Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

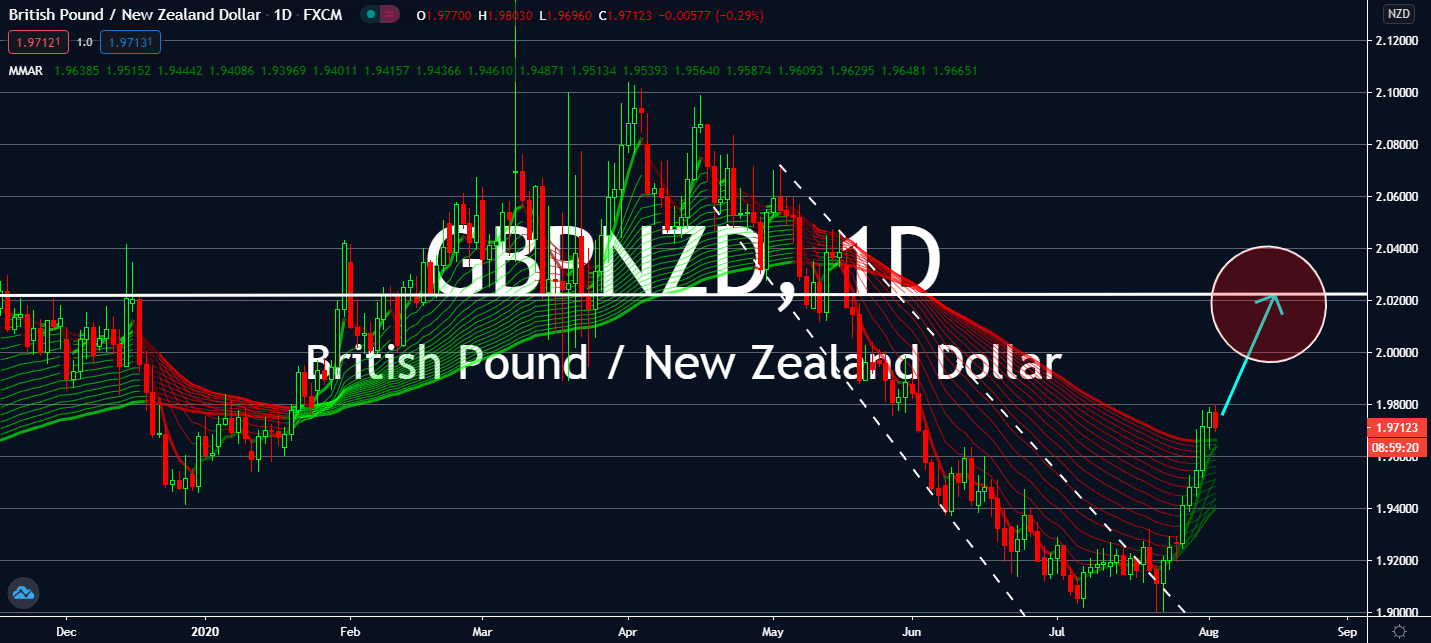

GBPNZD

New Zealand is set to report its employment change for the second quarter of 2020 within today’s trading. The forex market expects the country to report a negative figure, or 2.0%. The figure is much lower than the 0.7% achieved in the first quarter. Moreover, the country is bracing for an uptick in its unemployment rate for the second quarter, expected to come in at 5.8% against the first quarter’s 4.2%. Markets are now waiting for the country to announce its inflation expectations within the week, and consensus claims they would report a shallower decline of 1.39% in July from 1.44% in June. In the UK, bullish investors are betting on a retention for the City’s benchmark interest rate at 0.10% later this week, which will also help the sterling pound to boost against the New Zealand dollar near-term. The UK is also expected to retain other important monthly figures at the same level in July, such as Composite PMI and Services PMI.

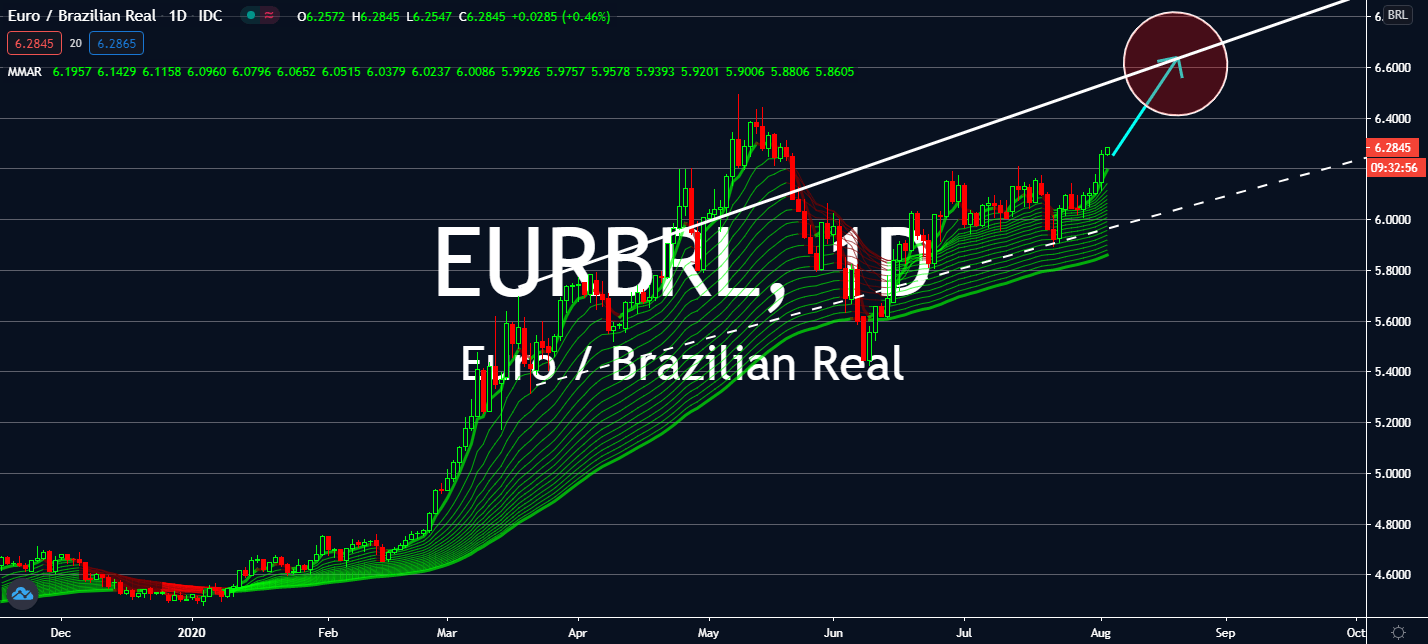

EURBRL

Spanish unemployment change recorded a massive plummet in July of -89.8 thousand against June’s 5.1K figure. Investors are worried about thousands of fresh coronavirus cases in the country reported daily, especially after it reported a 18.5% quarterly fall in GDP led by the coronavirus lockdown. It was the largest quarterly drop since the Spanish Civil War ended 1939, and it comes on top of a 5.2% decline during the first quarter. Lost production costs went to around 300 billion euros, which was enough to cover pension payments for 10 million domestic retirees for two years. Moreover, Germany’s economy shrank by 10.1% in the first quarter and France’s reduced by 13.8%. Brazil’s industrial production increased on both a yearly and monthly basis, too – from -21.8% in June 2019, it went up to -9.0% against market expectations of 10.2%, while June saw a higher figure at 8.9% against May’s 8.2% and consensus of 7.7%.

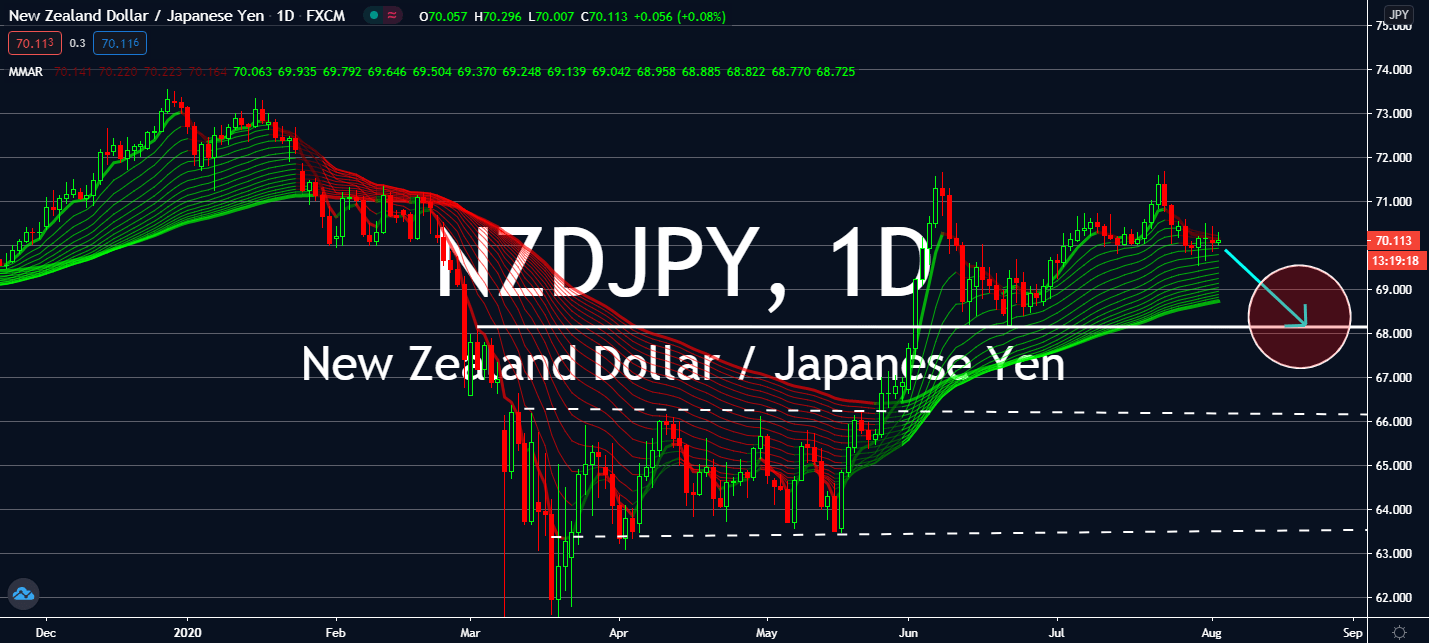

NZDJPY

Seasonal strength will help the yen boost against the New Zealand dollar with greenback weakness brought by surging coronavirus infections in the United States. The US dollar safe haven is prepared to rise above dollar-centered economies like the kiwi with rising global cases now jumping greater than 250,000 on a daily basis. Japan is also projected to report a higher figure for its services PMI for the month of July, which will come in as 45.2 against 45.0 recorded in June. Meanwhile, the Reserve Bank of New Zealand expects it’s a 1.39% inflation in the third quarter, down from 1.44% in June. Moreover, markets are expecting a 2% fall for NZ employment change during the second quarter of this year in comparison to the 0.7% seen in the first quarter. The New Zealand dollar will go up in near trade as investors await for Japan’s central bank’s Governor Kuroda to announce the state of Japan’s economy tomorrow.

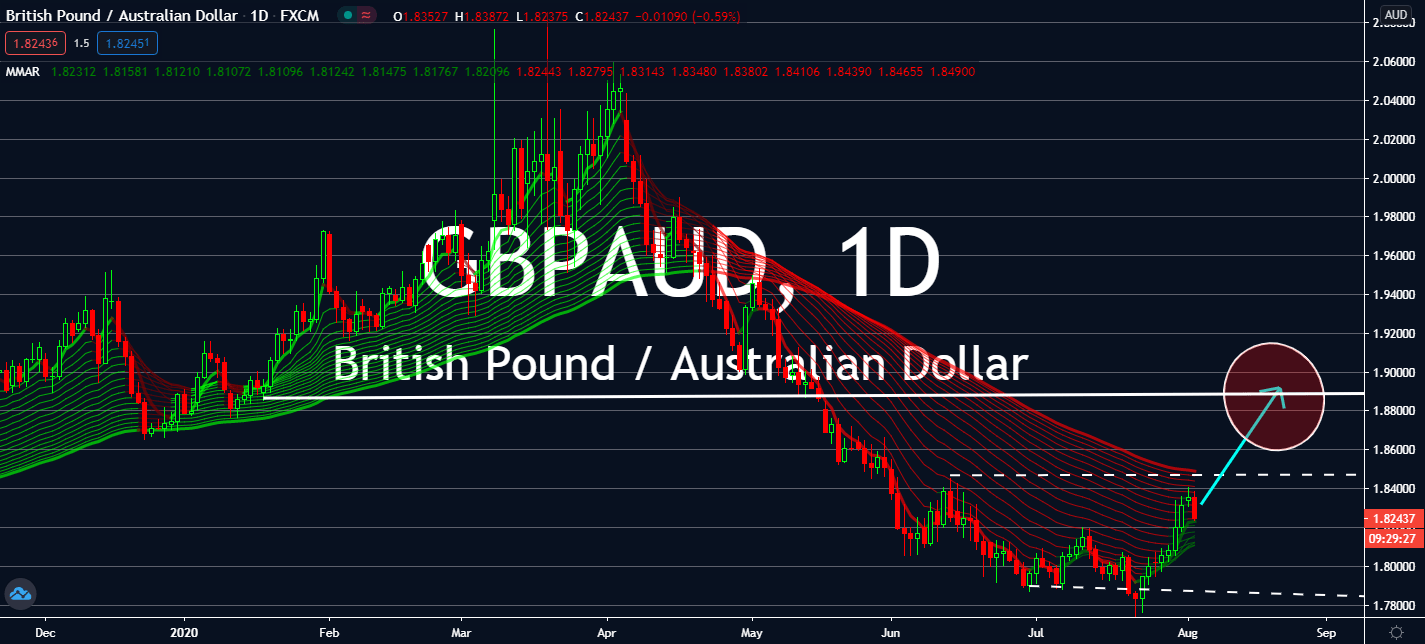

GBPAUD

The Reserve Bank of Australia retained its benchmark interest rates at 0.25% during its monetary policy meeting earlier today. This was supposed to boost the Australian dollar against its sterling counterpart, especially as the effects of the previously announced Manufacturing PMI in the United Kingdom renders in the forex market. But even when the City recorded a lower-than-expected figure for the month of July yesterday, the figure still improved in comparison to June from 50.1 to 53.3 against market consensus of 53.6. Retail Sales in Australia fell from 16.9% in May to 2.7% in June, and its trade balance recorded 8.202 billion instead of 8.800 billion projected prior. Notably, this figure was higher than what was recorded in May which recorded 8.025 billion. This is projected to mellow investors’ engagement towards the sterling near-term, but the market is still waiting for Australia’s central bank’s monetary policy statement later this week.