Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

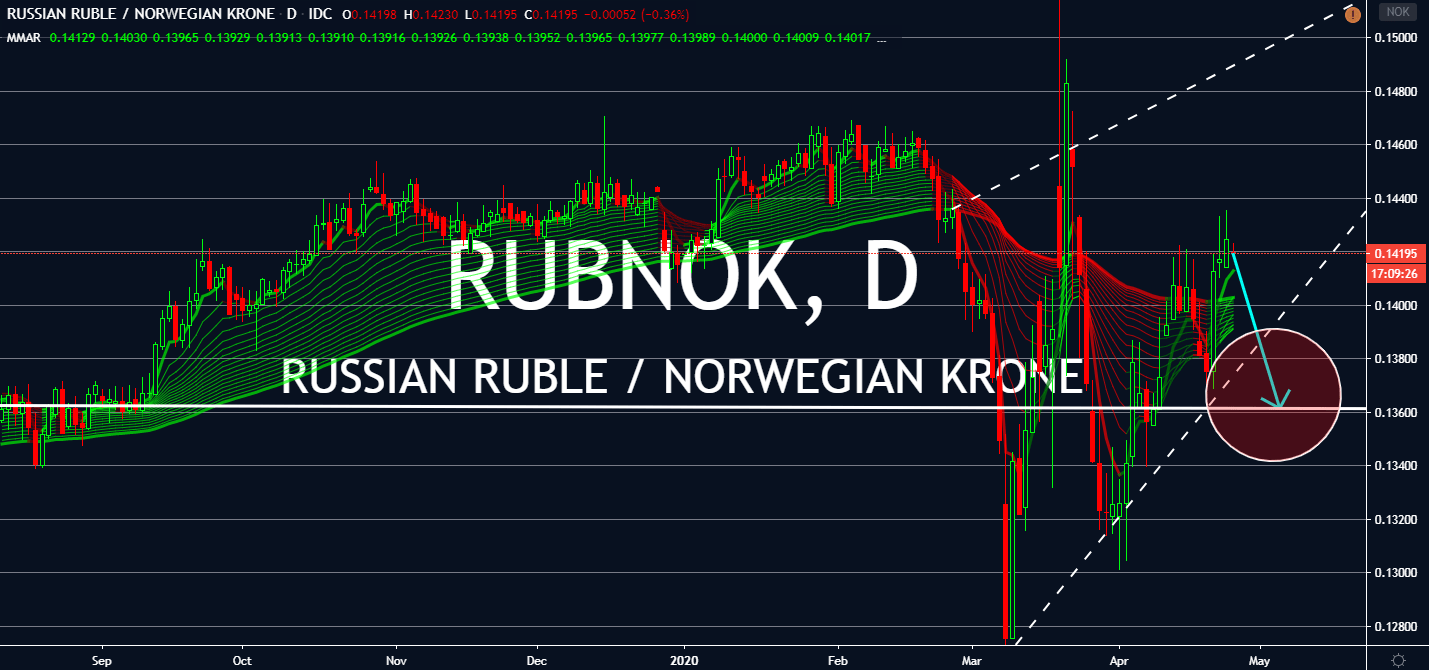

RUBNOK

Both the Russian ruble and the Norwegian krone are expected to perform badly in the next few sessions as the market continues to worry about oil’s status prior to the OPEC decision to halt production in the next coming months. Against each other, however, the ruble looks like it’s going to see the bears this week. The Bank of Russia cut its key interest rates down by 50 basis points on Friday to 5.5%, leaving the door open for more monetary cuts at future policy meetings for the currency. Furthermore, the country is expected to report weakening figures this week: the market predicts that it will report a much lower percentage for its retail sales for March 2020 in a yearly comparison, specifically from 4.7% last year to 2.6%. After it announces the anticipated slightly higher figure for its unemployment rate, Russia might also see its monthly GDP to tragically slump to negatives since it was last recorded in 2019.

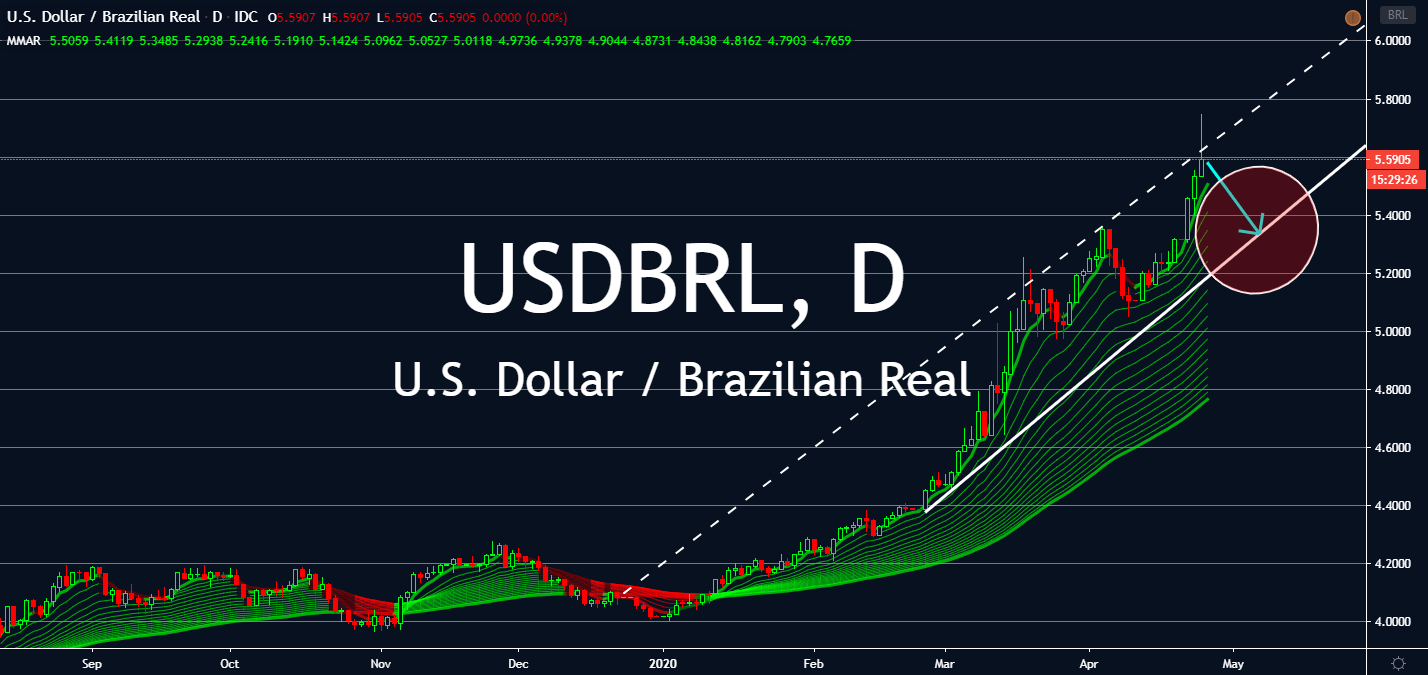

USDBRL

The Brazilian real reached an all time low against the US dollar last week, but it looks like the pair might see a halt in its sell-off as the market anticipates worse figures for the US in comparison to is counterpart this week. Investors believe that the United States will announce a -4.0% GDP for the first quarter of 2020 when compared to the previous quarter after it confirms lower monthly consumer confidence and possibly higher crude inventories this week. Meanwhile, the Federal Reserve previously faced public backlash after large businesses received multimillion-dollar loans under the Small Businesses Administration’s Paycheck Protection Program, so it promised to publish monthly reports with details about the recipients of the four new lending programs under the CARES program. As the market waits for this to take effect, it can expect the dollar to slump until the policy meeting for its interest rates later this week.

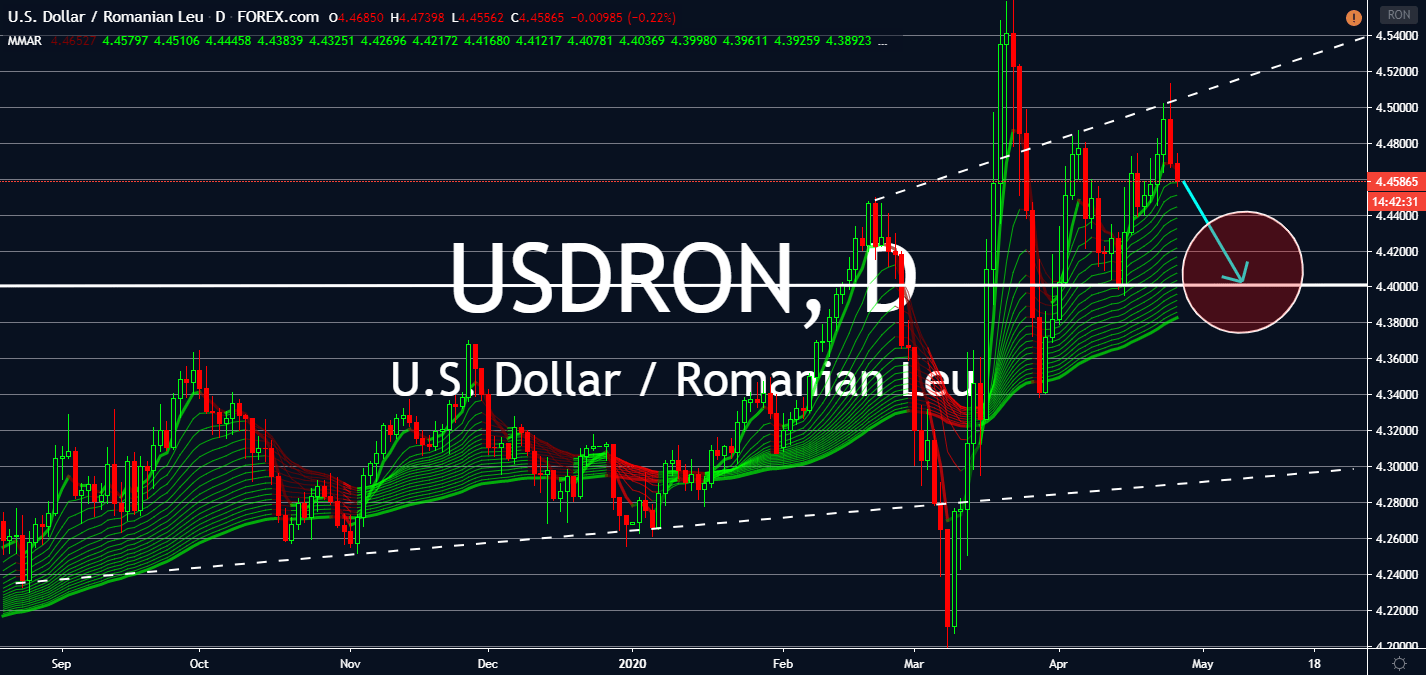

USDRON

Romania announced that it expects near doubling deficit for its budget last week, down to 7% this year, courtesy of the coronavirus pandemic. Furthermore, its economy is expected to contract by 1.9%. Finance Minister Florin Citu said its cabinet was preparing for a Phase 2 package of measures to relaunch the economy, but hasn’t elaborated on the matter since. The government is now targetting a fiscal shortfall of 3.6% of GDP above the EU’s 3% ceiling, as a result of fiscal moves by a previous cabinet ahead of the current local and parliamentary elections. Meanwhile, the US is anticipated to announce -4.0% of GDP later this week from a 2.1% figure seen last quarter. This alone could drive the market closer to rooting for the Romanian leu as the market awaits for the upcoming fiscal policy meeting by the Federal Reserve later this week as what investors could label as another coordinated effort to save the global economy from COVID-19.

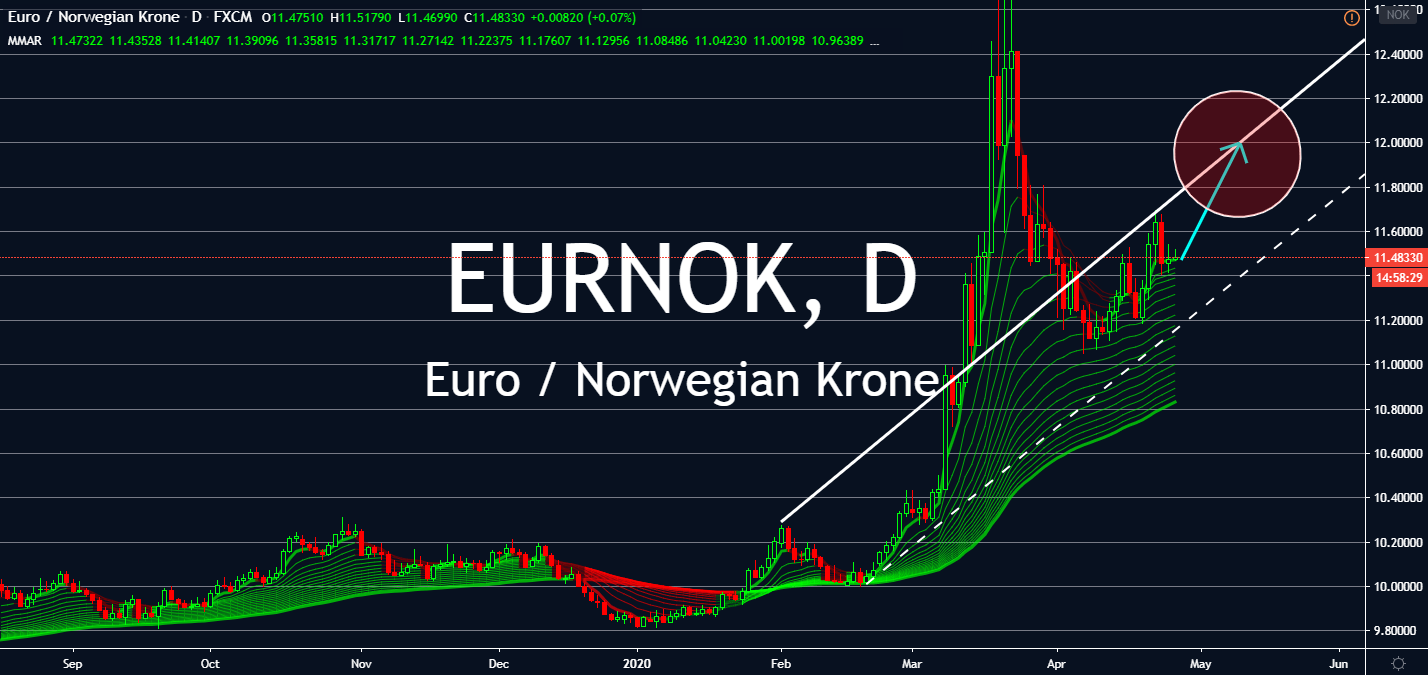

EURNOK

The European Central Bank also planned to hold another monetary policy meeting this week, which will be one of the main drivers for the EURNOK pair in near-term sessions. For now, the market should rely on how the oil industry will affect it, especially on the Norwegian krone. The oil-dependent economy will slump alongside the deteriorating sentiment on the commodity itself, especially if the ECB and the European Union manage to perform well for their united nations against its ongoing economic slowdown. That said, investors don’t see the ECB lowering their interest rates anytime soon. But it’s important to note that the Norges Bank slashed its rates as from 1.5% to 1.0% as early as March 13, then a week later by 75 basis points to 0.25%. Experts spotted that its prices moved alongside the WTI crude 90% of the time, so it’s safe to assume that once crude gets better, the Norwegian krone could, too.