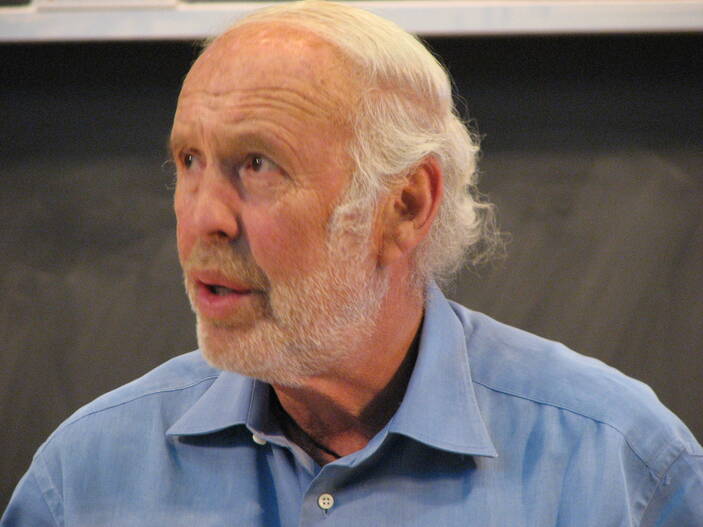

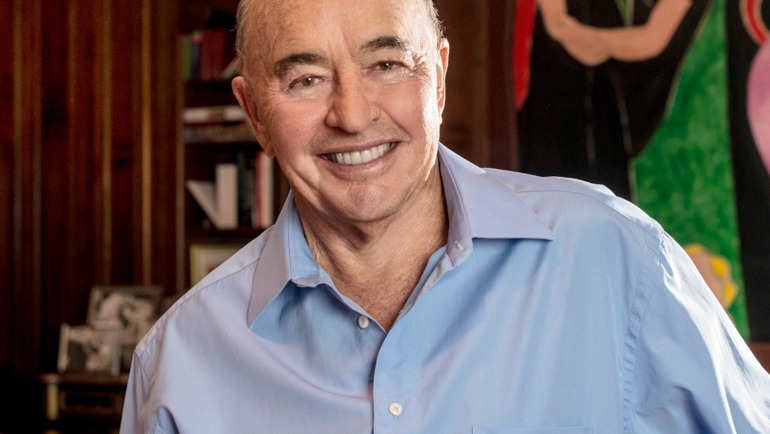

Bruce Kovner is best known as the founder and former Chairman of Caxton Associates, a macro-hedge fund he ran from 1983 to 2011. In 2016, Kovner retained his role as Chairman of CAM Capital, a private investment firm that he created to manage his assets and those of other high-ranking employees of the company.

Kovner is a self-made billionaire and philanthropist with a particular interest in the performing arts. Mr Kovner’s commitment to arts organizations started in the mid-1990s. He joined the board of the Juilliard School and was appointed as Chairman of the Board of Trustees in 2001. Also, he serves as vice-Chairman of Lincoln Center.

He is part of the Board of the Metropolitan Opera and has served on the Board of the New York Philharmonic. As part of these commitments, Mr Kovner and his foundation have given hundreds of millions of dollars to these artistic institutions.

Early life and education

Kovner was born in 1945 to a Jewish family in Brooklyn, New York. Her grandparents had fled to America penniless because of the persecution and violence in their home countries, Poland and Russia. With a bit of a struggle, the family worked its way into the American middle class, and Kovner’s childhood was comfortable.

At Van Nuys High School, Bruce Kovner was a National Merit Scholar. He played varsity basketball. And in his senior year was elected both Class President and Student Body President. As Kovner describes it, his family transmitted to him the belief that anything is possible in America with good education and hard work.

In 1953, Kovner moved to California, where his father worked as a mechanical engineer. Kovner excelled as a high school student and athlete and won the student presidency at 16. After high school, in 1962, he returned to the east to study at Harvard University on an academic scholarship.

After graduation, Kovner embarked on an extended period during which he struggled to find a way forward. He began a doctoral program at the John F. Kennedy School of Government at Harvard but left before completing his thesis. Moreover, he studied piano and harpsichord at the Juilliard School in New York. Further, he worked on political campaigns to little effect.

Bruce Kovner trading style

Bruce Kovner’s trading strategy comes from what he learned from his mentor Michael Marcus. With Michael, he started trading in Commodity Corp. The state of mind plays a significant role in a trader’s success; that’s the first lesson.

Furthermore, “You have to be prepared to make mistakes regularly, there is nothing wrong with being wrong, to do your third best judgment, and then double your money. Kovner describes the main lesson he learned working under his professional mentor, Michael Marcus, at Commodities Corporation. You need to have the self-confidence to admit your mistakes, cut your losses, and move forward.

“If you customize losses, you cannot trade.” Moreover, Kovner teaches a related lesson: a successful trader should never view the market as a nemesis. He believes trading with emotion puts an investor on the road to ruin.

Bruce Kovner trader’s career

Kovner began working as a commodity dealer in the late 1970s, under the direction of Michael Marcus of Commodities Corporation, which is now a subsidiary of Goldman Sachs. Kovner has a proven track record and proved to be an insightful and disciplined trader who has made a lot of money for investors.

Moreover, after six years at Commodities Corporation, he resigned. Then, he created his own hedge fund, Caxton Associates, in 1983. The fund quickly gained notoriety for its pioneering approach to a comprehensive hedge fund investment strategy that attempted to profit from global macroeconomic trends. It invested in a mix of currencies, commodity markets, stocks, bonds, options, futures, and other related instruments.

In 28 years as Chairman of Caxton Associates, Kovner led the hedge fund to gains in all but one year, 1994, when the fund declined 2.5%. The overall annual returns of the fund averaged 21% during Kovner’s presidency, surpassing the 11% annual gain posted by the S&P 500 during the same period. In fact, the fund’s cumulative earnings were over $ 12 billion for the period.

Net worth and current influence

With an estimated net worth of $ 5. 2 billion, Bruce Kovner placed 93rd on the 2015 Forbes 400 list of the wealthiest Americans. While his retirement from Caxton Associates in 2011 may have reduced his visibility and influence as an investor, he continues to wield considerable influence through his philanthropic activities.

He gave $ 60 million to fund a scholarship program at The Juilliard School among his publicly recognized donations. He and his wife, Suzie, have also donated millions to the Carnegie Hall Society, the Lincoln Center for the Performing Arts, and the Metropolitan Museum of Art, among other arts organizations.

Kovner also funds scholarships and provides funds to support charter school programs in New York City. In 2016, Kovner served on the board of directors of the American Enterprise Institute, a political organization dedicated to the expansion of individual freedom and free enterprise in the United States.

Besides being interested in arts over is specific as a businessman in so many aspects. His philanthropic enthusiasm makes him the best second to George Soros, according to many. The story goes that in his youth, he was a taxi driver in New York. It’s a classic story of the self-made man who succeeded thanks to his skills and dedication, drawing his path toward the American dream.

He made some of the recent investment decisions in Microsoft Corporation extra Energy. Inc, Taiwan Semiconductor Manufacturing Company Limited, Apple.Inc. He considers some of the best stocks for the next decade’s long-term investment. He is also very enthusiastic and prone to crypto investments.

Bruce Kovner as a philanthropist

Bruce Kovner as the founder of The Kovner Foundation manages his philanthropy. Suzie Kovner is Co-Chairman, where she develops strategy, identifies programs. Also, she evaluates the grantee’s results. Moreover, she advocates for top-notch schooling for all children. And for changing public policy that prevents children and families from access to opportunity.