After last year’s dire predictions about cryptocurrencies’ future, there were several significant changes, that proved them false. For example, Bitcoin’s price rose 300 % and then settled at an average. Facebook began the Libra project and technologists also launched more than 200 new crypto projects. However, as cryptocurrencies prove tenacious, the need for regulations increases. The problem is that behind these regulations often stand the overstated fears or assumptions. Here are the most sought after policy themes we can expect in 2020.

Cryptocurrencies may make illegal activities easier

Such as financing of terrorism, money laundering, and etc. But the fact is, that the main targets for criminal organizations are banks and other businesses. It doesn’t mean that we must close the banks, because it’s clear that the profit for society far outweighs the damage. Annual examinations, which are often obligatory for banks, are a more sensible solution. Blockchain analytics firms Chainalysis and Elliptic separately studied crypto cases and concluded that bitcoin transactions involving different illegal activities are fewer than 1 %.

Besides, the biggest crypto exchanges have already registered with the Treasury Department’s Financial Crimes Enforcement Network. Moreover, some even have state licenses like New York’s BitLicense, which means they have to endure annual examinations like banks. These restrictions reduce the risks significantly.

Monetary policy is threatened by cryptocurrencies

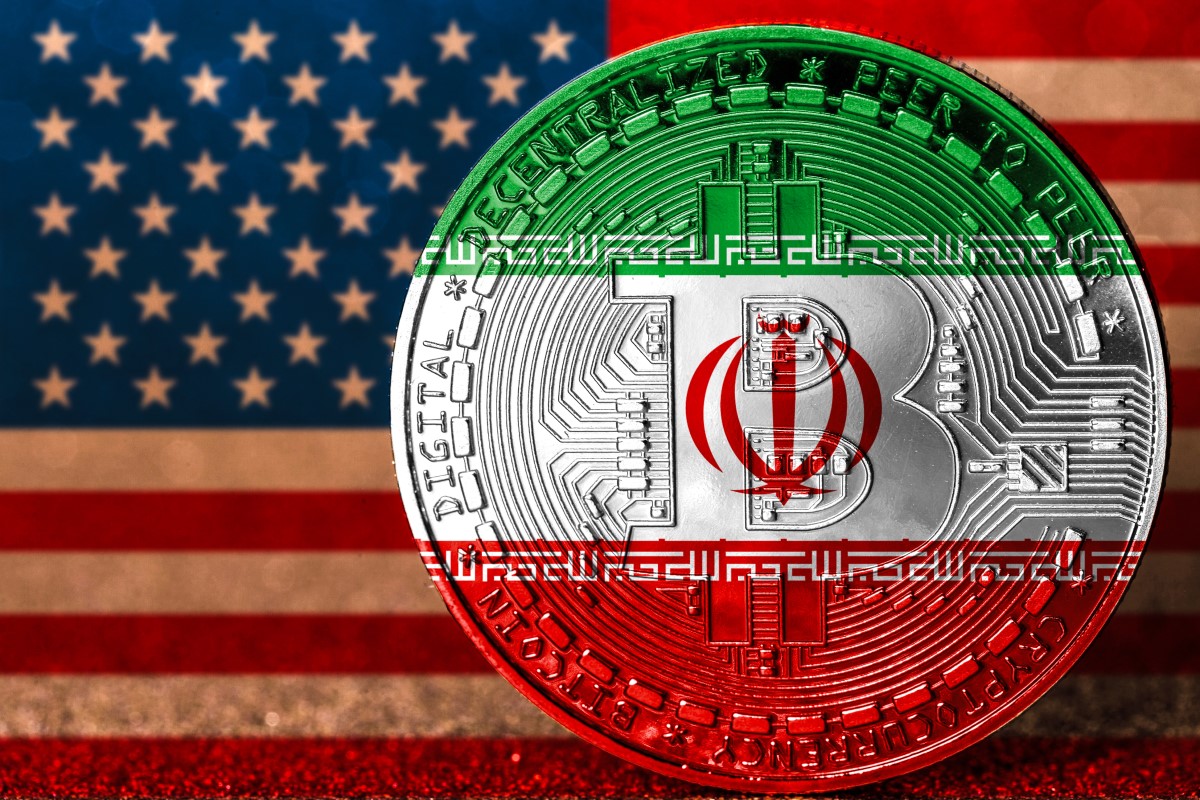

The fear that the central banks’ ability to control money supply might be complicated by crypto is often at the forefront when discussing the new currencies. President Trump tweeted in last July that Bitcoin and other cryptocurrencies are “highly volatile and based on thin air” and “the only … real currency in the USA” is the U.S. dollar. Assuming that central bankers are the most trustworthy guardians of monetary stability, which isn’t so. And we have quite a lot of examples of easy money policies, employed by banks, causing inflation and ultimately even the financial crisis.

“Privacy Token” cryptocurrencies threaten the national security

“Privacy tokens” are the cryptocurrencies obscuring sender/recipient information. Such a notion seems untrustworthy, but there are other cases proving this kind of protection valuable. For example, “Http” ‘s migration to “Https” was first met with suspicion, but after a while, the federal government mandated that its agencies’ information be protected behind https-enabled websites.

Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.