Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

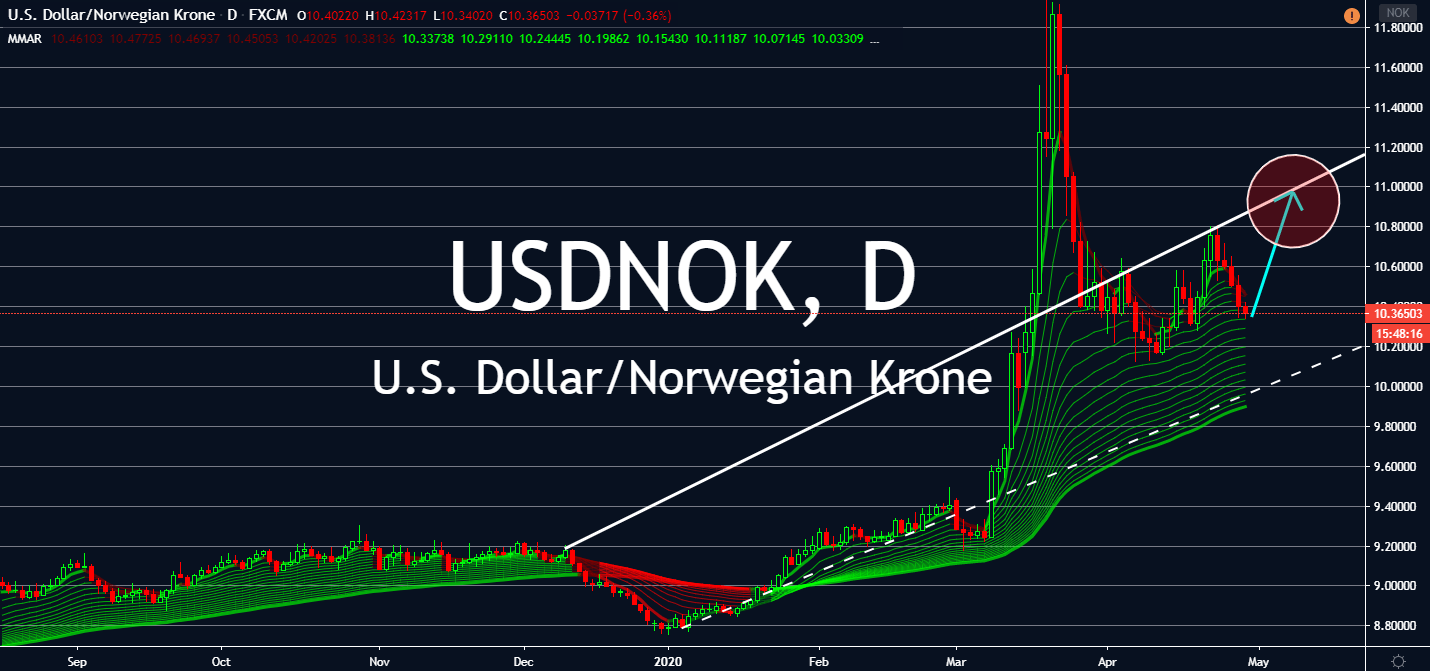

EURCZK

The market is still waiting for the European Central Bank’s response over concerns that the eurozone bloc is experiencing its worst economic crisis in history after it lost over €2 trillion from its 2018 GDP. The central bank will set the tone for Europe’s future tomorrow at its monetary policy meeting. Most investors expect another decrease in interest rates since 2016, raising the possibility of an even deeper quantitative easing to make up for its historical losses during the coronavirus crisis. Meanwhile, the Czech Republic is already slowly opening its economic gates. The country is transitioning back into their lives before the coronavirus by the end of May as its government gradually lifts the previously imposed limitations of movement within hours to reopen its borders. As these openings continue to stimulate its economy, serving as a case study for the rest of the world to follow, the Czech koruna is expected to see gains against the euro.

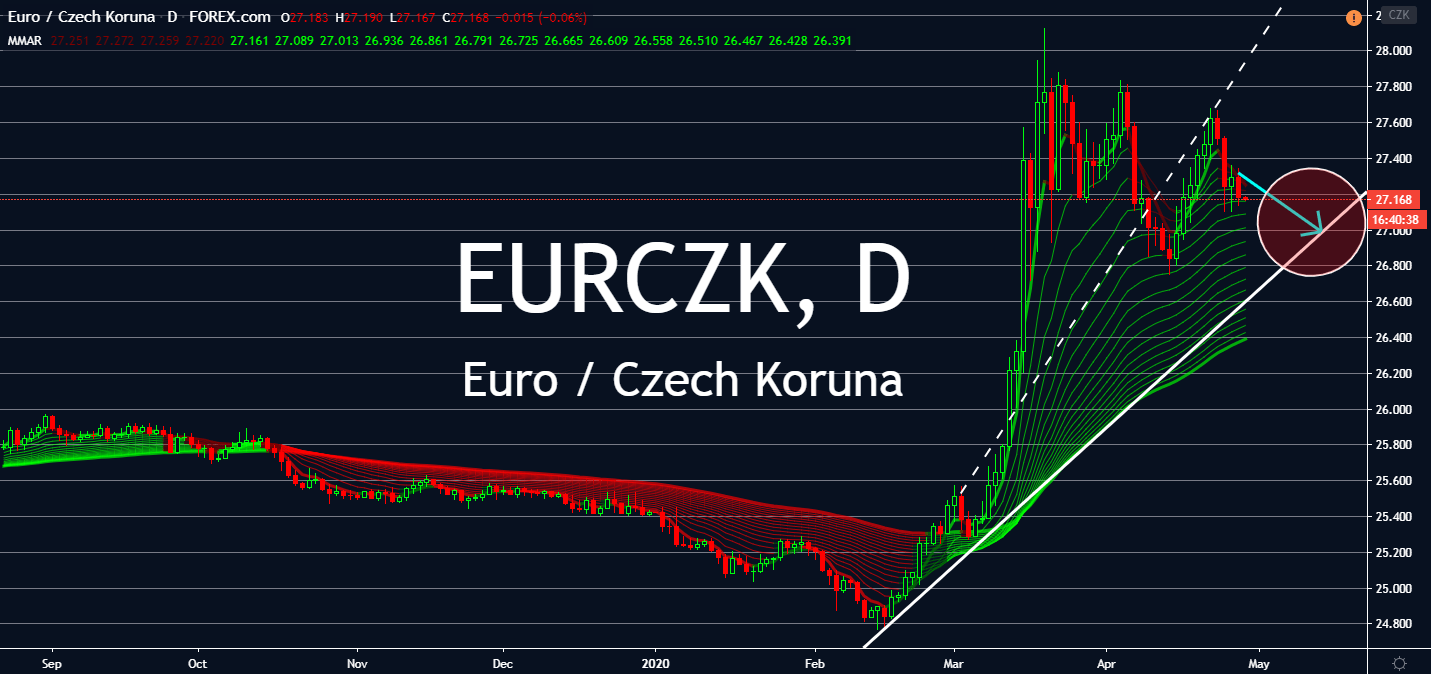

USDHUF

The Federal Reserve will begin its policy meeting today with plans to announce its benchmark rates decision by Friday. The Fed has twice lowered its short-term interest rate target to near zero from 1.5% so far this year, and even expanded liquidity and credit facilities to its financial system. Options for future stimulus packages include allowing low rates or depositing new money directly into individuals’ accounts, called the “people’s QE.” Although the country remains as the epicenter of the coronavirus, it looks like the upcoming packages will positively stimulate the US economy against currencies like the forint in the long-term. That said, the Hungarian government plans to ease the lockdown since it began its nationwide lockdown in mid-March. The loosening will begin early next month. Local publications believe that its economy will recover rapidly from the effects of the pandemic from there, although the market seems to doubt the notion.

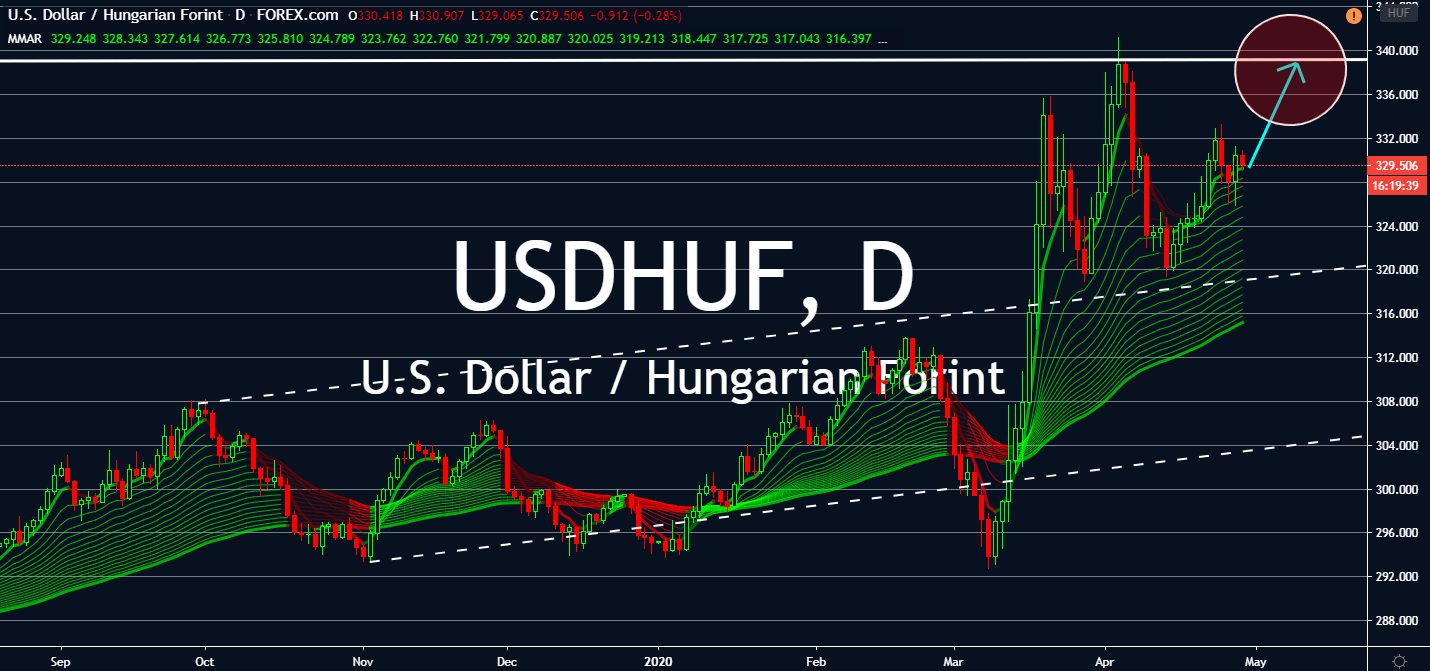

USDMXN

Oil-dependent countries are looking at its upcoming months in a positive light as countries begin to emerge from nationwide lockdowns led by the coronavirus. The Organization of Petroleum Exporting Countries (OPEC) including Mexico is expecting to see oil prices rise back to normal by the end of the year. However, the market is still hesitant, at least in near-term: the greenback’s safety is still easing its investors more than most currencies. The Federal Reserve is meeting for more possible stimulus packages, or an even lower interest rate after two decreases since the beginning of the pandemic which could result in another batch of quantitative easing for individual bank accounts. As the central bank continues to make aggressive movements to maintain its economy, the greenback is expected to play with the bulls until the oil market begins to see gains, which could mean that the world really is beginning to heal.

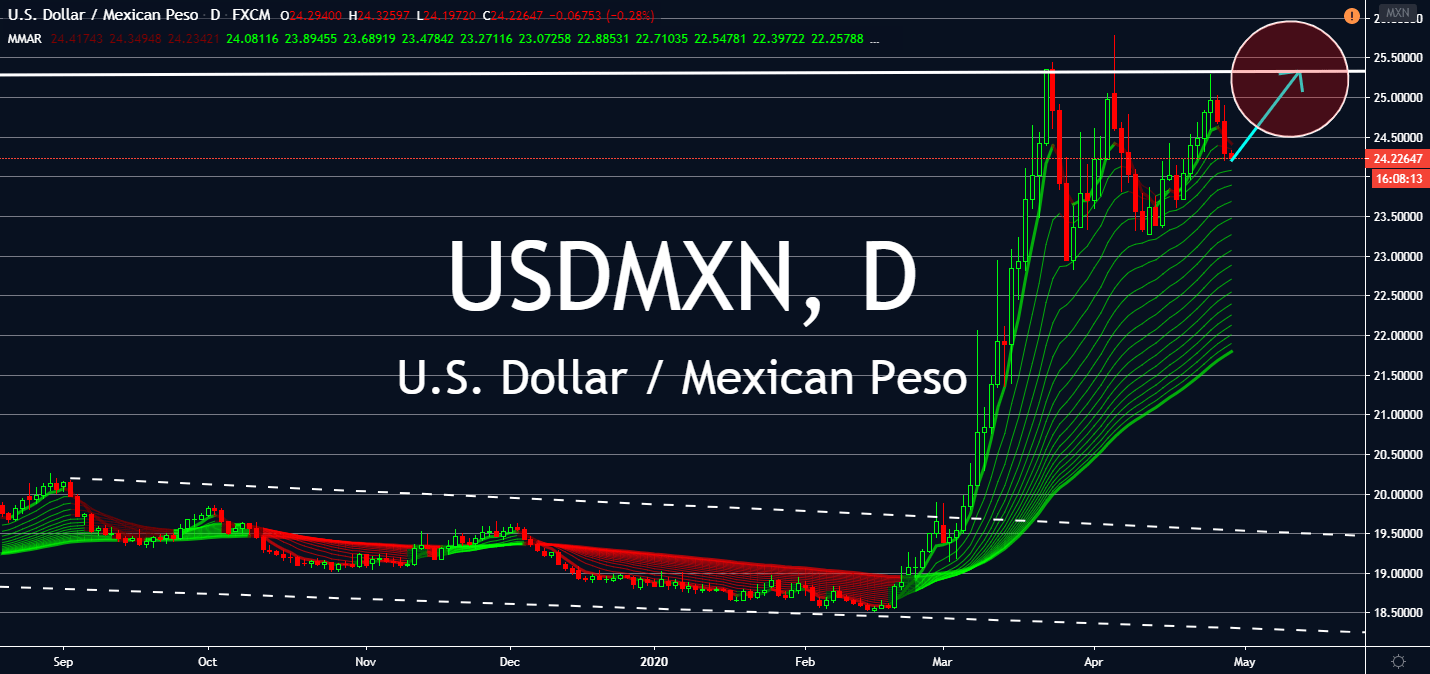

USDNOK

Schools and daycare centers opened back in Norway this week, seemingly as a test to see how far the Norwegian government can go in terms of how it can open its economy back up by the end of May. However, major events are still cancelled until September 1. This comes to show that although it might seem like it’s safe to go back to its normal economy, the situation remains uncertain. Prime Minister Erna Solberg said the country is still cautious of reopening. Investors might want to wait until this shows concrete results. Moreover, its oil-exporting sector is also at stake. Over the course of 24 years, Norway’s oil fund became a rare sovereign wealth fund. Now, investors are questioning each head’s ethical principles while the fund records its worst-ever quarterly loss in 2020. Because of this, and the positive sentiment for the Federal Reserve, the greenback is expected to thrive against the Krone.