Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

USDZAR

South Africa’s economy continued to suffer amidst the covid-19 pandemic. The third wave started in May and has taken a toll on the country’s Q2 unemployment data. The jobless rate climbed to 34.40% between April to June, representing 7.8 million of the working population. Adding people who stop looking for a job, the total unemployment would reach 44.40%. As a result, Johannesburg slipped in the global ranking to have the highest joblessness in the world. Analysts expect Q3 to be worse following the civil unrest in July. The jailing of former president Zuma sparked an outcry among the citizens, which resulted in looting. The civil unrest is estimated to cost South Africa 3.4 billion and 150,000 jobs. Businesses have temporarily closed and retrenched most of their workers. The unemployment in SA hit the financial sector the most. Meanwhile, the looting has resulted in the state insurer hiking its premium as political and economic risks spell higher financial burden.

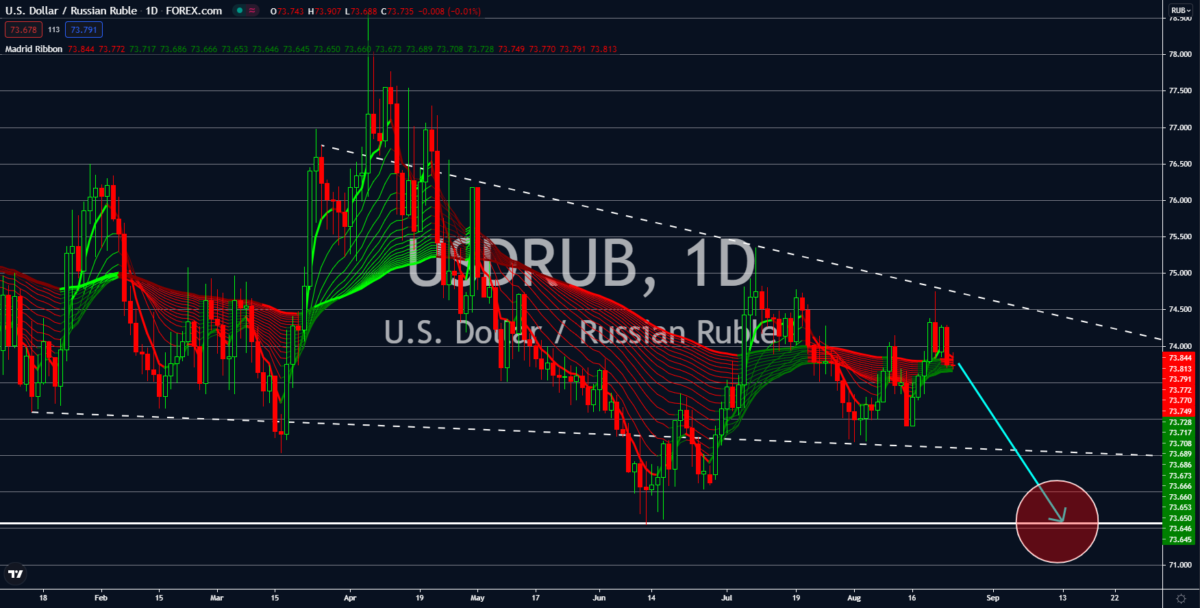

USDRUB

Tensions are rising between Moscow and Washington. Several sanctions have been imposed on Russia in recent months following cyberattacks targeting the government. In addition, Kremlin is supporting the uprising in Ukraine financially and in the military. The US condemned the action and summoned German Chancellor Angela Merkel to the White House. The discussion revolves around the Nord Stream pipeline, which is critical in energy security in Germany. Earlier this month, the US government announced it is reviewing Russia’s status as a market economy. The latter responded by saying it can defend its status in the WTO. The rouble is expected to outperform the greenback in the short term, with July unemployment anticipated to fall to 4.7%. This is at par with the pre-pandemic level. Meanwhile, retail sales could grow 5.4% based on August 25’s estimates. Also scheduled for release on Wednesday is industrial production with an 8.2% reading.

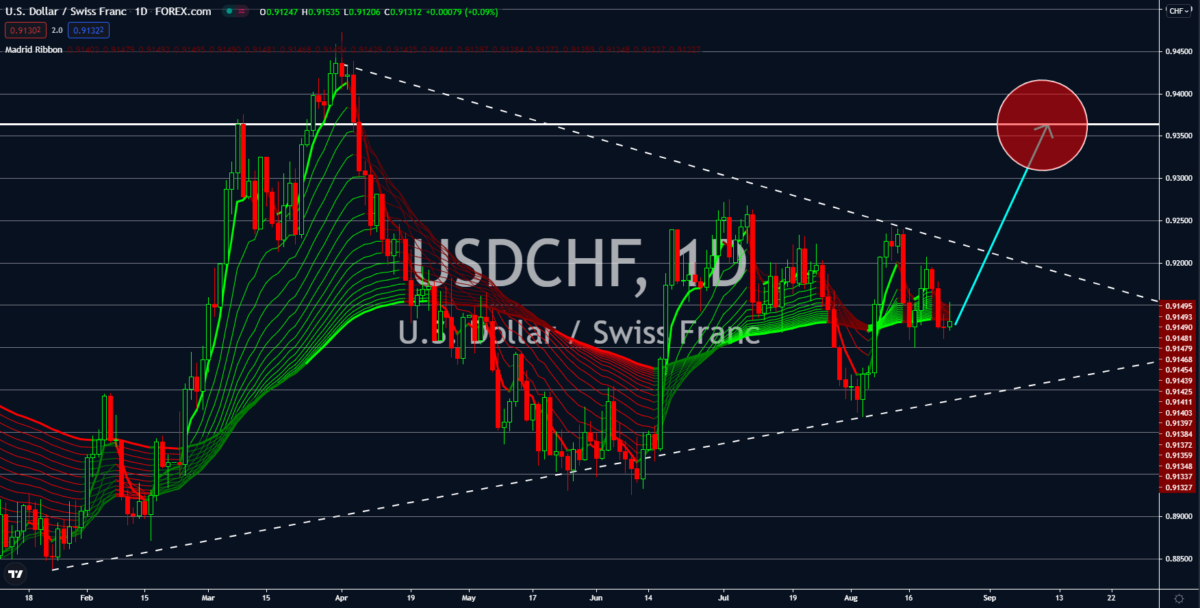

USDCHF

The United States published disappointing results for the Purchasing Managers Index reports for August preliminary. The manufacturing sector slowed down to 61.2 points. This is lower than the 62.5 points estimates and 63.4 points prior. Meanwhile, the Services PMI printed 55.2 points, and a 4.7 points decline from July’s 59.9 points. Despite the lower figures from August 23, analysts anticipate the US dollar outperforming its Czech Republic counterpart. The bullish forecast is due to the Jackson Hole Economic Policy Symposium scheduled on August 26 to 28. Influential individuals in finance and economics will attend the invite-only meeting. Federal Reserve Governor Jerome Powell and the FOMC are also present at the event. During the 3-day forum, the market anticipates the US central bank to discuss topics such as inflation, employment, and trade. These are issues that could impact the USD. Earlier in August, Powell hinted at a bond tapering.

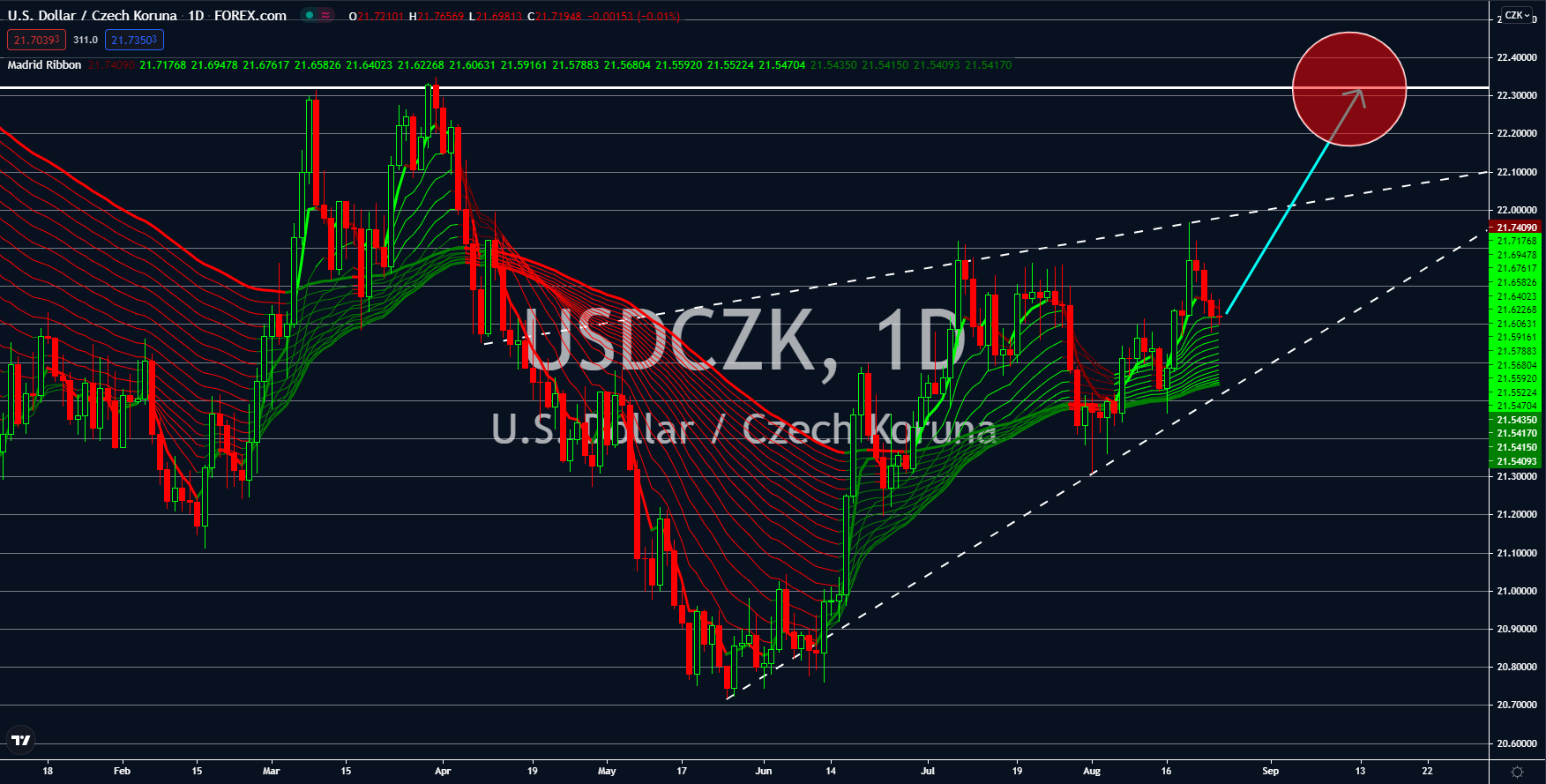

USDCZK

The United States published disappointing results for the Purchasing Managers Index reports for August preliminary. The manufacturing sector slowed down to 61.2 points. This is lower than the 62.5 points estimates and 63.4 points prior. Meanwhile, the Services PMI printed 55.2 points, and a 4.7 points decline from July’s 59.9 points. Despite the lower figures from August 23, analysts are anticipating the US dollar to outperform its Czech Republic counterpart. The bullish forecast is due to the Jackson Hole Economic Policy Symposium scheduled on August 26 to 28. The invite-only meeting will be attended by influential individuals in finance and economics. Federal Reserve Governor Jerome Powell and the FOMC are also present at the event. During the 3-day forum, the market anticipates the US central bank to discuss topics such as inflation, employment, and trade. These are issues that could impact the USD. Earlier in August, Powell hinted at a bond tapering.