Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

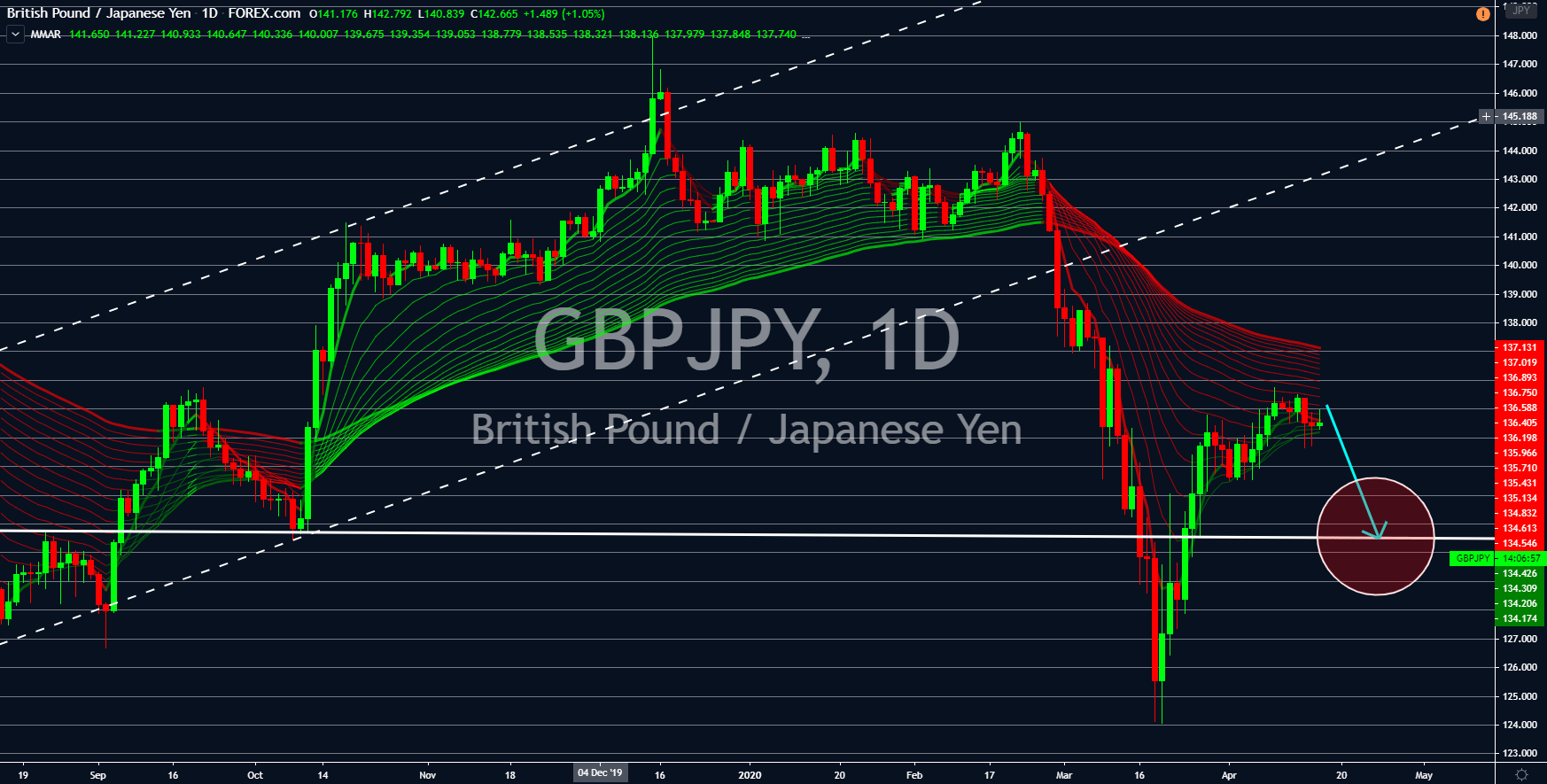

GBPJPY

Analysts were bearish with the British pound and the Japanese yen. Japan was forced to move the Olympic Games event next year due to the coronavirus outbreak. The country has been preparing for the event, which only happens once in four (4) years, since 2018. The decision to postpone the event will bring sponsors and the government a major blow to their investments. This, in turn, will affect the business climate in Japan. Aside from this, Japanese Prime Minister Shinzo Abe declared a “State of Emergency” in the country.

Meanwhile, the United Kingdom extended the lockdown in the country by another month. This was to prevent the second wave of coronavirus from further deteriorating the country’s economic health. Analysts expect the extended lockdown to further push the country into recession. A report was published for February indicating that the UK economy has been in a slowdown following its withdrawal from the European Union last January.

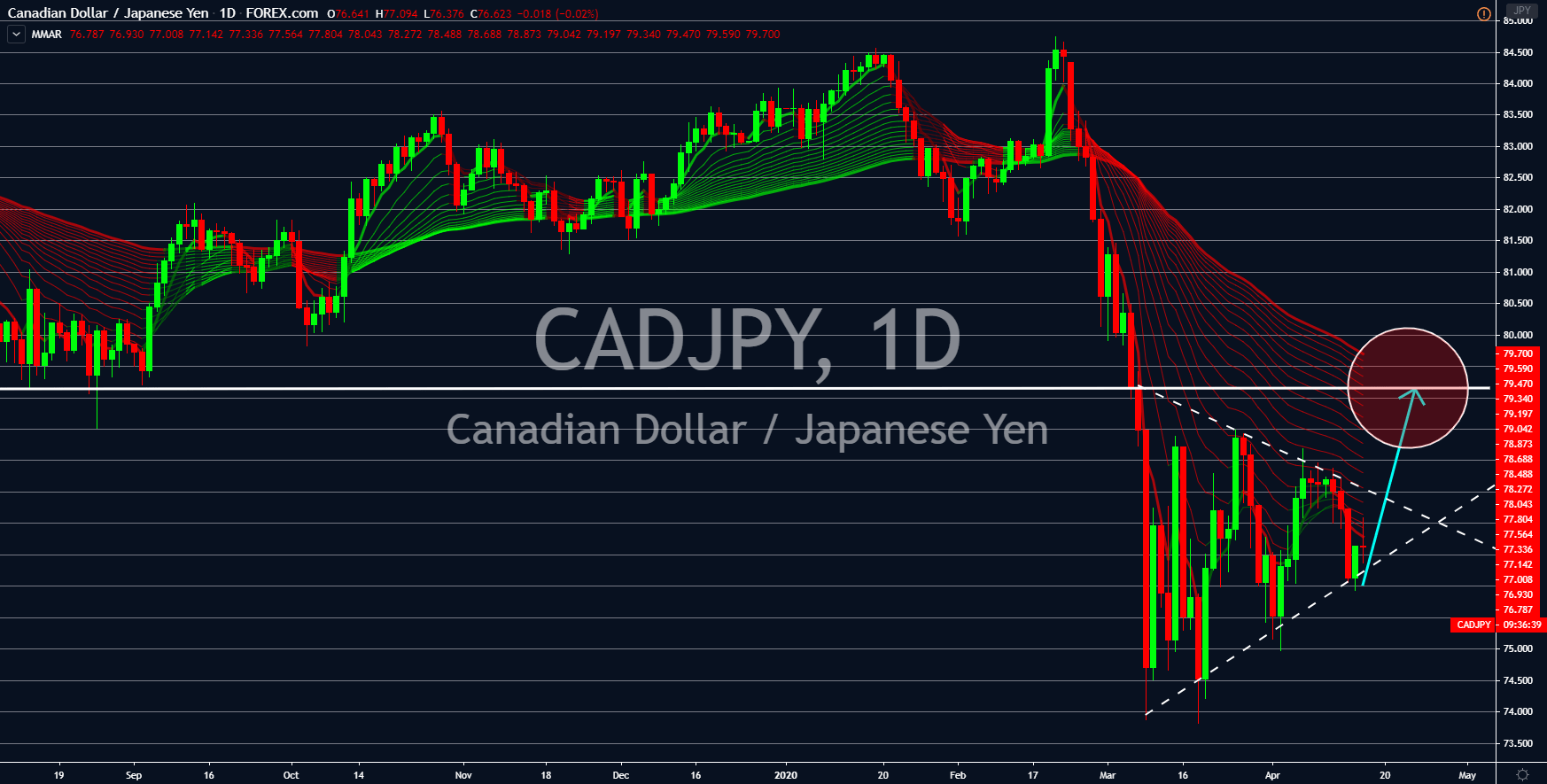

CADJPY

The “Greatest Lockdown” will send the global economy to contract the deepest since the Great Depression. Economies around the world are struggling to contain the economic threat posed by the coronavirus pandemic. Global institutions, credit rating agencies, and multinational banks are giving their forewarning about the looming global recession once countries publish their results for the second quarter of the year. To keep their economies afloat, countries are using their monetary policy tools to weigh down recession.

Japan introduced a $550 billion stimulus package to help its economy. The figure was the country’s biggest stimulus in its history. On the other hand, Canada slashed a total of 150 basis points in just two (2) months. The country followed the decision by the Federal Reserves to cut 50 basis points on the country’s benchmark interest rate. This was followed by three (3) consecutive cuts in March, totaling to a cut rate of 100 basis points.

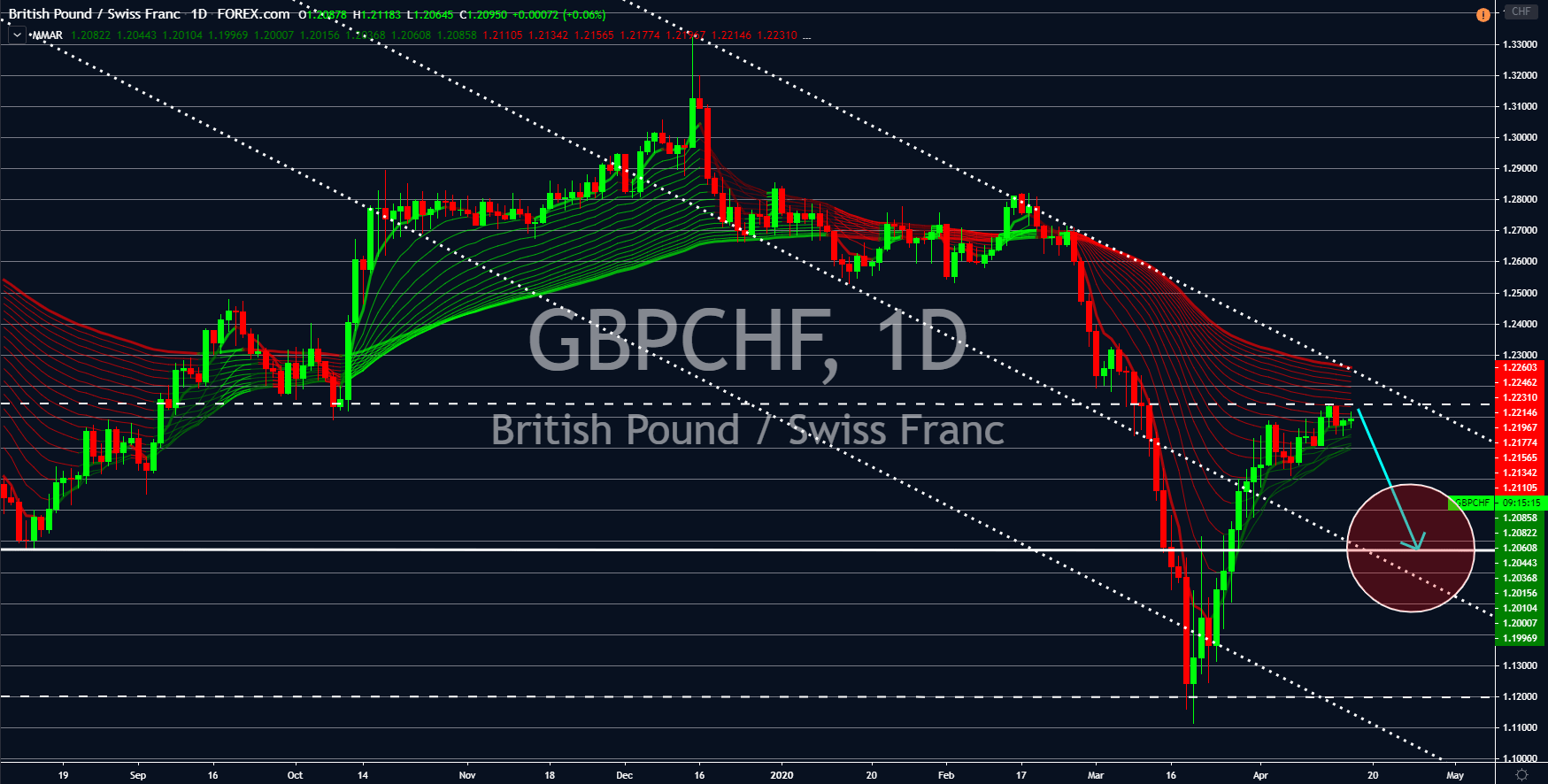

GBPCHF

The uncertainty in the global market had caused the demand for safe-haven assets to spike. The International Monetary Fund (IMF) and the World Bank suggest that global economic growth will shrink by 3%. This will be the biggest decline in growth since the Great Depression in the 1930s. Furthermore, they added that global economic leaders like the US, Canada, and Mexico in America and Germany, France, and the United Kingdom in Europe will suffer the most.

During times of crisis like this, the highest authority in the country is the one in charge to ease the impact of the coronavirus pandemic. However, this is not the case for the UK as its prime minister, Boris Johnson, was tested positive for COVID-19. Boris Johnson has the highest number of votes since Margrethe Thatcher during the December 2019 election. He also ended the 3-year negotiation between the United Kingdom and the European Union on January 31, paving way for Brexit.

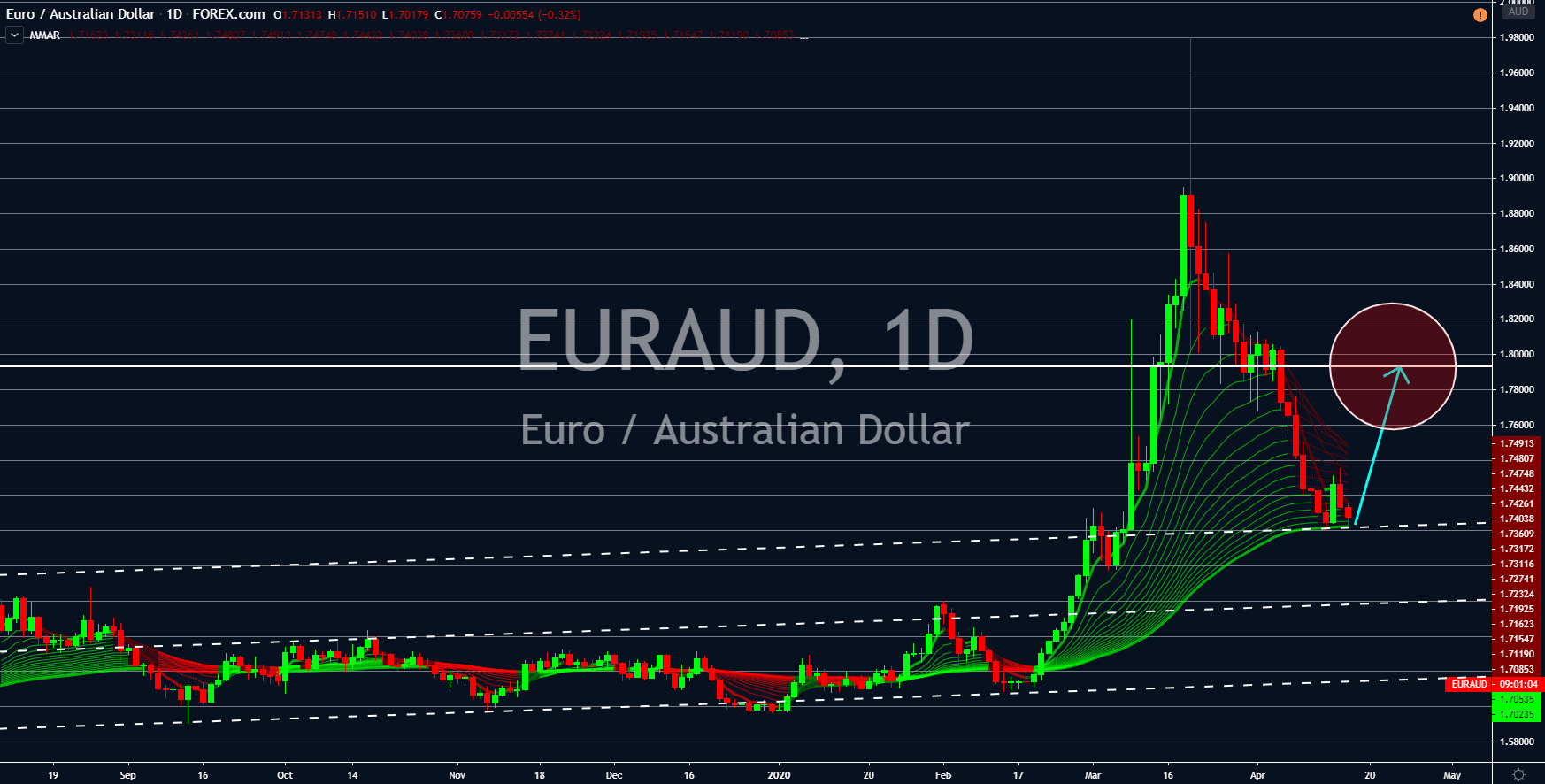

EURAUD

The single currency is ready to regain back its strength. Since March 19, the euro has been trading lower against a basket of major currencies. This was following the announcement by the World Health Organization (WHO) that Europe is now the center of the coronavirus pandemic. After this announcement, countries in the region began shutting their borders and local businesses to contain the virus. Each country has also introduced monetary policies that aim to counter the virus.

After a month, some members of the European Union were seen preparing to reopen their economy. Analysts see this as a hope for the largest trading bloc in the world. They believe that some businesses in America might choose to invest in Europe as the bloc slowly recovers from the pandemic. The US has now the largest number of coronavirus cases in the world. It also surpassed Italy to have the largest number of coronavirus related deaths.