Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

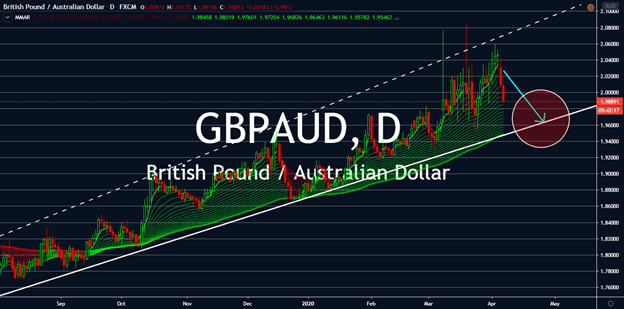

USDSGD

Billionaires flocked over the Dow Jones Industrial Average on Monday as the coronavirus pandemic seems to stabilize. This could be good news for engagement on the dollar, but former Federal Reserve chair Janet Yellen claims otherwise. She expects the US to see its second-quarter GDP to go down as much as 30% in the second quarter, supported by the CEO of JPMorgan, Jamie Dimon. He predicted that the US economic growth will plunge by as much as 35%. This signals a “bad recession”, the last such seen in the global financial crisis of 2008.

Meanwhile, Singapore announced a lower-than-expected GDP on a yearly and a quarterly comparison in Q1. Additionally, they reposted a drastically lower industrial production figure for February. However, it was higher when compared to the figures seen in 2019. Nevertheless, the USDSGD pair might see high volatility in the long-term as the buck remains as a safe haven amid uncertain times.

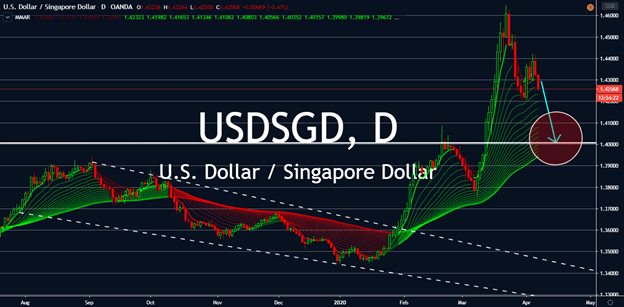

EURDKK

The euro is seeing high volatility against other currencies like the Danish krone. This is while faith in the European Central Bank’s “Coronabonds” plan continues to cause disarray in the market. The European Union is greatly divided by the stimulus plan as the wealthier countries hesitate to join the cause. Fortunately for the Euro, it might be able to recover in the long-term. This is in thanks to Germany’s industrial production, which showed better figures than anticipated, month over month.

In Denmark, the country is about to test the safety of loosening its restriction rules on April 14, starting with daycare and primary schools. Furthermore, its industrial production raised to 2.1% on February in a monthly comparison. For now, the market can only expect consecutive reds and greens from the pair. This is while the market anticipates how coronavirus will further impact the global economy, especially the pair. The market is keeping its eye on the situation as more countries in the previous epicenter join in the bandwagon.

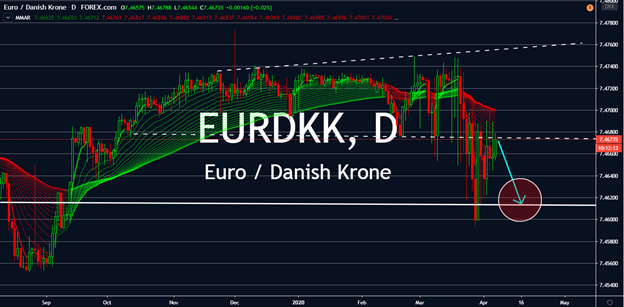

EURTRY

Although the euro isn’t looking great against other major currencies, the currency is expected to gain against the Turkish lira. Unlike the European commissioners, the Turkish government hasn’t exactly been doing its utmost best to economically cope with losses via the coronavirus. Reports emerged of the Turkish government’s irresponsible take on the severity of the pandemic. This includes an insufficient number of tests and deficient public health services. Furthermore, the country isn’t even sure if it can afford more than $15.5 billion stimulus package for its business sector.

Germany also announced a higher industrial production figure for February, which supports the case that the euro will see more gains than the lira. Investors anticipate the Turkish currency to go down against its other rivals at least until they see better results from its economy and how the government handles the spread of the coronavirus from now on.

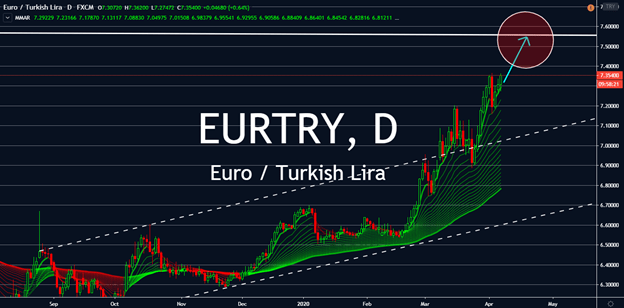

GBPAUD

The UK Prime Minister’s absence is bound to raise caution in the forex market. This is especially after investors found out he moved to the intensive care due to worsening coronavirus symptoms. If this situation worsens, even more so in the UK, it could drive sterling further down from several of its currency counterparts. GfK Consumer Confidence also fell for March into its weakest reading since 2009, weighing the heaviest on the pound in this week’s sessions.

Meanwhile, the Reserve Bank of Australia decided to hold its interest rates as it is at 0.25%, which also lifts the chances of a temporary relief for the Aussie. However, Markit Construction PMI for Australia fell deeper into contraction territory at 39.3. Coronavirus updates in both regions will affect much of the pair. However, the market is waiting more closely for what will happen to the UK economy if PM Johnson’s condition changes for the worst.