Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

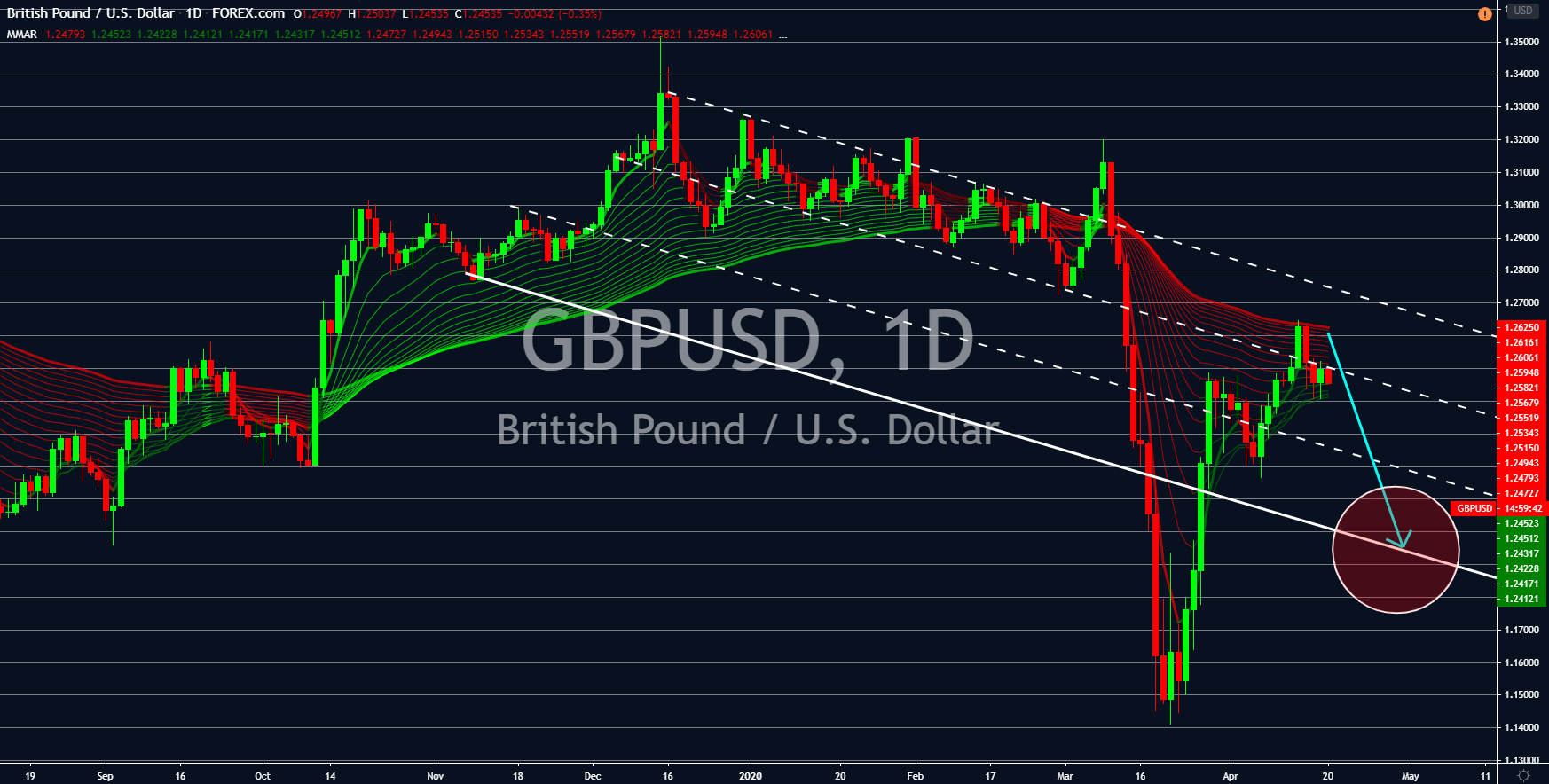

EURUSD

The EU is calling for its member states to create a coordinated exit plan. This was following the decision by some countries to either lift or ease restrictions on their territory. In March, the World Health Organization named Europe as the center of the coronavirus pandemic. This resulted in a lockdown to most of the countries in Europe.

As the number of new COVID-19 cases continues to subside, citizens are now calling for their government to reopen their economy. Businesses have been battered during the lockdown which resulted in losses. In the second week of April, member states’ finance ministers agreed to a €500 billion rescue aid to help businesses recover. In the US, the government and its central bank unveiled their record-breaking stimulus package at $2.0 trillion and $2.3 trillion, respectively. However, major concerns from investors were the country’s failure to contain the virus. Coronavirus related deaths in the US are now at 40,000.

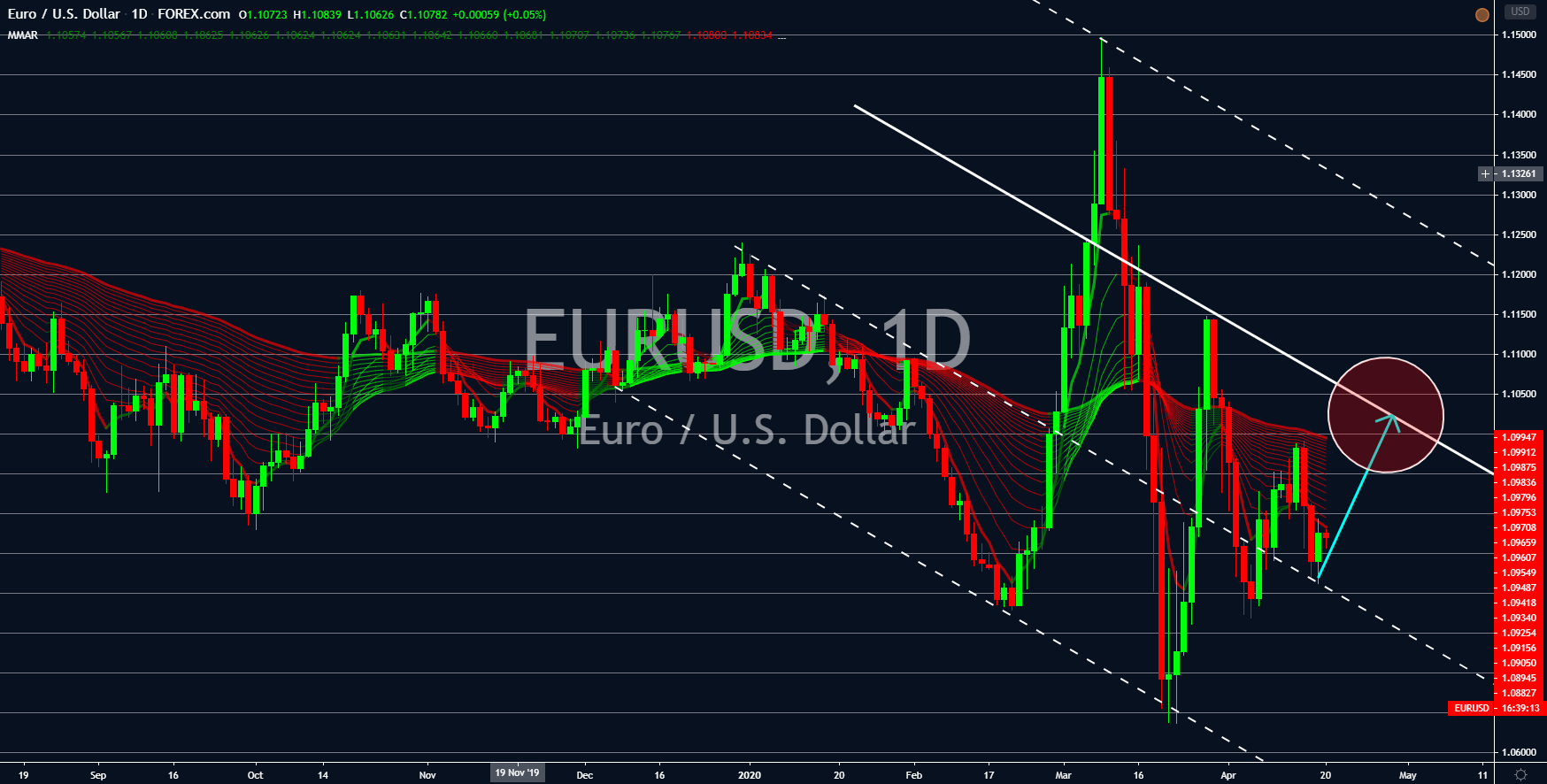

USDJPY

As Europe recovers from the coronavirus pandemic, the US and Japan are just starting out of their worst nightmare. Japan saw coronavirus cases jump to 10,000 on April 18. Japanese Prime Minister Shinzo Abe declared a “state of emergency” in the country to contain the virus on April 7. However, medical experts are worried that this declaration is already late to contain the virus. Most governments placed their country in a lockdown starting in the third week of March. This was following the announcement by the WHO that COVID-19 is now pandemic.

However, some governments downplayed the threat of the coronavirus in their country’s health and economy. Just as Japan reaches 10,000 cases, the US recorded 40,000 coronavirus related deaths in all its states. This figure was twice higher than Italy and represents a quarter of deaths worldwide. Investors are worried that the US stimulus package will not be enough to cover the country’s economic losses.

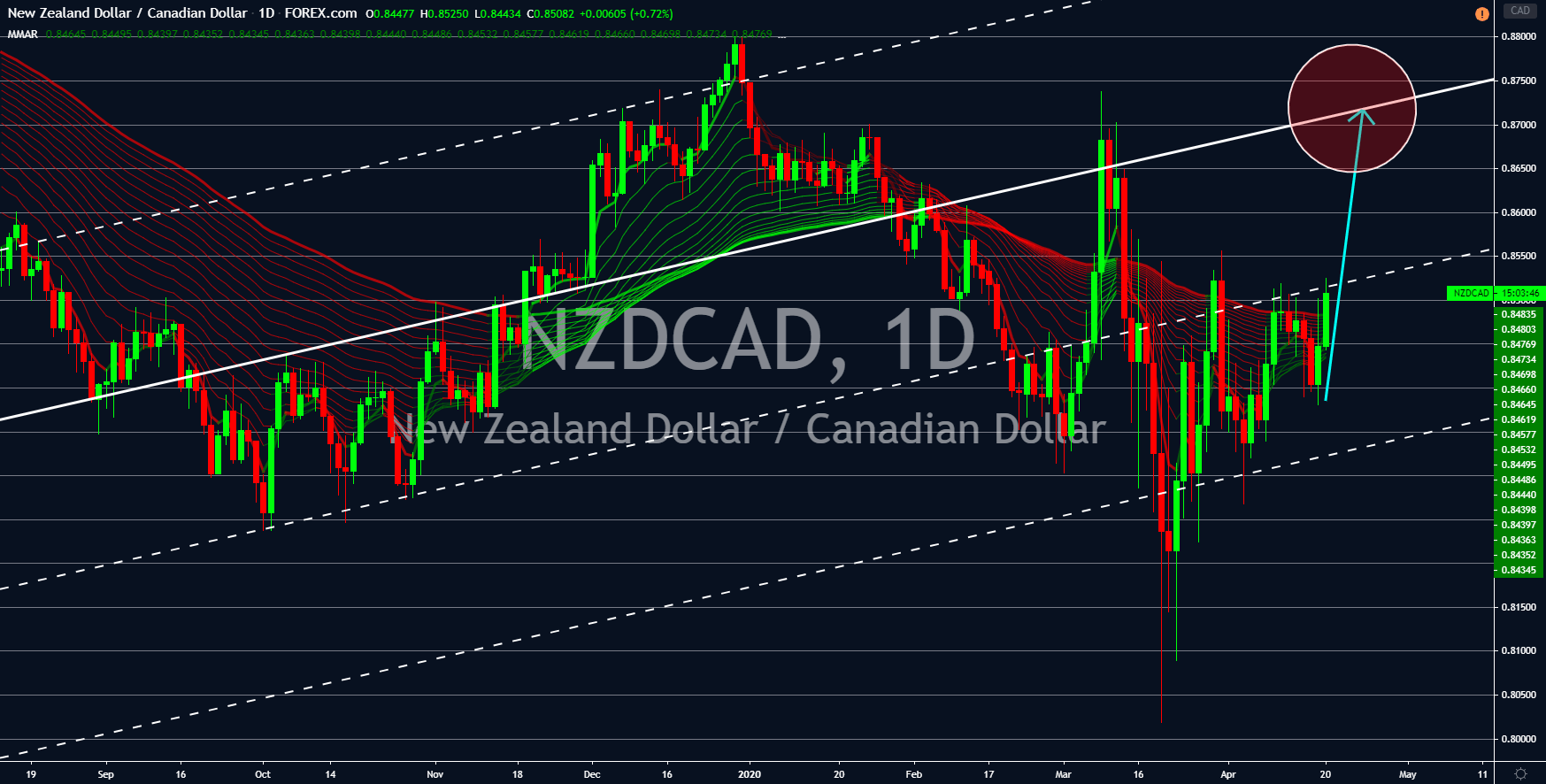

NZDCAD

New Zealand has one of the lowest figures of coronavirus cases to death ratio worldwide. The country has only 1,440 cases compared to confirmed deaths of 12. This gave New Zealand a ratio of 0.83% cases to death ratio. Meanwhile, Canada has a staggering 13.40% of death ratio. The country has 11,843 cases of coronavirus while its death was at 1,587. Analysts warned that New Zealand’s economy might shrink in the second quarter of 2020. However, investors and traders are confident that the leadership by Prime Minister Jacinda Ardern will weigh down the economic impact of the coronavirus.

The International Monetary Fund (IMF) expects New Zealand to plummet by 7.2%. The country’s finance minister, on the other hand, believed that New Zealand can bounce back from this economic turmoil. Projection in the country’s unemployment rate is kept at 10% in the worst-case scenario.

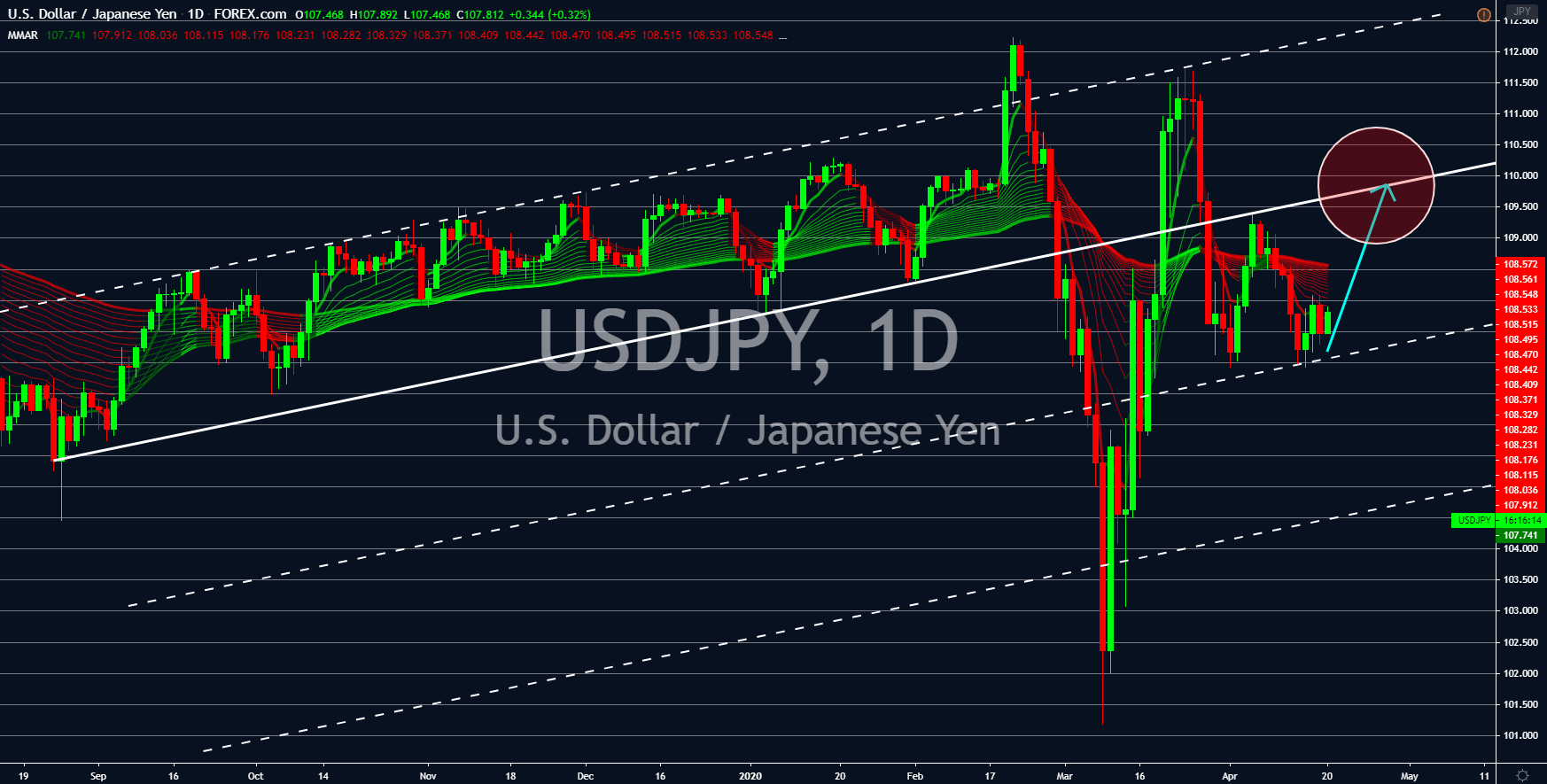

GBPUSD

The United Kingdom has the grimiest outlook for unemployment rate. Analysts’ outlook for unemployment was at 35% or 2 million job loss. Reports suggest that the UK economy could plunge by up to 10% of the country’s gross domestic product (GDP). However, what startled investors the most was a recent report saying that the UK’s economy is already slowing down prior to the coronavirus outbreak.

Analysts believe that the slowdown in February was due to the recent withdrawal of the United Kingdom from the European Union. Investors and traders are now moving away from the British Pound as the report for the country’s Q2 GDP growth might further derail the British economy. On the other hand, the US unveiled the largest stimulus package in history at $2.3 trillion. This effort was initiated by Federal Reserve Chairman Jerome Powell. He overshadowed the US government’s $2 trillion package.