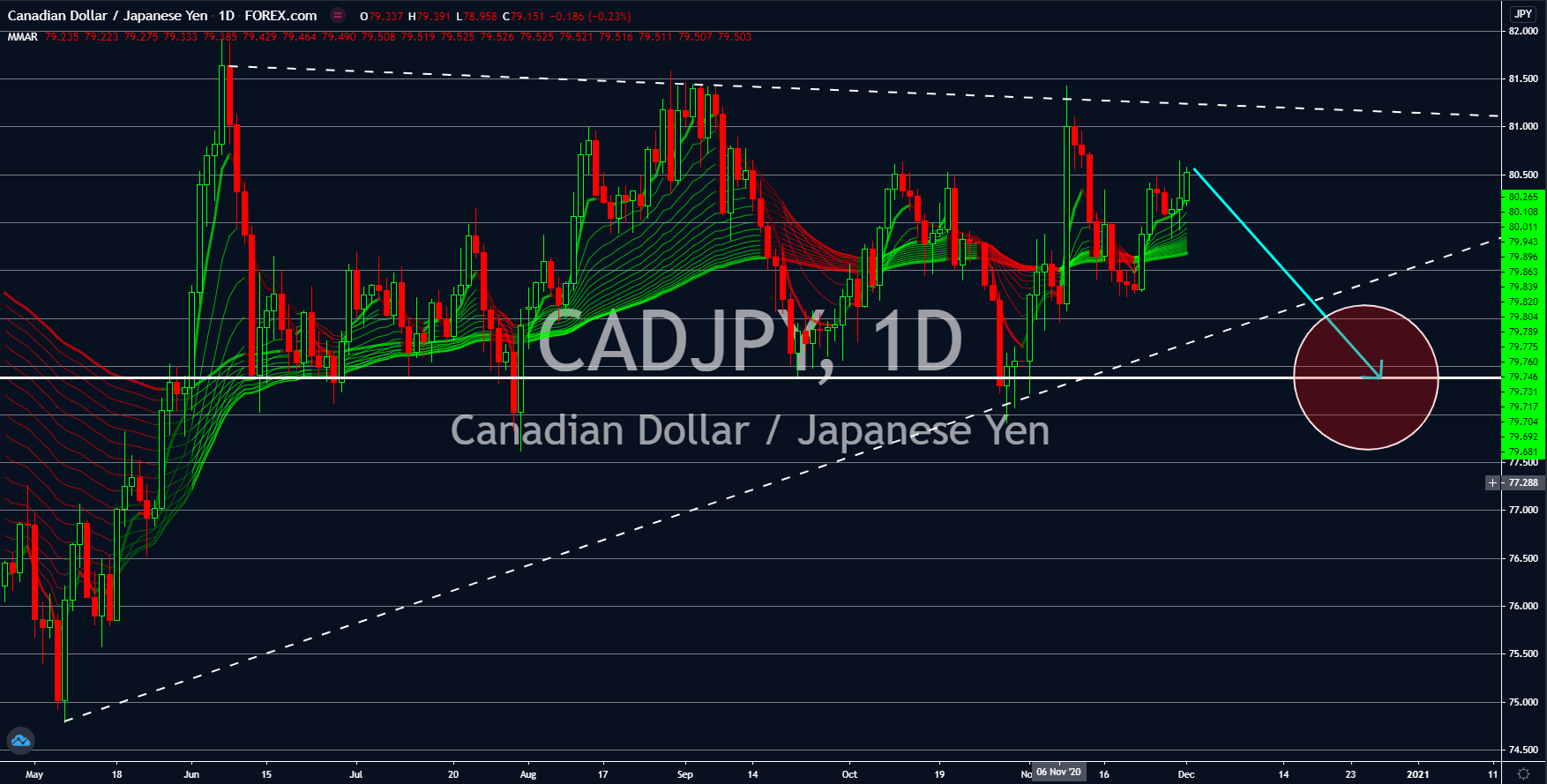

CADJPY

Canada unveiled its latest stimulus program to kick-start the economic recovery in the country. The $77 billion economic aid was currently the largest stimulus package by the government since World War II. The aid will be distributed among hard-hit businesses by the coronavirus pandemic. Despite the good intention for the introduction of the new stimulus, this package will send the government deficit to a historical high in March 2021 at $295 billion or around 3 to 4 percent of the country’s GDP. The country’s finance minister defended this action by saying that without government intervention, Canada could see its economy collapsing just like what happened during the 2008 Global Financial Crisis. The country’s manufacturing sector was hit the hardest by the resurgence of COVID-19. On Monday’s report, November 30, the country’s building permits dropped by a staggering -14.6% against September’s 18.6% growth.

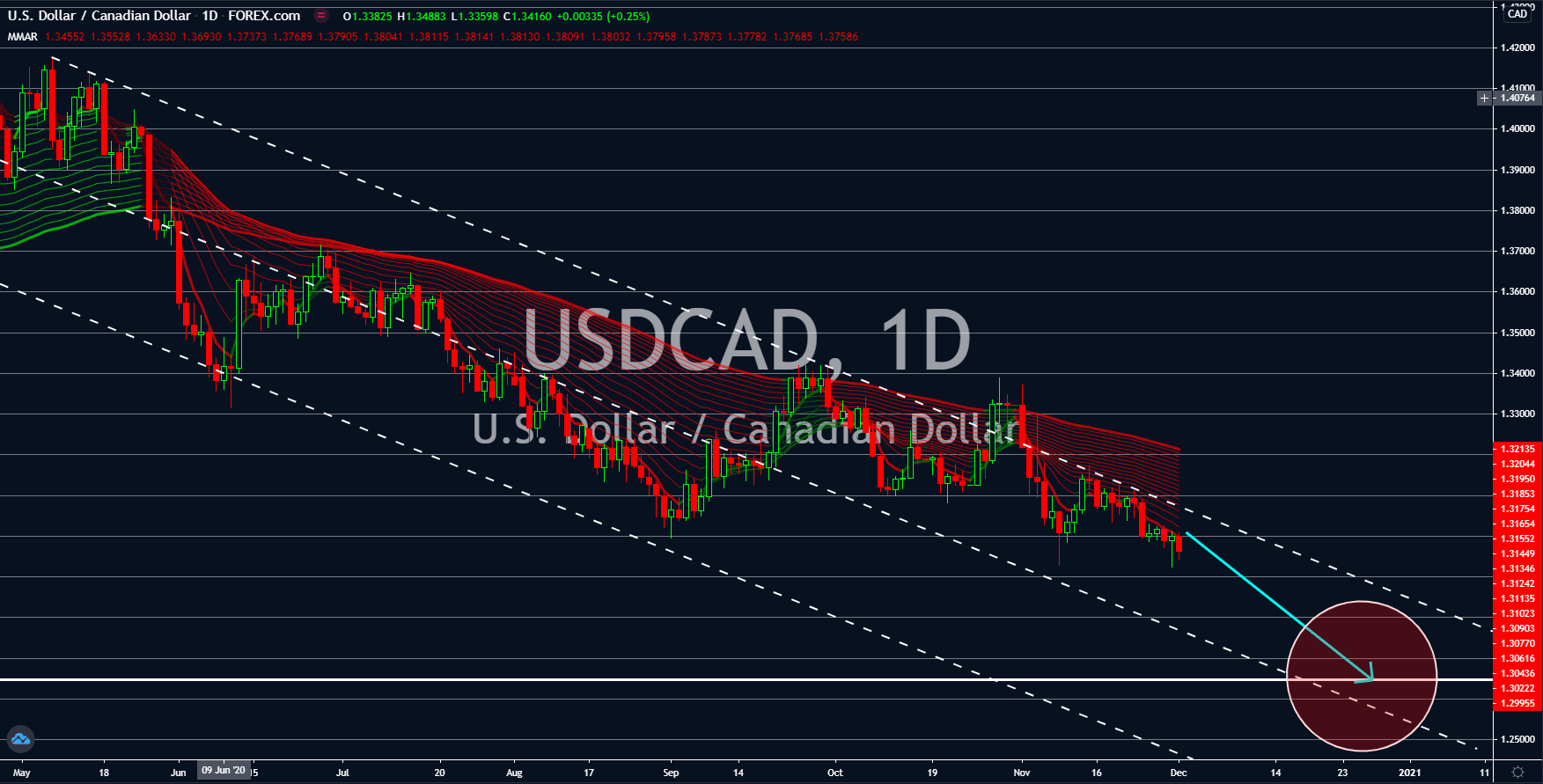

USDCAD

Investors of the CADJPY currency pair are worried that the new $77 billion stimulus by the Canadian government could send the country’s deficit to a record high. However, it seems that investors of the USDCAD could fear more from the ballooning debt of the United States. Over the course of the pandemic, the US government and the Federal Reserve injected $6.6 trillion in the local economy. However, it could break this record once the proposed $2.2 trillion additional stimulus is approved. Thus, investors should expect a weaker US dollar in coming sessions. However, more economic aid might be needed following the massive increase in the number of claimants of unemployment benefits. The initial jobless claim last Wednesday, November 25, added 778,000 individuals on its list. This represents a 30,000 increase from the prior week. Analysts are looking forward to a mere 3,000 difference on the upcoming report this week.

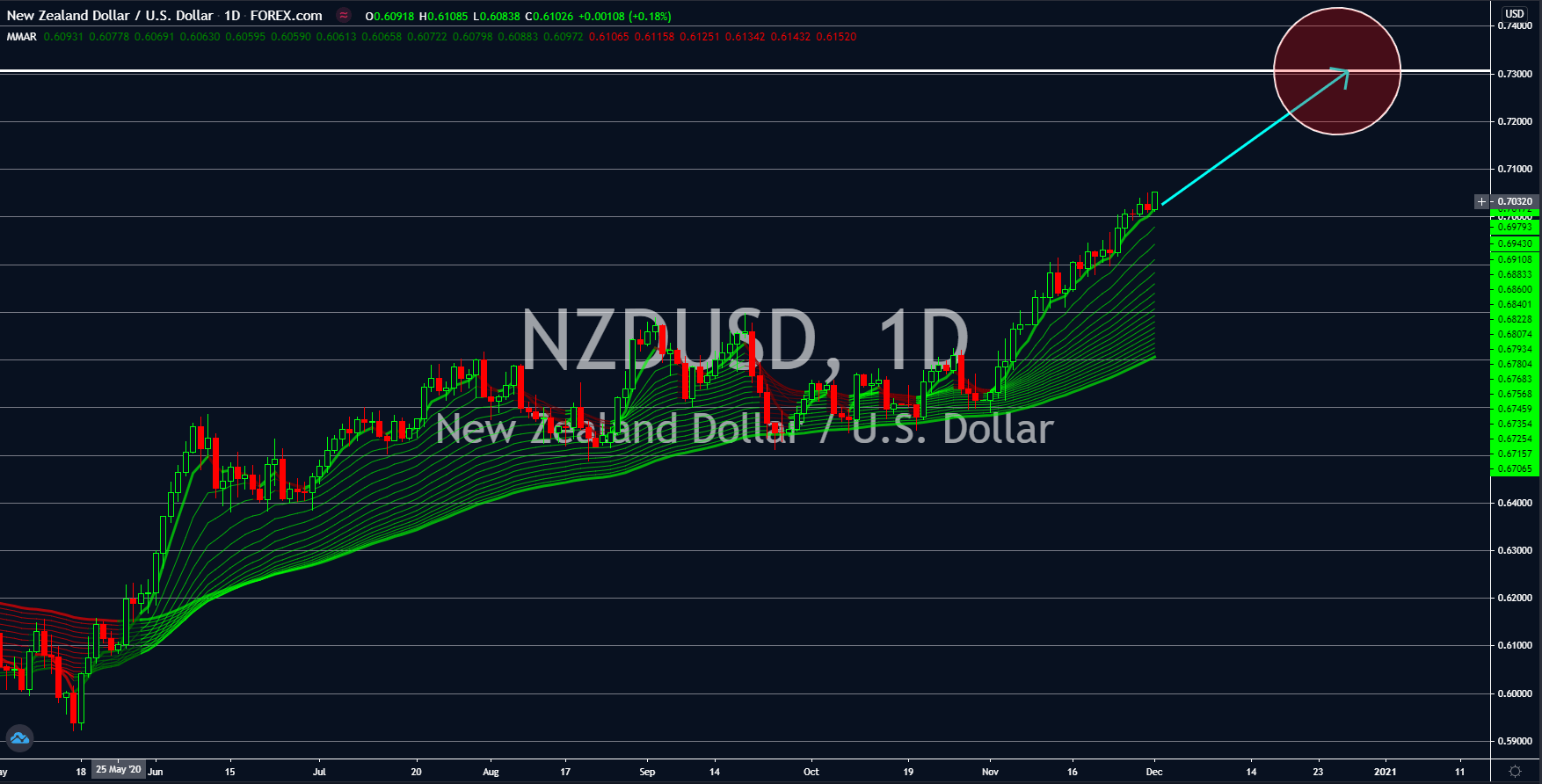

NZDUSD

New Zealand continues to recover from the impact of COVID-19 in the local economy. In its most recent reports, New Zealand’s ANZ Business Confidence showed a major improvement from -15.7 points despite recording another decline of -6.9 points. NBNZ’s own economic activity also managed to post better figures compared to its previous result at 9.1%. The Reserve Bank of New Zealand cited these reports by saying that the country’s economy proves its resiliency. New Zealand was among the countries who had the strictest measures against COVID-19, including closing its borders from the rest of the world. This had initially caused the economic activity in the country to decline. However, recent reports suggest that the country is now slowly recovering from the pandemic. In addition to this, the newly formed RCEP (Regional Comprehensive and Economic Partnership) is expected to boost trades throughout the Asia Pacific region.